Ethereum Price Hovers Around $4,200 on August 8 — Could ETH Be Heading for New Highs?

Jakarta, Pintu News – Ethereum continued its positive trend into August after recording one of the most bullish July months in history. Last week, ETH closed at $4,200 – its highest weekly close since December 2021.

According to CCN, historically, fund inflows into Ethereum ETFs have tended to be in line with price movements. With the latest price spike occurring mostly on the weekend, it’s possible that new capital could enter the ETF today and push prices even higher.

Optimism is also growing thanks to growing speculation regarding the approval of an Ethereum staking ETF.

With various bullish catalysts coming together, Ethereum may be just one step away from its record high price.

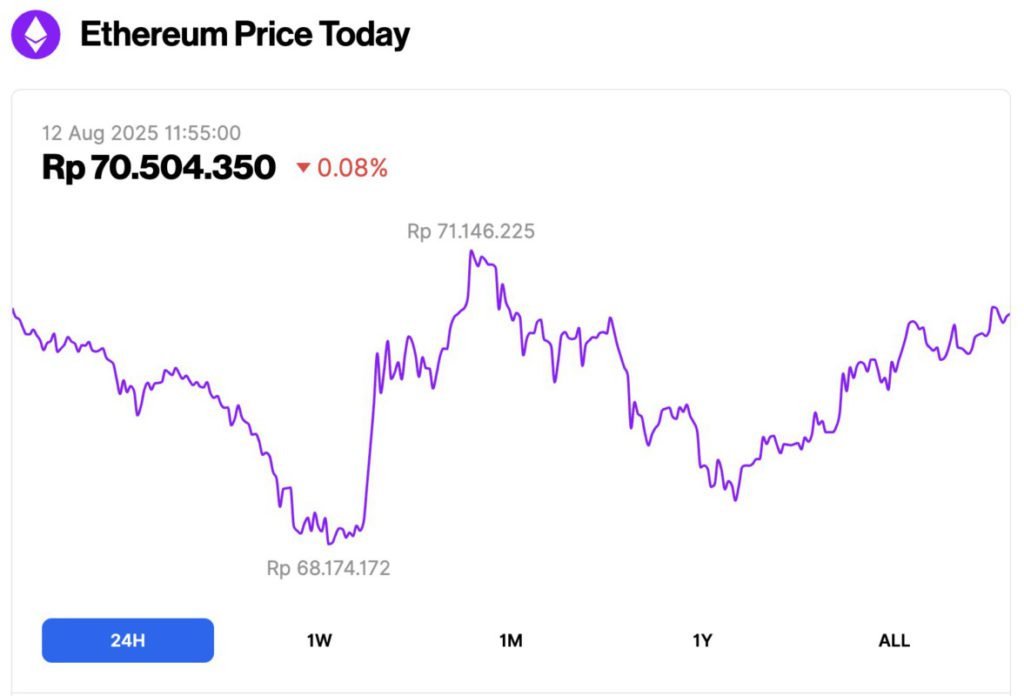

Ethereum Price Drops 0.08% in 24 Hours

On August 12, 2025, the price of Ethereum was recorded at around $4,299 or the equivalent of IDR70,504,350, experiencing a slight correction of 0.08% in the last 24 hours. During this period, ETH had touched its lowest level at IDR68,174,172, and its highest level at IDR71,146,225.

At the time of writing, data from CoinMarketCap shows that Ethereum’s market capitalization stands at around $519.6 billion, with daily trading volume rising 20% to $45.22 billion within the last 24 hours.

Read also: Dogecoin Dips 4% Amid Rising Whale Activity—Is a Potential Rally Brewing?

Ethereum Price Forecast

Citing the CCN report (11/8), price analysis on the weekly time frame shows how important Ethereum’s price close was last week. The $4,000 level has been a strong obstacle throughout the history of Ethereum’s price movements.

The record high price in November 2021 was the only time when the price managed to break out of that area (black circle), but even then the rise didn’t last long.

Last week was the first weekly close above the resistance level since 2021, after ETH tried to break through it four times before finally succeeding.

With Ethereum’s price now above $4,000, there is no longer any significant resistance to the record high of $4,869.

