5 Trading Signals Bitcoin (BTC) is Under Pressure-Is This the Start of a Major Correction?

Jakarta, Pintu News – The market is currently in a phase of direction determination. Between a potential deeper correction and the possibility of a healthy consolidation, all will depend on Bitcoin’s ability to hold USD 115,000 in the next few days.

Here are 5 important Bitcoin signals that you need to pay attention to!

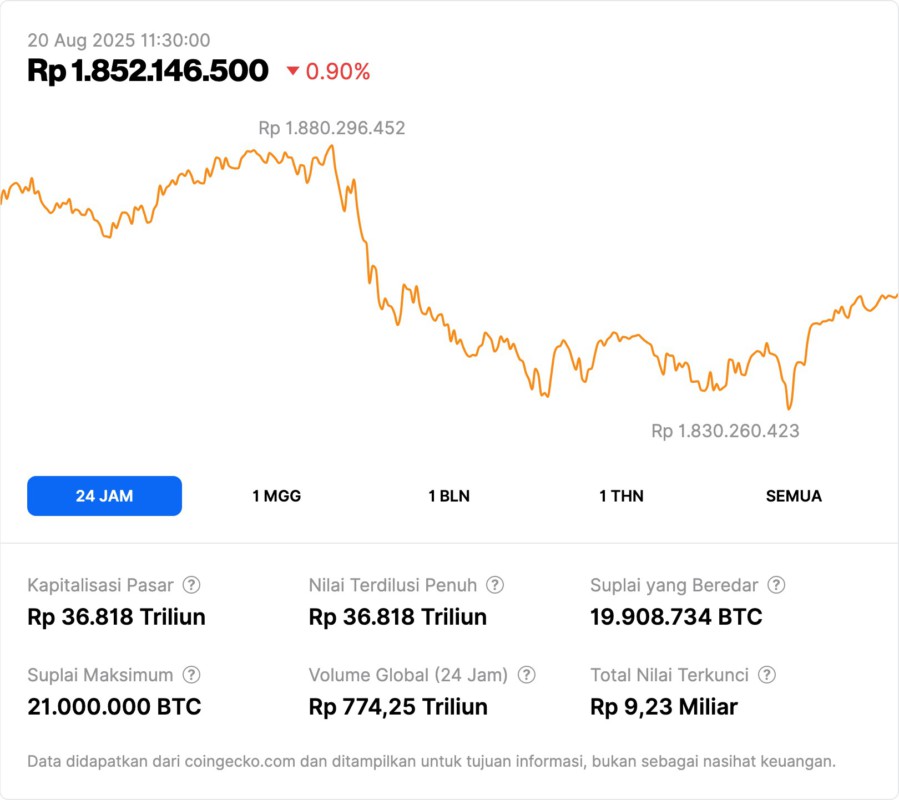

1. Bitcoin fails to stay above IDR1.95 billion, selling pressure increases

Bitcoin (BTC) is currently struggling to hold onto an important support level at USD 115,000 (approximately Rp1.87 billion) after being rejected from strong resistance at USD 125,000 (Rp2.03 billion). This drop comes just days after BTC touched a new record high above USD 120,000 (Rp1.95 billion).

This triggered an increase in short-term volatility, where selling pressure became dominant and disrupted market sentiment. Price consolidation between key support and resistance levels makes the next move decisive for BTC’s short-term direction.

Also Read: Ethereum (ETH) Price Predicted to Surge to $15,000, What’s Driving This Increase?

2. New Demand Weakens Despite Inflows

Data from CryptoQuant shows that despite Bitcoin’s record-breaking run, demand momentum is starting to lose steam. Technical indicators reflect market fatigue after the sharp rise over the past few months.

Many short-term holders started taking profits in the price range of USD 120,000 and above, magnifying the selling pressure. If Bitcoin fails to hold the USD 115,000 support zone, a correction to USD 112,000 (IDR 1.82 billion) or lower could happen in the near future.

3. Real Demand Indicators: Still Positive, But Starting to Fall

According to on-chain analyst Axel Adler, one important indicator right now is Bitcoin’s Real Demand. This metric measures the movement of coins owned by new investors, especially those holding BTC for less than a year.

Currently, the indicator still registers a positive figure around 30,000 BTC, indicating the presence of active circulation and demand. However, the drop in value from its peak signals that the intensity of purchases by new investors is starting to slowly decline.

4. Technical Pressure: Golden Cross Fails, Downtrend Emerges

Bitcoin’s 4-hour chart shows symptoms of technical weakness. BTC is currently trading around USD 115,573 and is below important moving averages, with the 50-day SMA now below the 100-day SMA-indication of a short-term downtrend.

Rejection from the USD 123,000 area has formed a consolidation phase with strong selling pressure in the USD 118,000-USD 120,000 range. If the USD 115,000 support fails to hold, the road to USD 110,000 (IDR 1.79 billion) could open up. Conversely, if it manages to hold, a recovery to USD 118,000 is still possible.

5. What Should Investors Watch Out For Now?

Investors and traders need to look at some important indicators before making a decision, especially regarding trading volume, on-chain demand, and price reactions to critical levels. Indicators such as Real Demand can provide early signals about market strength or weakness.

Also Read: Dogecoin is the only meme coin in the top 25 – is it the king of meme coins?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Bitcoinist. Bitcoin Apparent Demand Weakens, Expansion Slows. Accessed on August 20, 2025