5 Causes of the Bitcoin Price Crash to the Lowest Level in 2 Months: What’s Up?

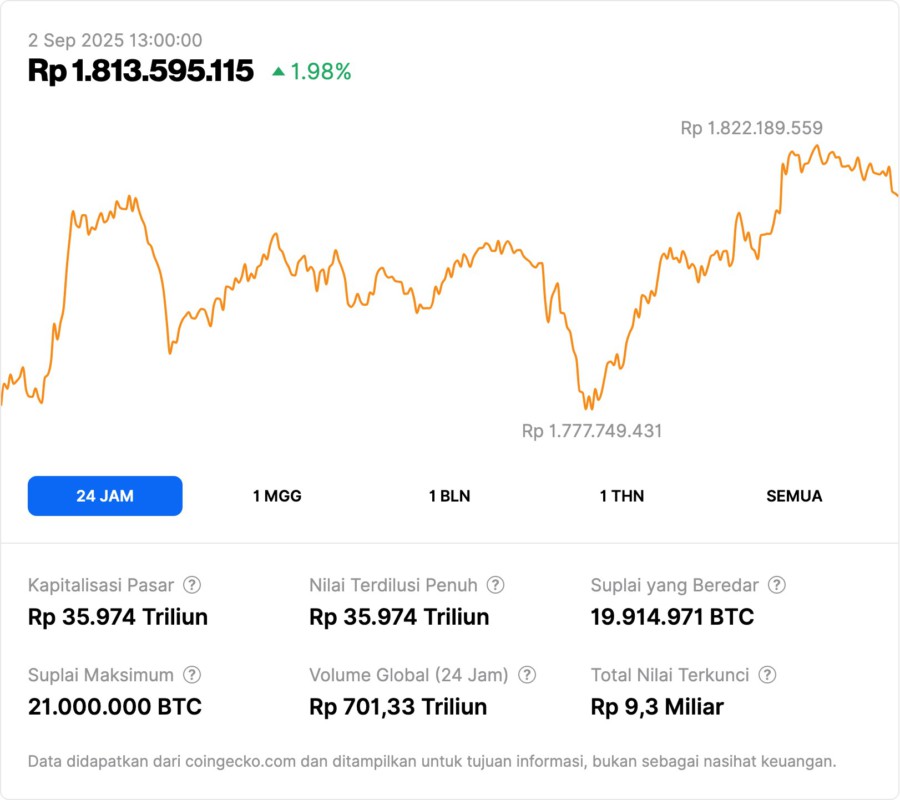

Jakarta, Pintu News – Bitcoin continued its downward trend in early September 2025 by touching the price of $107,290 or around Rp1.763 billion (exchange rate 1 USD = Rp16,447). This drop marks the lowest level in two months and is a correction of about 14% from its highest price on August 14.

1. Bitcoin (BTC) price drops to Rp1.76 billion, lowest in 2 months

According to a report from Bitcoin.com, this drop highlights the declining investor interest in this major crypto asset. Although some technical indicators still imply a possible rebound, analysts warn that if the price of BTC drops below $107,000, then selling pressure could increase further.

2. Spot Bitcoin ETF Experiences Rp2 Trillion Outflow

One of the main factors suppressing Bitcoin price is the outflow of funds from spot Bitcoin ETF products. Throughout last week, the total outflow reached $126.64 million or around Rp2.083 trillion.

These outflows indicate that institutional investors are starting to withdraw their capital from crypto assets, magnifying the selling pressure in the market. This phenomenon contradicts the expectation that ETFs will be a positive catalyst for Bitcoin prices in the long run.

3. Technical Analysis: No Sign of Bear Market Yet

Although many are starting to panic, some analysts believe that the market has not yet entered a true bearish phase. A popular analyst known as Mr. Wall Street stated that the current market condition is still in a phase of uncertainty, not euphoria.

In his post on platform X, he said that bear markets usually start when euphoria peaks, while currently investors are still torn between optimism and fear. He also predicted that the price of BTC could reach $140,000-$145,000 by the fourth quarter of 2025, depending on the interest rate decision by the Federal Reserve.

4. Ethereum (ETH) and XRP (XRP) Also Affected

The selling pressure is not only on Bitcoin, but also major altcoins such as Ethereum and XRP . In the past 24 hours, ETH fell 1.4% to $4,400, while XRP fell 3.6% to $2.74.

In the past week, ETH has seen a 7% drop and XRP has even dropped by 9%. XRP has also lost third place in market capitalization due to this selling pressure, according to data from Bitcoin.com.

5. Crypto Market Capitalization Drops to IDR 62.5 Quadrillion

The impact of the major coins’ price drops caused the total capitalization of the cryptocurrency market to shrink to $3.8 trillion or around Rp62,498 trillion. Most altcoins recorded daily declines of between 1.5% to 4%.

This suggests that the market pressure is all-encompassing, not just limited to BTC. Many investors are currently awaiting the direction of interest rate policy in the upcoming FOMC meeting which is predicted to have a major impact on the crypto market.

Also Read: Bitcoin Price Increase Prediction: Analyst Dave The Wave Reveals Potential Spike in September!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Terence Zimwara/Bitcoin.com. Bitcoin Hits Two-Month Low Amid $126M ETF Outflows and Bearish Pressure. Accessed on September 2, 2025