5 Reasons Why Bitcoin (BTC) Is a Top 5 Asset in the World

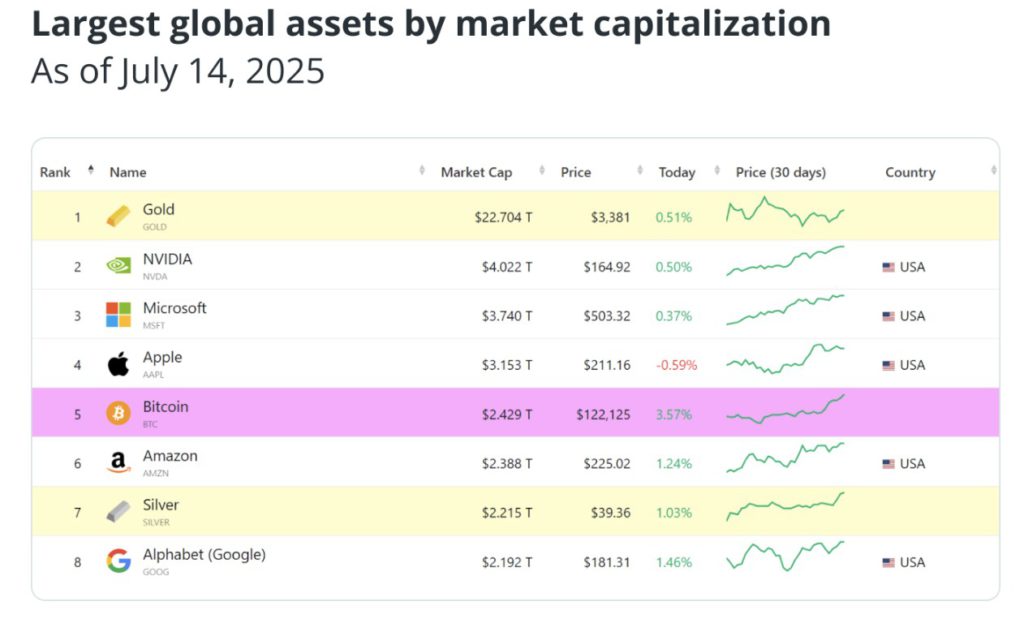

Jakarta, Pintu News – On July 14, 2025, Bitcoin made history. The price broke $122,600 with a market capitalization of around $2.4 trillion, surpassing Amazon’s estimated valuation of $2.3 trillion. With this achievement, Bitcoin officially entered the list of the 5 most valuable assets in the world, even surpassing silver and Google.

Here are the five main factors driving the surge.

1. Spike in Demand from Spot Bitcoin ETFs

Bitcoin spot ETFs in the United States were the main drivers of the price surge. On July 10 and 11, 2025, the spot ETF recorded inflows of funds above $1.17 billion and $1.03 billion, respectively. This was the first time since its January 2024 debut that there were daily inflows above $1 billion for two consecutive days.

This surge in demand pushed the price of BTC past the $120,000 psychological level. BlackRock’s iShares Bitcoin Trust (IBIT) now manages over $80 billion in assets, making it one of the largest Bitcoin ETFs in the world. This rise shows that institutional demand for Bitcoin is getting stronger, with ETFs being the main entry point.

2. Regulatory Support Through “Crypto Week”

In addition to demand factors, the changing regulatory climate in the US is a big driver. The government launched a series of pro-crypto legislation known as “Crypto Week”, spanning the CLARITY Act, GENIUS Act, and Anti-CBDC Surveillance Act.

Read also: Ethereum Flies 64% in 3 Months, Unseats Bitcoin Thanks to Institutional Fund Invasion?

These regulations provide legal clarity, protection for investors, and signal that Bitcoin is now accepted as part of the regulated financial system. For years, regulatory uncertainty has been a barrier to institutional adoption. With this law in place, large corporations, asset managers, and financial institutions have a stronger legal foundation to include BTC in their portfolios.

3. Favorable Macro Factors and Market Sentiments

Global economic conditions and US government policies also play a big role. Under the pro-crypto Trump administration, policy direction favors digital asset innovation. In addition, the weakening value of the US dollar has prompted investors to seek alternative stores of value that are not tied to a centralized fiat currency.

Bitcoin’s correlation with tech stock indices such as the Nasdaq and S&P 500 also rose sharply to 0.87 in January 2025. This shows that the market is starting to view BTC as a tech-grade asset with high profit potential, rather than just a speculation instrument. This increased correlation also makes BTC more relevant in modern diversified portfolio strategies.

4. Scarcity and Function as a Store of Value

Bitcoin is designed with a maximum supply of 21 million coins, making it a very rare asset, similar to gold, but in digital form. This scarcity is amplified by the halving mechanism that reduces the new supply every four years.

