Global Crypto Adoption: One Billion Dollar Solana (SOL) Reserve by Wall Street Giant!

Jakarta, Pintu News – The crypto market is back in the spotlight with ambitious plans from some of Wall Street’s biggest firms backing the creation of a one billion dollar Solana reserve. The initiative not only marks a major step in the institutional adoption of Solana (SOL) but also establishes the cryptocurrency as a serious asset in corporate portfolios.

Introduction of Large Reserves

This planned new reserve will surpass all existing Solana (SOL) reserves. Currently, Upexi, a supply chain management brand, is the largest holder with over 2 million Solanas (SOL), valued at approximately $400 million. It is followed by DeFi Development Corporation with 1.29 million Solana (SOL), worth approximately $240 million.

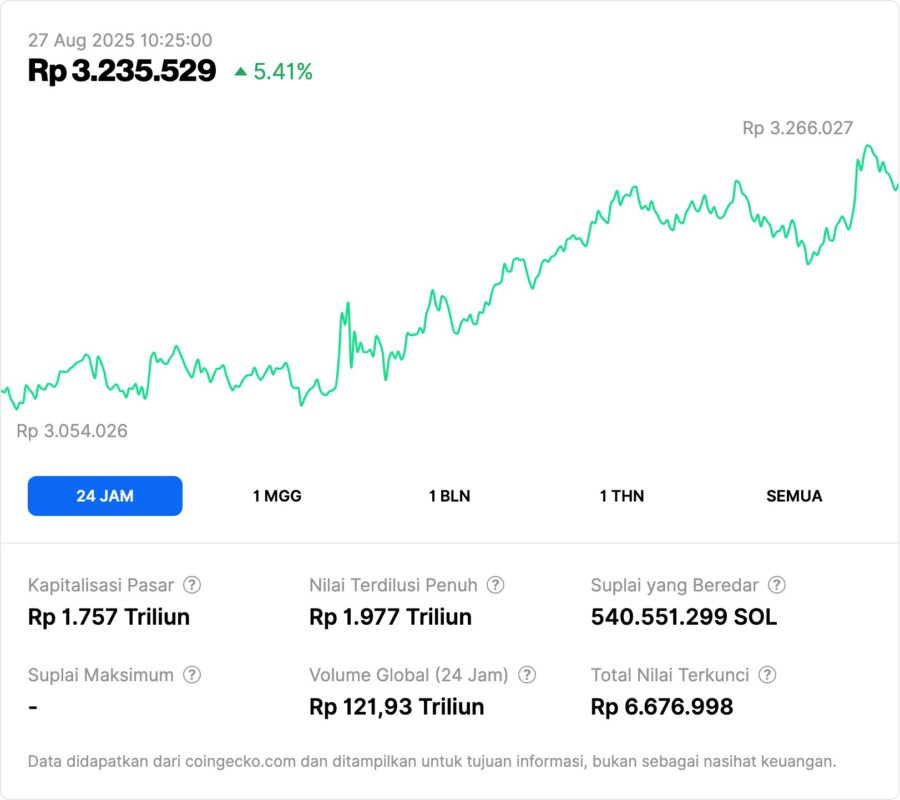

With this new reserve, the amount of Solana (SOL) held will more than double the amount held by Upexi. The reserve also marks the recovery of Solana (SOL) after the FTX crash that previously took a huge toll on its ecosystem. With an ever-increasing market value, Solana (SOL) is currently trading close to $200 and is up 6.6% in the last month, further affirming its position in the market.

Also Read: Dogecoin (DOGE) Price Prediction: 3 Key Levels to Watch This Week

Reserve Building Strategy

To form this reserve, the plan is to take over publicly traded entities and turn them into companies that focus on digital assets specifically Solana (SOL).

Cantor Fitzgerald, a leading banking firm, is leading the banking side of the deal. The backing of the Solana Foundation also adds credibility to the venture, showing that Solana (SOL) is taken seriously as a reserve asset.

The presence and support of big names in the traditional finance and crypto industries shows that Solana (SOL) is not only surviving, but thriving. This marks an important step in the evolution of Solana (SOL) as a long-term strategic asset that large corporations can rely on.

Also Read: Dogecoin (DOGE) Price Prediction: 3 Key Levels to Watch This Week

More than Just Crypto Reserves

The establishment of this reserve is not just about adding to the number of Solana (SOL) held. It’s also about establishing Solana (SOL) as a serious contender in the corporate reserve space, previously dominated by Bitcoin . With this reserve in place, Solana (SOL) could become the new benchmark in how companies treat blockchain tokens as long-term strategic assets.

In addition, the success of this reserve will strengthen Solana (SOL)’s position in the post FTX crash recovery, demonstrating Solana (SOL)’s resilience and growth potential in the face of challenges. This is a significant step forward for the Solana (SOL) ecosystem and for the crypto market as a whole.

Conclusion

The initiative to establish a one billion dollar Solana (SOL) reserve marks a new era in crypto adoption by large institutions. With the backing of key players on Wall Street and the Solana Foundation, Solana (SOL) is poised to strengthen its position as an important asset in the financial world. This move not only increases confidence in Solana (SOL) but also opens up new opportunities in the use of crypto as a corporate asset.

Also Read: Ethereum (ETH) Prepares to Surge Again: Will History Repeat itself in September 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. A Billion Dollar Solana Reserve: Wall Street Giants Jump onto Sol. Accessed on August 27, 2025