Can XRP beat Bitcoin? Check out 3 facts and recent data analysis!

Jakarta, Pintu News – The competition between Bitcoin and XRP is heating up in the cryptocurrency world. Many people are asking, could XRP one day shift Bitcoin’s dominance as the world’s number one crypto asset?

With technological developments, institutional adoption, and changing market sentiment, it is interesting to analyze XRP’s chances of overtaking Bitcoin. This article breaks down the price data, market cap, and fundamental factors of both assets based on the latest data for August 2025.

Bitcoin (BTC): Remains Unwavering at the Top

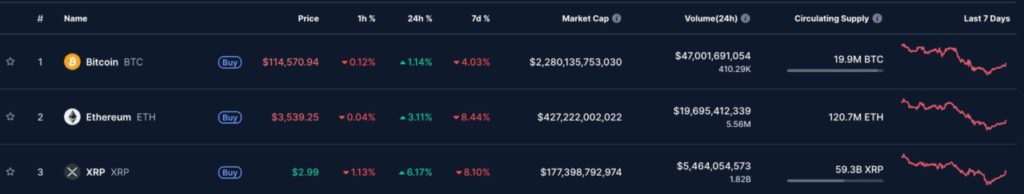

Bitcoin (BTC) is currently still leading the crypto market with a price of $114,570.94 or equivalent to Rp1,876,370,707 (exchange rate 1 USD = Rp16,382).

Bitcoin’s market cap is a massive $2,280,135,753,030 (IDR 37,355 trillion), far outpacing other crypto assets. BTC’s daily transaction volume is also very high, reaching $47 billion (IDR 770.0 trillion) with a circulating supply of 19.9 million BTC. Although the price of BTC has dropped 4.03% in the last 7 days, Bitcoin’s appeal as “digital gold” and a hedge asset is still unrivaled.

Also Read: 5 Crypto that Can Bring Bigger ROI than Bitcoin: Analysts’ Picks?

XRP: Price rises sharply, but market cap is still a long way off

XRP (XRP) is currently trading at $2.99 or €48,474.18, showing a 6.17% increase in the last 24 hours.

However, in terms of market cap, XRP stands at $177,398,792,974 (IDR 2,908 trillion), a far cry from Bitcoin. XRP’s daily transaction volume reached $5.46 billion (IDR 89.5 trillion) with a circulating supply of 59.3 billion XRP. In the past 7 days, the price of XRP fell 8.10%, reflecting high volatility and sensitivity to market sentiment and regulatory news.

Fundamentals and Drivers of XRP vs Bitcoin

Fundamentally, Bitcoin has the edge in terms of scarcity as its maximum supply is only 21 million coins, while XRP has a much larger supply.

XRP’s main advantages are speed and very low transaction fees, as well as a focus on the cross-border payments sector. If institutional adoption and integration of global payment systems become more widespread, demand for XRP could jump significantly. However, Bitcoin is still seen as a store of value asset, which makes it preferable for long-term investments by large institutions.

Could XRP Overtake Bitcoin?

For XRP to beat Bitcoin in terms of market cap, the price of XRP would have to rise dramatically-even thousands of percent from its current position.

With BTC’s market cap being 13 times larger, XRP requires a tremendous surge in demand. XRP’s biggest challenge is the stigma of past legal cases with the SEC and the dominance of the Bitcoin brand in the global crypto market. While XRP is very innovative in payment technology, in terms of capitalization and public perception, Bitcoin remains ahead.

Conclusion

In conclusion, mathematically and fundamentally, the chances of XRP overtaking Bitcoin as the number one crypto are still very slim in the near future. However, the cryptocurrency world is full of surprises and innovations. If there is a major breakthrough in global payments adoption or market sentiment changes drastically, XRP still has a chance to close the gap with Bitcoin. Stay tuned to market developments and do your research before investing in any of these assets.

Also Read: 5 Crypto Ready to Pump After Bitcoin Consolidates in August 2025, Don’t Miss Out!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- The Motley Fool. Can XRP Overtake Bitcoin? Accessed August 4, 2025.