Altcoin Season is Here? Check out 4 Important Signals from the Crypto Market!

Jakarta, Pintu News – The crypto market is once again showing interesting dynamics with strong indications of the coming altcoin season. Various signals from market structure to practical blockchain applications indicate a shift that may be favorable for market participants. This analysis will outline some of the signals that may be key for effective trading strategies in the future.

Market Structure and Resilience TOTAL3

In the past five days, price movements in the altcoin market showed a pattern similar to the beginning of the altcoin season, rather than simply a rotation in the major coins. TOTAL3, which includes the market capitalization of coins other than Bitcoin and Ethereum , did not record any new declines despite BTC and ETH fluctuations.

The derivatives side showed order with almost neutral funding levels and limited passive liquidations, signaling real demand led by spot trading.

This allows traders to expand their market coverage without waiting for BTC or ETH to reach new peaks. The selection of altcoins in pair trading offers better cost efficiency, providing opportunities for wider portfolio diversification and increased profit potential.

Also Read: Can Ripple (XRP) Make Investors Millionaires? Here Are the Prospects According to Analysts!

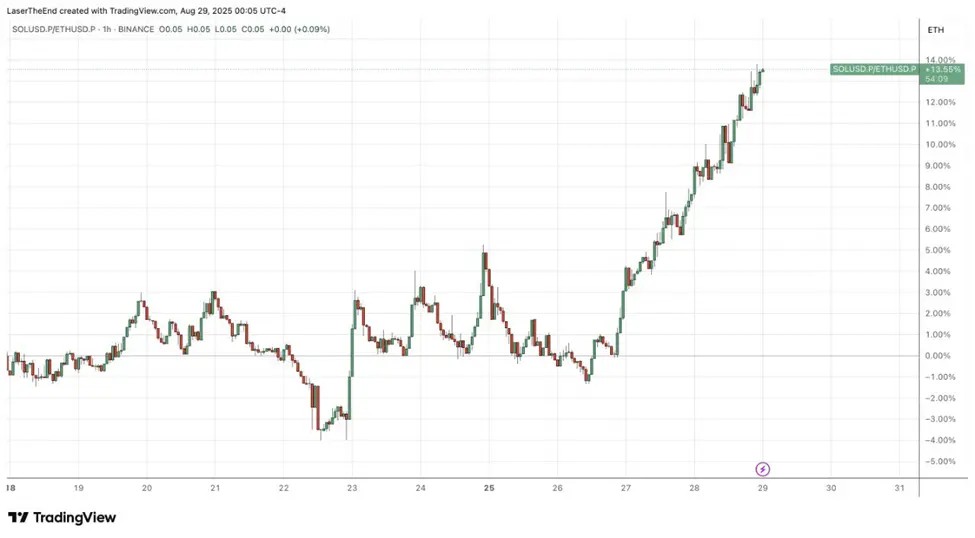

SOL Begins to Outperform ETH, Rotation Begins

One interesting phenomenon is the performance of Solana which has started to outperform Ethereum (ETH). The stability of funding levels and the absence of any indication of a short squeeze suggests that active buying is taking place. Historically, this has often been followed by a rotation to mid-market cap altcoins that have high liquidity and diverse functionality.

A possible strategy is to go long on Solana (SOL) and short on Ethereum (ETH). This approach offers a lower β expression, which means more controlled risk while capitalizing on the upside potential of SOL.

Key Coins: Stable, But Not Leading

Although the fundamentals of major coins like Bitcoin (BTC) and Ethereum (ETH) remain positive, their marginal momentum is decreasing. Each price drawdown finds support, but the upward movement is less powerful and often not enough to reach new highs. This suggests that the major coins probably won’t be the main drivers of the market in the near future.

Market participants may need to adjust their strategies to rely less on major coins and start looking at opportunities on altcoins that show more significant growth potential. Portfolio diversification is key in dealing with the current market dynamics.

Practical Blockchain Applications are Advancing

There are strong catalysts supporting the advancement of practical blockchain applications, especially from the policy and infrastructure side. The US Department of Commerce has announced that official data such as actual GDP, PCE, and more will be integrated into blockchain through platforms such as Chainlink and Pyth, which include networks such as Arbitrum, Avalanche, and Base.

This integration opens up new scenarios for data-driven DeFi, tokenized risk controls, and event markets. This is a major step that not only improves transparency and efficiency but also opens up new opportunities in the development of innovative financial products.

Conclusion: Trade Framework

With orderly major market conditions, ETF inflows starting to decline, and thin DAT premiums, hard catalysts are steering the fund in a downward direction. The recommended strategy is to continue prioritizing pair trades and follow breaking news to capture emerging opportunities.

Also Read: 4 Interesting Facts Why 1 in 4 Brits are Interested in Crypto Investment for Retirement Funds

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Chain Catcher. BitMEX Alpha: The signals for altcoin season are becoming clearer. Accessed on September 1, 2025