Bitcoin Price Hits $111,000 Today (Aug 27): Are Traders Starting to Pull Back and Sell?

Jakarta, Pintu News – Bitcoin is trading 10% lower than its record high, pressured by heavy profit-taking that has eroded some of its value since August 14.

The leading cryptocurrency is now trading around the $111,000 level, with on-chain signals indicating a possible deeper correction in the near future.

Bitcoin Price Rises 1.10% in 24 Hours

On August 27, 2025, Bitcoin’s price reached $111,134, equivalent to IDR 1,813,336,765, marking a 1.10% increase over the last 24 hours. During this period, BTC hit a low of IDR 1,785,340,228 and peaked at IDR 1,832,825,366.

As of now, Bitcoin’s market capitalization is approximately IDR 36.258 trillion, with a 29% drop in trading volume over the past 24 hours, bringing it down to IDR 661.35 trillion.

Read also: Is Bitcoin’s Dominance Slowing Down? Experts Weigh in on the Coming Altcoin Season

BTC Futures Traders Retreat as Decline Continues

On August 26, on-chain data showed that selling pressure continued to mount, threatening to push BTC below the $110,000 psychological mark.

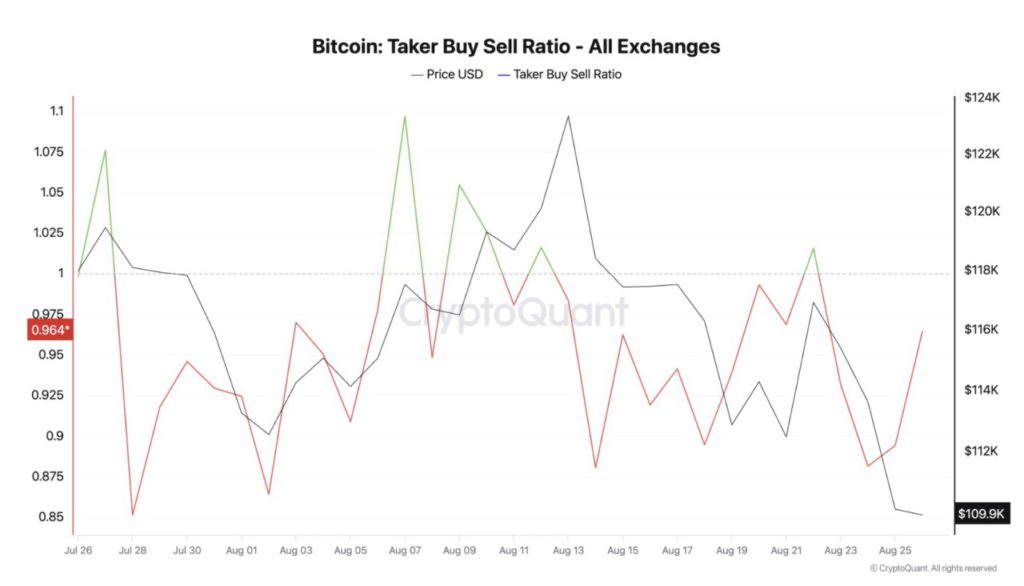

One of the most striking indicators is BTC’s Taker-Buy Sell Ratio, which has been mostly negative since July. At the time of writing, this ratio stands at 0.96 according to CryptoQuant, indicating that sell orders dominate buy orders in this coin’s futures market.

An asset’s taker buy-sell ratio measures the ratio between buy and sell volumes in its futures market. Values above one indicate buy volume is greater than sell, while values below one indicate more futures traders are selling their holdings.

For BTC, this trend suggests that futures traders are starting to back away from aggressive bullish bets, adding to the pressure already weighing on the market. This shows a lack of confidence among derivatives traders that the coin of the realm will experience a significant recovery in the near future.

Bitcoin Spot Traders Turn into Sellers

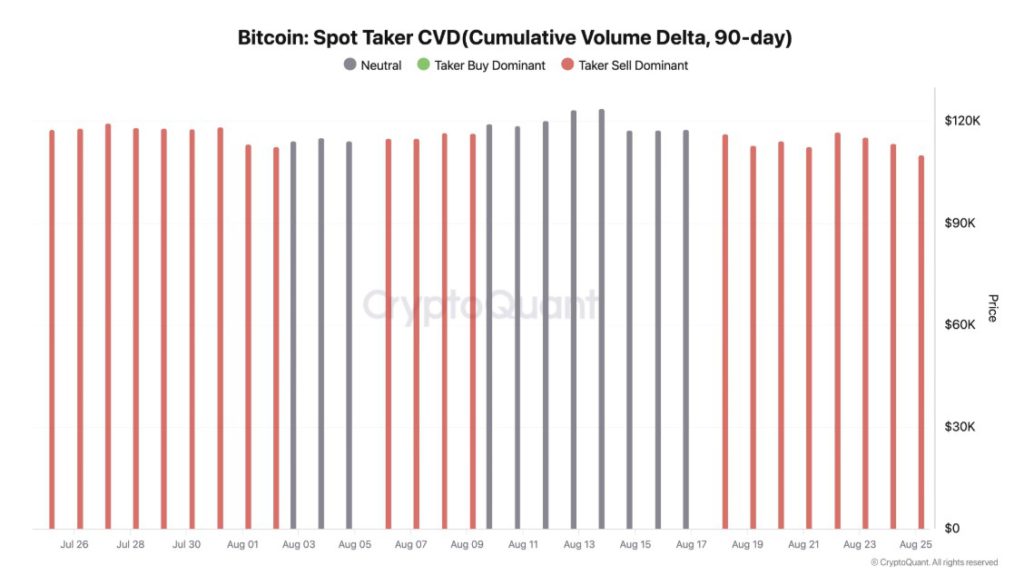

This trend is also visible among spot market participants. Based on data from CryptoQuant, Bitcoin’s Spot Taker CVD (Cumulative Volume Delta, 90 days), which tracks net buying and selling activity in the spot market over a 90-day period, reversed from its “neutral” position on August 18.

Since then, this CVD has continued to show red bars, signaling that sellers are dominating spot market activity.

This shift towards a taker-sell dominated phase for BTC reflects reduced demand and weak buy-side absorption of the ever-increasing supply.

With spot traders increasingly selling rather than buying, this imbalance increases the risk of further declines.

Read also: Grayscale Files Spot Avalanche (AVAX) ETF Application to the SEC!

$110,000 Support Threatened Amid Declining Demand

As demand in the spot and futures markets wanes, BTC, the main coin, is at risk of falling below $110,000. In this scenario, the price of the coin could drop to $107,557, the next major support level.

However, if buyers dominate again and trigger a rally, BTC price could rise to $111,961. If this level is broken, the price could move towards $115,892.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Bitcoin Struggles at $110,000 as Traders Pull Back Across Markets. Accessed on August 27, 2025