Read also: Pantera Capital Survey: Salary Payments in Crypto to Increase 3x by 2024

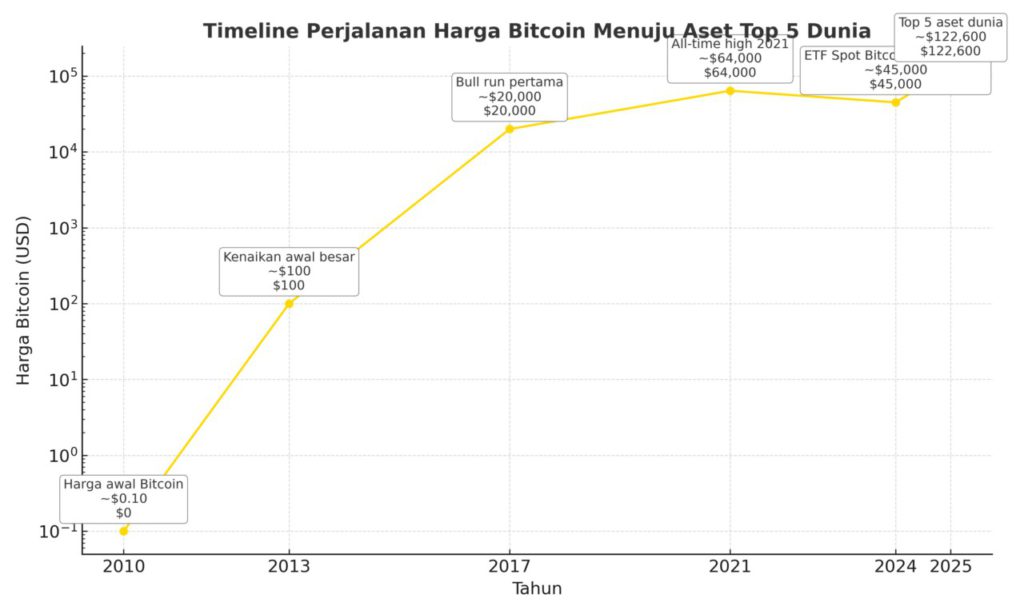

From a price of $0.10 in 2010 to $122,600 in July 2025, BTC has risen more than 1.2 million times in 15 years. Many investors now view Bitcoin as a substitute for gold in the role of store of value and inflation hedge. Its global, transparent and borderless accessibility makes it more practical than physical assets.

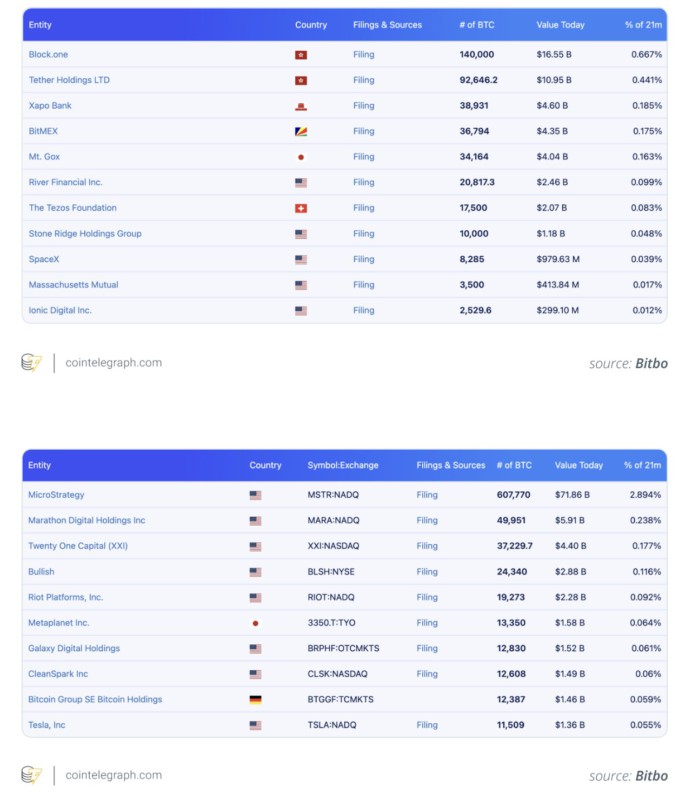

5. Strong Institutional Ownership

As of mid-2025, more than 265 public and private companies held a total of 853,000 BTC, equivalent to 4% of the circulating supply. Large companies such as Tesla, Square, and Semler Scientific make BTC a strategic part of their balance sheets.

The spot Bitcoin ETF alone holds around 1.4 million BTC, or 6.6% of supply, making it one of the largest “whales” in the market. This adoption at the institutional level not only sustains the price of BTC, but also provides a strong foundation for long-term growth, including the opportunity to rival the valuations of Apple and Microsoft in the future.

Timeline of Bitcoin Price’s Journey to the World’s Top 5 Assets

Here is a timeline of BTC’s price journey to the world’s top 5 assets from the initial price of $0.10 to the price of $122,600:

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Bitcoin is now bigger than Amazon: Here’s how it became a top-5 asset. Accessed August 9, 2025

- Featured Image: Generated by AI