Momentum indicators also supported this move: The Relative Strength Index (RSI) broke above the 70 level, which is usually a phase of accelerating price gains. The Moving Average Convergence/Divergence (MACD) was also positive and recorded a new high this year.

As such, Ethereum’s price outlook is bullish, and a new price record high is likely to be reached in 2025.

ETH Short-term Outlook

Although the long-term outlook is very bullish, Ethereum’s short-term technical analysis shows potential headwinds.

The momentum indicator is starting to show signs of weakening, while the price movement pattern (wave count) indicates that a local price peak may be near.

Read also: Ethereum Surge Pushes Vitalik Buterin’s Net Worth Past $1 Billion!

First, RSI and MACD formed a bearish divergence (orange), signaling that a price drop is likely in the near future.

Based on wave calculations, ETH is currently nearing the top of wave 3 in a five-wave (orange) bull pattern that started on April 7. However, it’s not time to panic just yet – these calculations suggest that wave 3 is likely to end around $5,470.

Furthermore, the 1.61 external Fibonacci retracement resistance level provides an initial target for the top of the uptrend around $7,330.

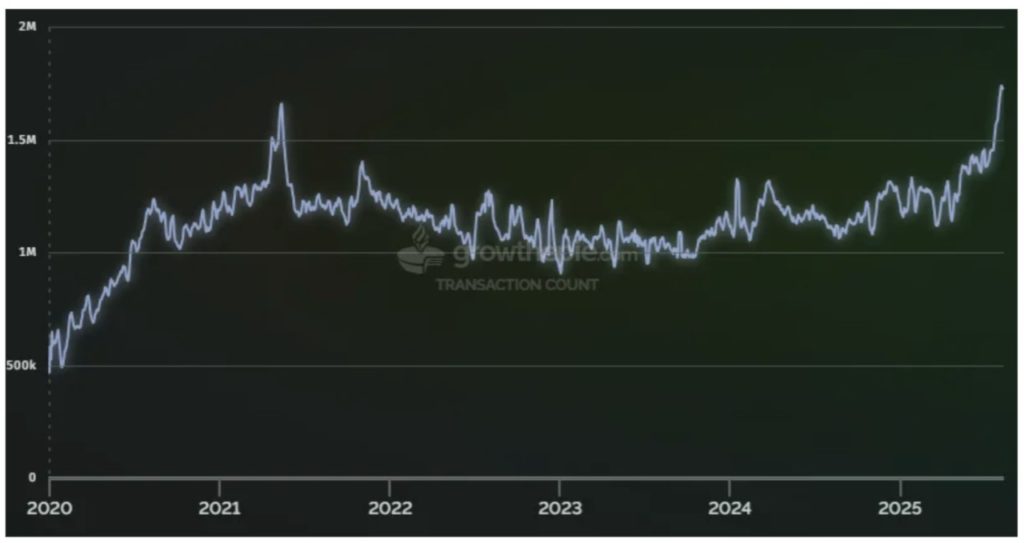

Ethereum Transactions Set a New Record

Not only is Ethereum’s price nearing an all-time record high, its transaction count has also broken the May 2021 record, breaking 1.5 million daily transactions.

In 2021, the surge in transactions was heavily influenced by the Non-Fungible Token (NFT) trend, even though ETH prices were declining at the time.

This time, the surge was driven by stablecoin transfers, decentralized finance activity, and swaps, which was further amplified by the increase in Ethereum’s gas limit to 45 million, as reported by Vitalik Buterin in July.

The supply of stablecoins itself has continued to set new records so far this year, as Layer 2 networks have grown rapidly, with Base Chain leading the way.

Given the near-record revenue of applications on Ethereum’s base chain, it’s hard to overstate how strong the network data is right now and how in tune it is with Ethereum’s price movements.

Overall, Ethereum managed to break the strong resistance level of $4,000 for the first time since 2021.

With solid bullish momentum, the next target is to set a new price record high.

The network activity, number of transactions, and supply of the stablecoin are now at record levels, supporting an organic price increase. Based on projections, Ethereum’s price is expected to reach at least $7,330 by the end of 2025.

That’s the latest information about crypto. Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today‘ s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Ethereum (ETH) Price Hits 4-Year High – Countdown to New All-Time High Begins. Accessed on August 12, 2025