5 reasons why Ethereum (ETH) is the target of big investors in August 2025

Jakarta, Pintu News – With ETF dominance, surging volumes, and traction in the derivatives market, Ethereum shows strong fundamentals for long-term growth. The current price correction may be the best opportunity before ETH breaks new records again.

1. Massive Inflow of Funds into Ethereum ETF

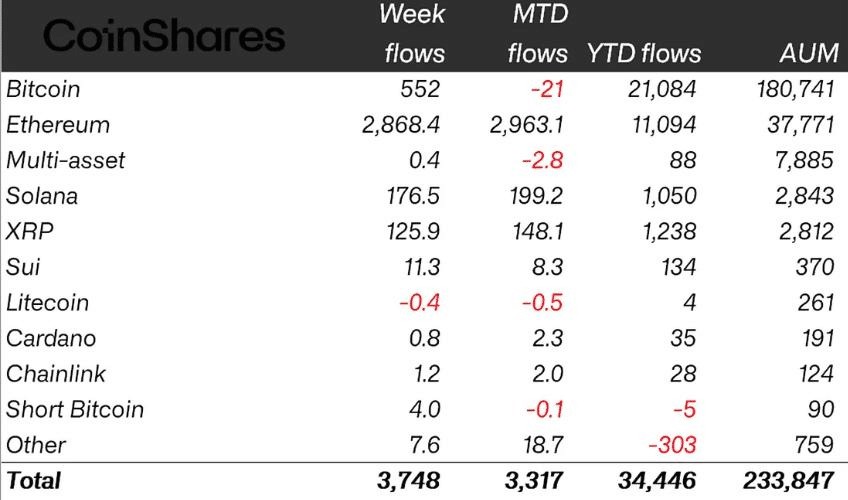

In the past week, Ethereum (ETH) absorbed USD 2.9 billion in investments through ETFs-an astounding figure as it accounts for nearly 80% of the total fund flows into global crypto ETPs worth USD 3.75 billion.

In comparison, Bitcoin only received inflows of USD 552 million, despite printing all-time high prices. This indicates that Ethereum is currently a top magnet for institutional investors looking for long-term potential.

Also Read: Ethereum (ETH) Price Predicted to Surge to $15,000, What’s Driving This Increase?

2. ETH ETF Transaction Volume Surges

The weekly volume of the spot Ethereum ETF reached an incredible figure: USD 17 billion. This is a big part of the total USD 40 billion combined volume of Bitcoin and Ethereum in ETFs.

This figure reflects the massive liquidity rotation from Bitcoin to Ethereum. In other words, large investors are starting to turn to ETH to pursue higher growth potential in the coming years.

3. ETH Market Dominance Increases Since May

Since May, Ethereum has surged by more than 100%, while Bitcoin has only risen by about 20%. This isn’t just the usual fluctuations, but rather a clear indication of Ethereum’s macro dominance in the crypto market.

Moreover, the ETH/BTC price trend shows a rise of more than 70% since May and scored consecutive green months since 2022. Investors seem to see Ethereum as a risk-on asset with more potential than Bitcoin in a bull market.

4. Derivatives and Leverage Get More Popular on ETH

In the first two weeks of this month, Ethereum attracted nearly USD 10 billion from leveraged investors-more than double Bitcoin’s record of only USD 1 billion. ETH’s open interest has now reached a record USD 65 billion, signaling high optimism from derivatives traders.

This is a strong signal that not only spot investors, but also derivatives market participants are increasingly leaning towards Ethereum. If this trend continues, ETH could perform spectacularly in the next quarter.

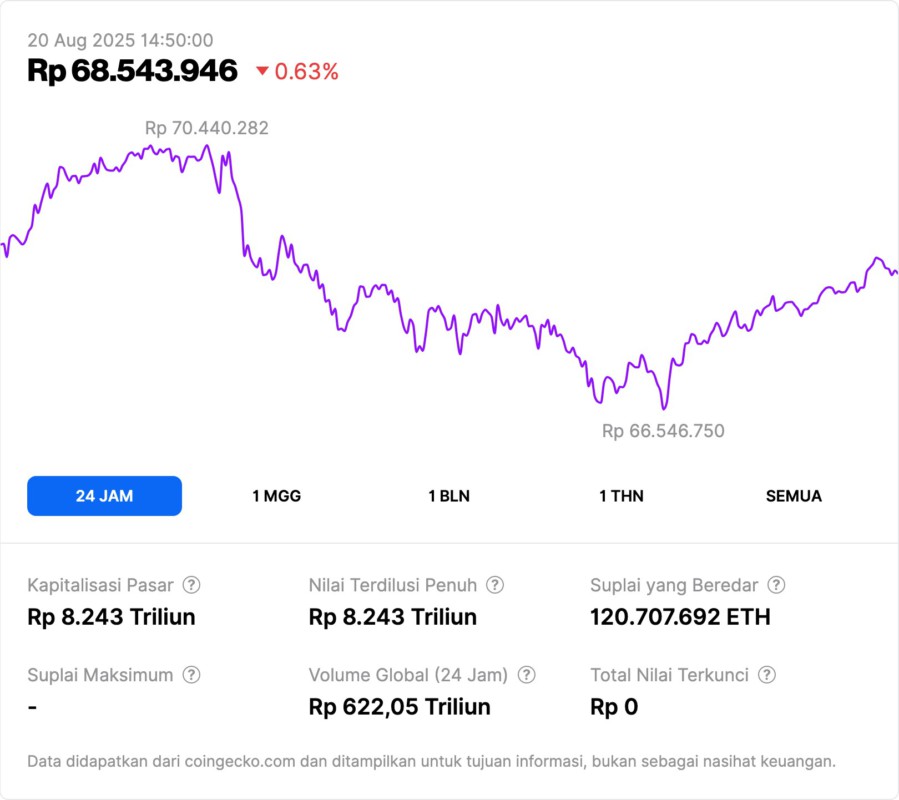

5. 4% Correction Could Be a Buy Opportunity

Although Ethereum recently dropped 4%, many analysts see it not as a bearish signal, but rather just a temporary market shuffle. With the momentum of fund flows and solid market participation, this drop could be an ideal entry point for new investors.

If adoption and capital flows continue to grow at the current rate, Ethereum has the potential to provide greater returns than Bitcoin in future market cycles.

Also Read: Dogecoin is the only meme coin in the top 25 – is it the king of meme coins?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. $2.9B Flows into Ethereum ETFs; Is ETH’s dip a buying signal?. Accessed on August 20, 2025