Ethereum Falls to $4,500 Today, but Tom Lee Predicts a Surge to $12K

Jakarta, Pintu News – Tom Lee, managing partner of Fundstrat Global Advisors, predicts Ethereum could reach $5,500 in the next few weeks and rise to $10,000-$12,000 by the end of the year.

At the same time, BitMine’s accumulation of hundreds of thousands of ETH and the increasing “tightening of supply” in the market has raised concerns. This has left investors wondering whether a big surge for ETH is imminent.

Then, how is Ethereum’s current price movement?

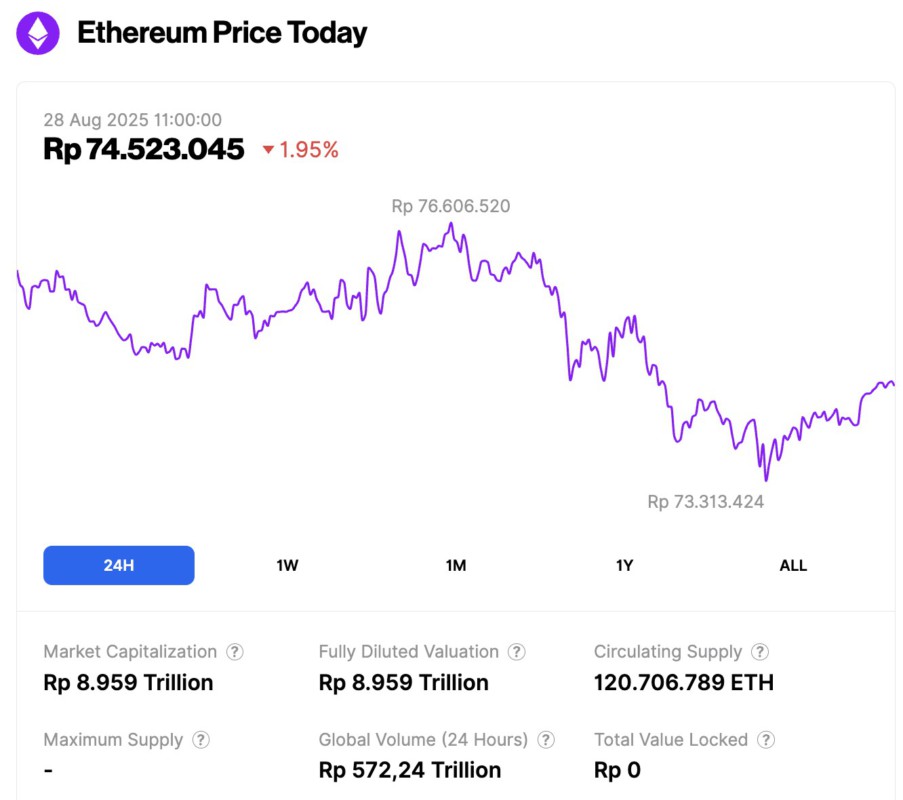

Ethereum Price Drops 1.95% in 24 Hours

As of August 28, 2025, Ethereum was trading at approximately $4,537 or IDR 74,523,045, reflecting a 1.95% decline over the past 24 hours. During this period, ETH dipped to a low of IDR 73,313,424 and reached a high of IDR 76,606,520.

At the time of writing, Ethereum’s market capitalization is around IDR 8,959 trillion, while its 24-hour trading volume has dropped by 12% to IDR 572.24 trillion.

Read also: Bitcoin Holds Strong at $111,000 Today – Could It Reach $160,000 by Christmas?

New Predictions for Ethereum in 2025

In a recent interview, Tom Lee, who is also the chairman of BitMine, shook the community with his arguments. He predicted that Ethereum could reach $5,500 in the next few weeks and rise to $10,000-$12,000 by the end of the year.

This is not just an optimistic prediction, but a statement from an influential figure who is closely associated with BitMine’s grand strategy of managing ETH reserves.

Lee summarized his prediction with two main arguments. First, institutional buying power is getting stronger (through ETFs, staking, and corporate cash). Second, Ethereum’s supply structure is thinning out.

Impact of Institutional Accumulation

On the institutional side, BitMine emerged as one of the most aggressive accumulators of ETH. Data shows that BitGo transferred 95,800 ETH from its custodial wallet to six new wallets allegedly associated with BitMine.

With this scale, BitMine quickly increased its Ethereum holdings to billions of dollars, making it the largest ETH reserve in the world.

As institutions of such magnitude continue to accumulate, the impact on the balance of supply and demand is obvious. In fact, many on-chain observers are warning that Ethereum is entering a “tightening of supply.”

Balances on exchanges continue to drop to unprecedented lows, while ETH locked in staking and burned through EIP-1559 continues to grow.

“Six months ago, ETH reserves weren’t even a thing to talk about. Now, they have over 3.3 million ETH, worth over $14.5 billion. That’s 2.75% of all ETH in existence and locked up. The tightening of Ethereum’s supply is real,” Lark commented.

Read also: Crypto Market Tanks, But Whales and Big Investors Keep Buying

In addition to supply dynamics, analysts are closely monitoring Ethereum through the ETH/BTC ratio. Many analysts expect the pair to soon break the trend formed since 2017.

Such a breakthrough could signal the start of a strong rally, with a price target of between $10,000 and $15,000. This projection further reinforces Tom Lee’s belief that Ethereum may be on the verge of an unprecedented acceleration.

However, these Ethereum predictions should be seen as scenarios, not certainties. In order for ETH to reach that price milestone, several conditions must support each other: sustained institutional flows, a favorable macroeconomic backdrop without major liquidation pressures, and most importantly, no sudden liquidity surprises from large wallets withdrawing profits.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Eyes Breakout as Tom Lee Predicts $5,500 to $12,000 in 2025. Accessed on August 28, 2025