Altcoin Surge 2025: Investment Opportunities to Watch As the Year Ends!

Jakarta, Pintu News – By 2025, Bitcoin’s market dominance declines from 65% to 59%, signaling a capital shift to altcoins post-halving and an influx of institutional funds.

Macroeconomic factors such as interest rate cuts in the US, Trump-era pro-crypto policies, and a $200 million liquidity injection into M2, have accelerated altcoin adoption in the fourth quarter of 2025.

Macro Signals: Bitcoin Halving and Liquidity Expansion

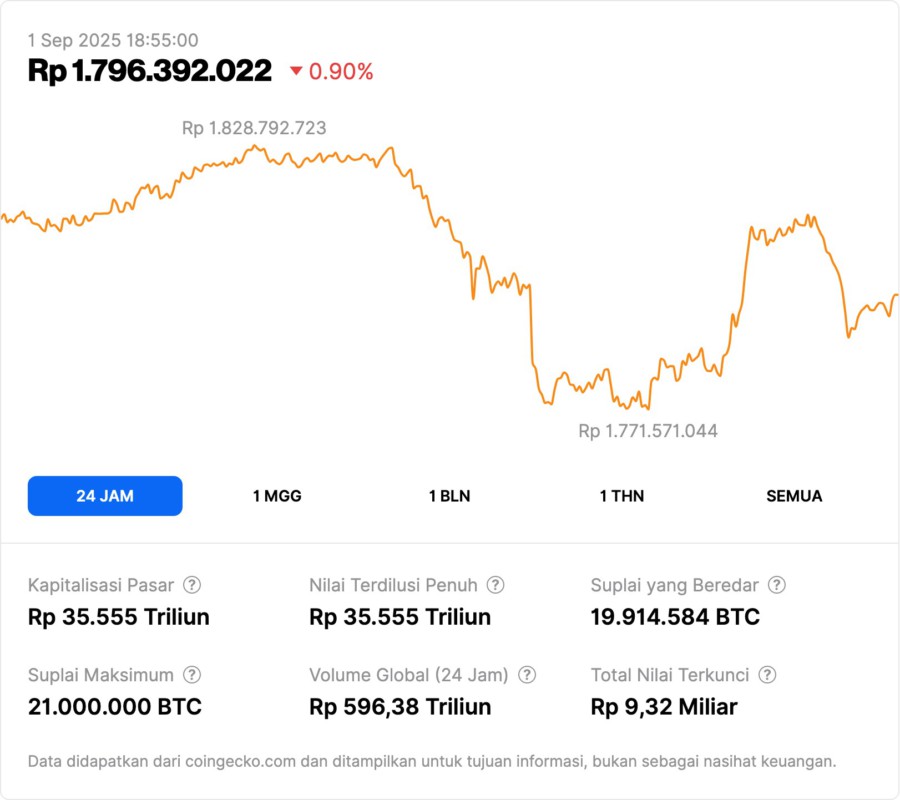

Bitcoin’s (BTC) halving on April 19, 2024 served as a catalyst, reducing supply and triggering a 47% price surge to $64,000 in May 2024. By the fourth quarter of 2025, Bitcoin’s price had reached $109,000, but its dominance declined as macroeconomic headwinds – interest rate cuts by the US Federal Reserve and Trump-era pro-crypto policies – shifted capital to altcoins.

The US M2 money supply, which now stands at $22 trillion, has injected liquidity into the altcoin market, with $200 million of new inflows recorded in August 2025 alone. This liquidity expansion, along with Bitcoin’s mature on-chain metrics, suggests a structural shift in capital allocation.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

Technical Indicators: Golden Cross and Megaphone Pattern

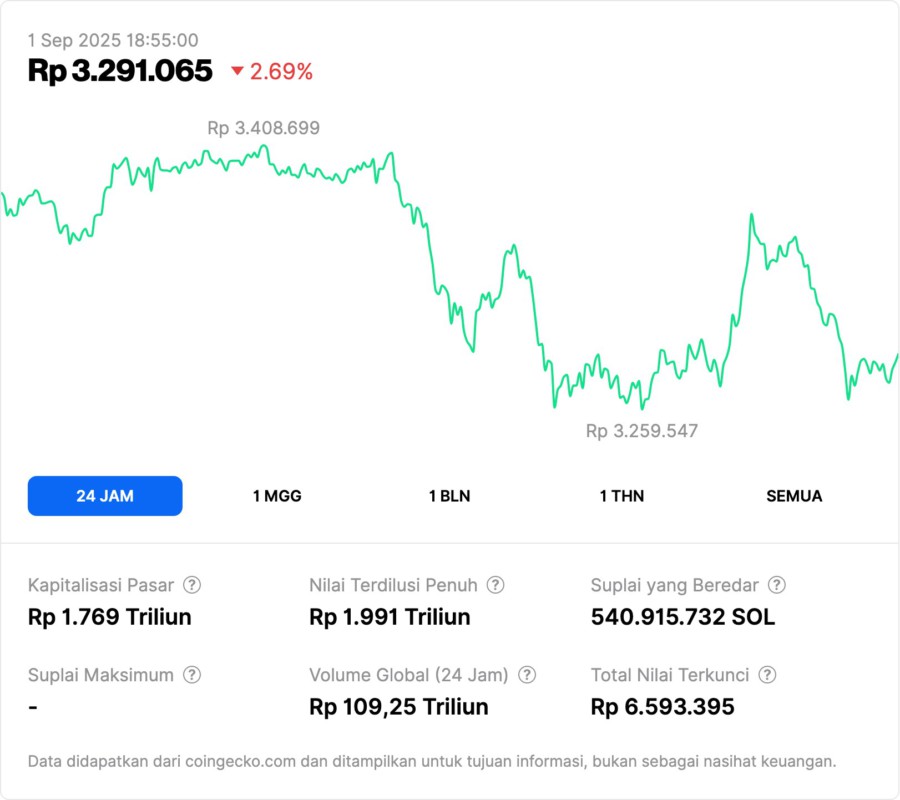

Solana is an example of a very promising altcoin. Its price chart shows a golden cross on the SOL/BTC pair, with the 50-day moving average crossing above the 200-day line, and a megaphone pattern forming as volatility increases ahead of a possible breakout.

Institutional adoption has strengthened Solana’s position: public companies now hold 1% of the circulating supply, and annual staking yields of 7-8% attract capital. The next key resistance level at $295-$300 could trigger a parabolic move if the Alpenglow upgrade improves scalability.

Ethereum is also showing bullish technical signals. The megaphone pattern on its weekly chart suggests a potential surge to $10,000 if it manages to break above $5,000. The Pectra/Dencun upgrade has improved transaction efficiency, while institutional demand for ETH-based ETFs has surged, with inflows of $4.5 billion as of January 2025.

Conclusion

The altcoin surge in 2025 is not a purely speculative phenomenon, but rather a calculated response to Bitcoin’s post-halving dynamics and institutional reallocation.

As Bitcoin’s dominance declines, investors who strategically allocate to these highly convincing altcoins stand to capitalize on the next phase of crypto evolution.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AINVEST. Imminent 2025 Altcoin Breakout: Institutional Shifts Post Bitcoin Halving Strategic Guide High Conviction Opportunities. Accessed on September 1, 2025