Crypto News Today (8/6/25): SEC Relaxes Staking Rules, Ethereum ETF Loses $465 Million, Trump Ready to Intervene

Jakarta, Pintu News – The global cryptocurrency market was in turmoil again on Tuesday, August 6, 2025, after three major pieces of news rocked the industry. The United States SEC released new guidance regarding liquid staking activities that were partially declared outside the scope of securities.

At the same time, the Ethereum ETF recorded the largest outflow of funds since its launch at $465 million, signaling a change in investor sentiment.

Meanwhile, President Donald Trump is reportedly preparing an executive order to investigate alleged debanking of crypto companies.

SEC Relaxes Liquid Staking Rules

The United States Securities and Exchange Commission (SEC) announced that some liquid staking activities in crypto are not categorized as securities offerings.

In its statement, the SEC emphasized that this decision depends on the facts and circumstances of each case related to the Securities Acts of 1933 and 1934. The statement sends a positive signal to the industry, which has been concerned that staking activities could trigger intense scrutiny from regulators.

The SEC defines liquid staking as the process of depositing digital assets into a protocol and receiving a “staking receipt token” as proof of ownership.

SEC Chairman, Paul Atkins, called this move a major advancement in clarifying digital asset activities that do not fall under the SEC’s jurisdiction. For crypto players, this could open up new growth space for staking platforms without excessive legal risks.

Read also: Price of 1 Pi Network (PI) in Indonesia Today (6/8/25)

Ethereum ETFs Record the Largest Outflows

On the other hand, the cryptocurrency market is facing pressure from news of a massive withdrawal of funds from the Ethereum (ETH) ETF. Farside Investors data shows that the spot Ether ETF experienced a net outflow of $465 million on Monday, setting a record daily decline since launch. The decline comes after a series of strong fund inflows in July, which totaled $5.43 billion.

Data from SoSoValue revealed that BlackRock’s iShares Ethereum Trust (ETHA) bore the biggest losses, with outflows of nearly $375 million.

Despite this, the ETF still recorded total net inflows of $9.3 billion and net assets of $10.7 billion. This correction comes on the heels of ETH prices falling to $3,380 on Sunday, before recovering to $3,629 on Tuesday.

Also read: 4 Long-Term Crypto Raves- Besides ETH and BTC!

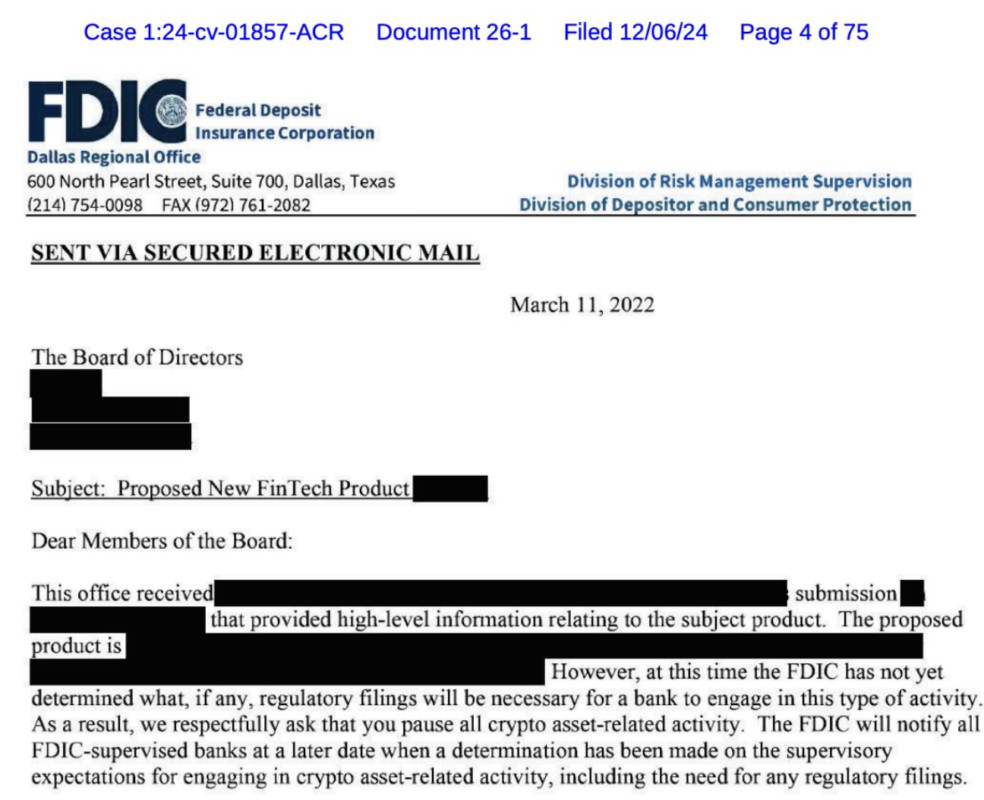

Trump Set to Investigate Crypto Debanking

Another big news came from the White House, where President Donald Trump is reportedly ready to sign an executive order to investigate alleged debanking practices against crypto companies and conservative groups.

According to the Wall Street Journal, the draft order instructs banking regulators to examine potential violations of antitrust law, consumer protection, and fair credit practices.

The order also requests that serious violations be referred to the Department of Justice to be followed up with fines or legal action. This debanking issue came to the fore after the collapse of crypto exchange FTX in 2022, which prompted regulators to ask a number of banks to suspend crypto-related services. If this order is officially signed, it could open a new chapter for the cryptocurrency industry in its relationship with the US banking system.

Conclusion

These three big news stories reflect the fast-paced dynamics in the crypto world, where regulation, capital markets, and politics converge. From the easing of staking rules by the SEC, to the massive outflow of funds from Ethereum ETFs, to Trump’s investigative debanking moves, they all show that the cryptocurrency landscape continues to move fast. For investors, vigilance and market understanding are key to dealing with these fluctuations.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. US SEC says certain liquid staking activities fall outside of securities laws. Accessed August 6, 2025.

- Featured Image: Generated by Ai