Revealed! The Secret Behind High Frequency Trading

Jakarta, Pintu News – High Frequency Trading is a method that uses sophisticated computer programs and algorithms to execute transactions in a matter of milliseconds.

This technology allows market participants to capitalize on very small price differences by executing large transactions in a very short period of time. This high execution speed provides significant advantages to financial institutions and traders using HFT, with turnover rates and order to trade ratios increasing.

High Frequency Trading Mechanism

HFT is a form of algorithmic trading. By analyzing market data in real-time, HFT enables the execution of large volumes of transactions in a very short period of time. These algorithms constantly monitor market movements and look for arbitrage opportunities, where they can buy and sell assets in different markets to profit from the existing price differences.

Also Read: Ethereum (ETH) Price Predicted to Surge to $15,000, What’s Driving This Increase?

Pros and Cons of High Frequency Trading

One of the main advantages of HFT is the increase in market liquidity and the reduction of very small bid-ask spreads. A study in Canada showed that when the government imposed fees on HFT, bid-ask spreads increased by 13%, showing how important HFT is in keeping spreads low.

However, HFT also has its drawbacks. It reduces the role of brokers and dealers and relies on mathematical models for decision-making, which reduces human interaction in the trading process.

Criticism and Social Impact of HFT

HFT is often a controversial topic in discussions about financial markets. On May 6, 2010, for example, the Dow Jones Industrial Average (DJIA) experienced its biggest drop of the day, dropping 1,000 points in 20 minutes, triggered by a large order that triggered massive selling.

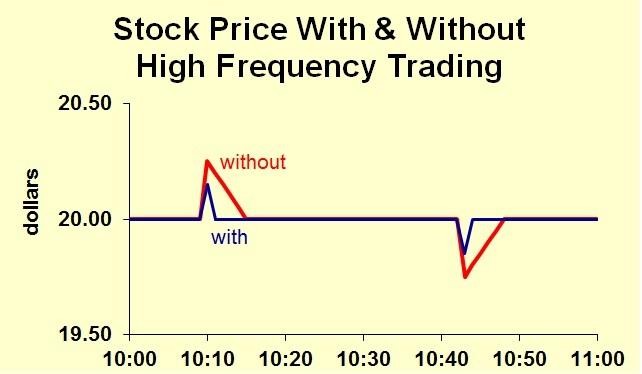

This incident shows how HFT can dramatically affect the market. In addition, the liquidity offered by HFT is often perceived as “ghost liquidity”, which appears and disappears quickly, making it difficult for traders to take advantage of it.

Conclusion: The Future of High Frequency Trading

While HFT brings some advantages such as speed and efficiency, there are serious concerns regarding its impact on market stability and fairness. Technological developments continue to shape the financial industry, and it is important for regulators to understand and manage the risks associated with this algorithmic trading.

The future of HFT will probably involve more oversight and regulation to ensure that all parties can utilize the advantages of this technology without harming market stability.

Also Read: Dogecoin is the only meme coin in the top 25 – is it the king of meme coins?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Investopedia. High-Frequency Trading. Accessed on August 20, 2025