Fed Rate Cut Optimism Triggers Crypto Market Surge in September 2025!

Jakarta, Pintu News – Crypto markets experienced a significant surge following signals from US Federal Reserve Chairman Jerome Powell about a potential interest rate cut in September. Ethereum is nearing record highs, while Bitcoin is stabilizing, and Chainlink is reaching the peak of the year.

Market Reaction to Powell’s Signal

The dovish remarks made by Jerome Powell at the Jackson Hole symposium have sparked optimism among investors. Ethereum (ETH) managed to touch a price of $4,834, while Bitcoin (BTC) stabilized around $117,000 with the next target being $120,000.

On the other hand, Chainlink (LINK) recorded impressive gains by reaching $27.11, a year-to-date high, showing a separation from the broader market trend. These gains were not only in the crypto market, but also in the stock market with the S&P 500 hitting a new record high.

This shows that the market is very sensitive to signals from the Fed. Prior to this spike, negative sentiment among retail traders hit its lowest level since July, signaling that the market may have bottomed.

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

High Enthusiasm, Increased Risk

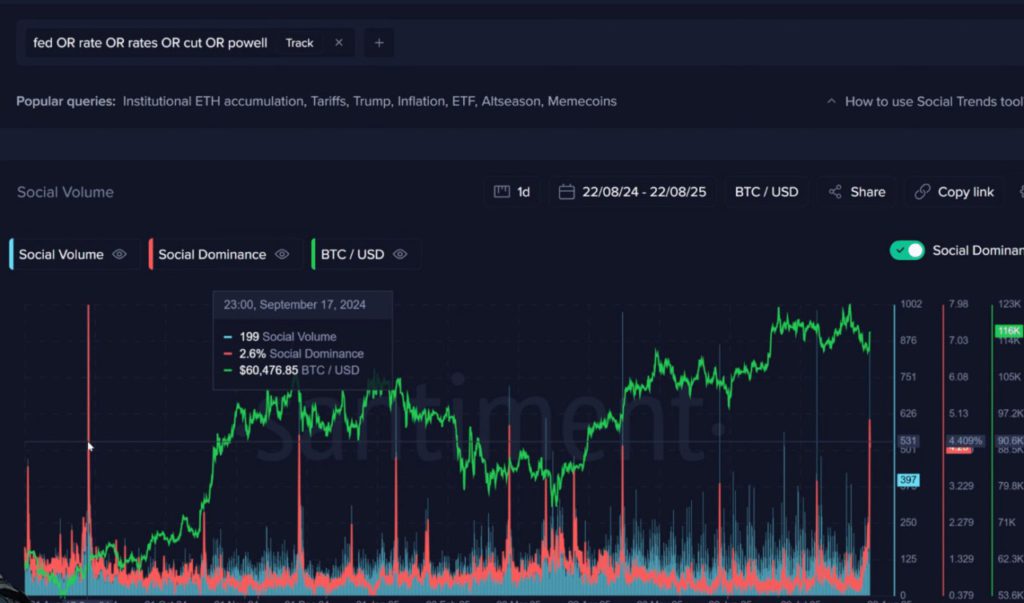

While there is high enthusiasm, it is worth being aware that discussions about “Fed,” “interest rates,” and “cuts” have reached their highest level in 11 months. This reflects a combination of excitement and anxiety regarding the upcoming rate cut.

Santiment notes that a large spike in discussion around a particular bullish narrative could signal that the euphoria has peaked and may indicate that the market has already reached local highs.

Meanwhile, on-chain data and sentiment show a more complex picture. Bitcoin (BTC) showed optimism in social conversations, but utility metrics such as Active Addresses and transaction volume showed a decline, while Supply on Exchanges increased, indicating potential selling pressure.

Also Read: Ondo Finance (ONDO): RWA Project Claimed to be 10x in 2026, Is it True? Here’s the Analysis!

Analyst Views and Potential Impacts

Analysts from Santiment state that Ethereum (ETH) has a good chance of breaking the all-time record high and approaching $5,000, mainly because widespread FOMO hasn’t happened yet. However, the biggest risk to the market remains the narrative surrounding the Fed.

If there is news that contradicts the expectations of a rate cut, the market could experience a rapid correction. David Duong, Head of Research at Coinbase, added that a rate cut could drive more liquidity into crypto as money market funds become less attractive and M2 money supply grows.

This factor, along with tariff uncertainty, has many investors holding onto their cash, waiting for clarity before taking the plunge.

Market Conclusions and Expectations

Although Ethereum (ETH) is near record highs, regulatory signals, including a call from Vice Chair Michelle Bowman for digital asset oversight, suggest that data-driven decision-making will remain important as markets brace for the Fed’s next move. With the potential for a rate cut, investors may return to riskier assets, triggering the next market move.

Also Read: Notcoin (NOT): Why 100 Billion Supply Could Be a Strength and Risk in the Crypto World

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto markets such as Bitcoin price today, XRP coin price today, Dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. ETH leads BTC steady, LINK hits $27 on September Fed rate cut optimism. Accessed on August 25, 2025