WLFI Price Prediction: Could These Two Catalysts Push WLFI to a New Price Peak?

Jakarta, Pintu News – WLFI (World Liberty Finance) officially launched on spot exchanges yesterday, and traders immediately tested its limits. After surging to a record high near $0.35, the token’s price experienced a sharp correction and dropped more than 19% in the last 24 hours.

Although the market is partially bearish, a deeper look reveals one unexpected momentum driver that could take WLFI beyond its recent record highs.

WLFI Price Prediction: Spot Market Shows Early Signs of Weakness

Reporting from BeInCrypto (2/9/25), on-chain flows in the past 24 hours reveal why the WLFI spot market appears fragile.

Read also: Solana Holds Strong Above $200 — Could the Alpenglow Upgrade Spark the Next Big SOL Rally?

The top 100 addresses are known to have sold nearly 216.54 million WLFI tokens, worth close to $49.15 million at an average price of $0.227. On the other hand, Smart Money bought more than 102.78 million WLFI in the same period, valued at around $23.33 million.

However, public figures-including KOLs (Key Opinion Leaders) and well-known market figures-released nearly $546.40 million in WLFI.

Meanwhile, whales holding between one and ten million tokens increased their holdings by 26.85 million WLFI, worth nearly $6.10 million. While these numbers may seem significant in percentage terms, their impact pales in comparison to the sales volume of the top 100 addresses and public figures.

Overall, the spot market showed clear weakness in the early stages, with net selling pressure dominating. This makes it unlikely that buyers in the spot market alone can push WLFI prices up in the near term.

Hence, the focus has now shifted to the derivatives market, where the liquidation map and the position of the players show a very different picture.

WLFI Price Prediction: Position in Derivatives Market Hints at Potential Triggers

If demand in the spot market weakens, the derivatives market is often an unexpected short-term trigger. The WLFI perpetual contract has been active since August 23, even before spot trading began. This makes derivatives charts particularly useful as early indicators of price movements.

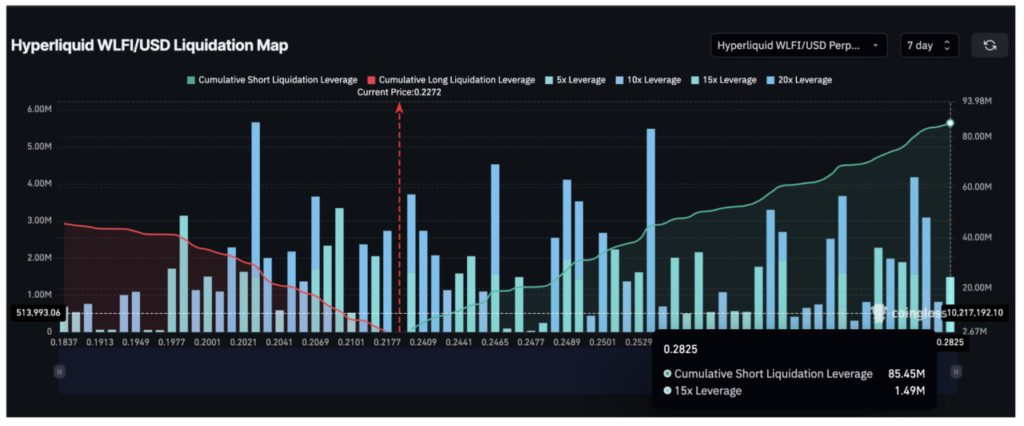

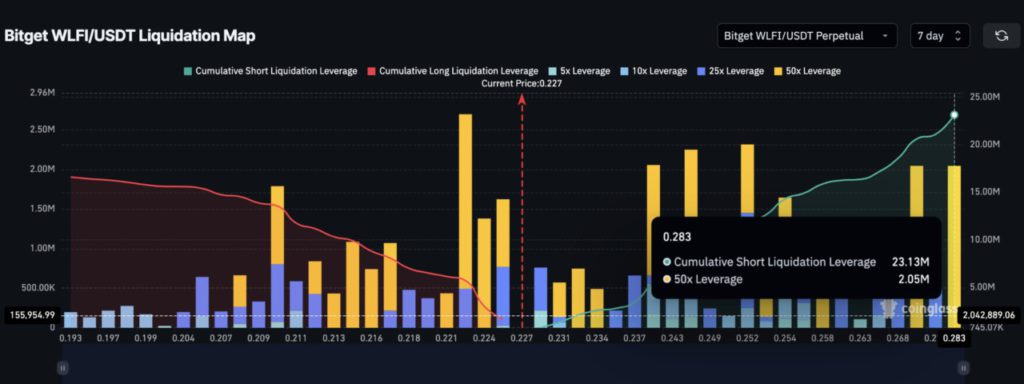

Across platforms such as Binance, Bitget, and Hyperliquid, the emerging trend looks similar: short positions dominate. On Binance alone, short positions account for almost double the amount of long liquidations.

On Bitget, short liquidations totaled over $23 million, while long liquidations were only around $16.6 million. Meanwhile, the seven-day liquidation map on Hyperliquid shows a concentration of positions around the $0.28 level – an important price threshold.

This imbalance creates the opportunity for a short squeeze – when the price rises and forces short traders to close their positions, pushing the price up even faster.

If WLFI is able to break the $0.28 level, then this liquidation zone could be triggered quickly, potentially pushing the price towards $0.32, the previous high.

It is important to note, however, that if the price of WLFI corrects downwards, then the token could also experience a long squeeze – the opposite condition that could invalidate the short-term bullish outlook. Further analysis will be discussed in the price analysis segment.

WLFI Price Prediction: WLFI Price Action and Hidden Bullish Divergence

The perpetual chart provides important context to WLFI’s price movements. Between August 27 and 29, the token exhibited a short-term pattern where the price formed a higher low, while the RSI (Relative Strength Index) indicator printed a lower low. This divergence pattern triggered a price increase in late August.

Read also: Trump-Backed WLFI Token Officially Debuts on Binance Alongside USD1 Launch on Solana

Now, if we look at a broader time scale, a similar pattern reappears. From August 24 to September 1, the price of WLFI recorded higher lows again, while the RSI fell deeper to lower lows.

This kind of divergence on a longer timeframe usually indicates that the downward pressure is starting to weaken – even though the spot market still appears weak – and opens up the opportunity for the next attempt at a price increase.

WLFI perpetual contracts began trading on August 23, 2025, ahead of the token’s launch on the spot market of various exchanges. Initially, trading was conducted under a capped price mechanism, meaning that prices moved within a certain range until an official spot price index became available.

On the WLFI spot chart on Bybit (1-hour timeframe), the price is currently trading slightly below the VWAP (Volume-Weighted Average Price) line at around $0.23. VWAP is often considered a dynamic support or resistance level by traders.

WLFI attempted to break the VWAP line, but failed-so this level is now an important barrier in the short term. If WLFI is able to break convincingly above $0.23, then the technical momentum will align with the derivatives market’s position.

If this harmony is maintained, then a domino effect can occur:

- Break $0.29 → short position potentially liquidated,

- Break $0.32 → price will retest the previous high,

- Above $0.32 → the price enters into a price discovery phase, paving the way towards new highs.

However, if the price drops below $0.20, then the potential for liquidation of long positions will increase, invalidating the short-term bullish view and bringing the price into the untested lower area.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. WLFI Flashes 2 Hidden Catalysts That Could Push Its Price to a New All-Time High. Accessed on September 2, 2025

- Coinpedia. WLFI Price Prediction as Token Launches with $7B Market Cap. Accessed on September 2, 2025