Korean Investors Switch from Tesla to Crypto: A New Phenomenon in the Capital Market!

Jakarta, Pintu News – South Korean retail investors are showing a significant shift in their investment preferences in the United States equity market.

August saw Korean investors withdraw $657 million from Tesla Inc. shares, while they allocated more than $12 billion to US-listed crypto companies so far this year. This change attracted considerable attention from Wall Street analysts and indicates a fundamental shift in investment strategy.

Tesla is losing its appeal among Korean investors

Data from Bloomberg shows that withdrawals from Tesla in August were the largest since the start of 2023, reflecting a major shift in Korean investor sentiment. These investors were previously known as big supporters who helped boost the electric vehicle manufacturer’s stock value.

However, they are now starting to doubt Tesla’s artificial intelligence narrative and growth prospects, which is reflected in their massive share sales. Concerns over Tesla’s deteriorating fundamentals and leadership risks are the main reasons for the massive sell-off by Korean investors.

Those who previously held Tesla shares worth around $21.9 billion-making it their largest foreign equity holding-are now starting to look for more promising investment alternatives.

Also Read: 5 Facts about Metaplanet’s Crypto Strategy: Save 20,000 BTC Even if the Stock Price Plummets!

Aggressive Adoption of Crypto Stocks

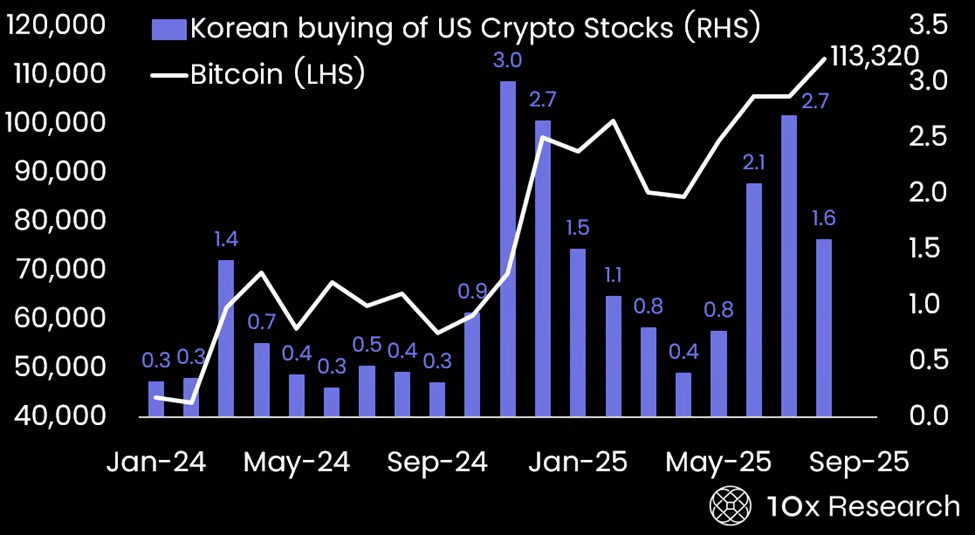

On the other hand, Korean investors have shown great enthusiasm for US-listed crypto companies. According to data from 10x Research, Korean investors have bought more than $12 billion worth of shares in crypto-related companies so far this year. In August alone, they invested $426 million in Bitmine Immersion Technologies Inc., $226 million in Circle stock, and $183 million in Coinbase.

In addition, Korean investors also placed $282 million in an Ethereum ETF that provides 2x leveraged exposure. This shows a sophisticated approach in leveraging digital assets through traditional equity markets. This aggressive buying activity has not only changed global capital flows but has also been a highlight for Wall Street analysts who are closely monitoring the behavior of Korean retail investors.

Favorable Regulatory Support

This massive investment coincides with the development of supportive regulations in South Korea, such as regulations for stablecoins, Security Token Offerings (STOs), and crypto ETFs. Discussions on the tax framework are still ongoing among policymakers. In contrast to previous extreme caution, there is now agreement in political and industry circles on the need for institutionalization.

Korean investors’ influence is not only limited to individual stock selection but also as one of the largest foreign investors in American equities as a whole. Their concentrated buying power can significantly influence the performance of individual stocks, especially in volatile sectors, where their collective actions create market movements that are felt in global trading sessions.

Korea’s Investment Paradigm Shift

The dramatic shift in investment choices by Korean investors marks a new era in global market dynamics. By switching from automotive stocks to crypto assets, they are not only seeking financial returns but also participating in the evolution of financial technology. This phenomenon deserves further attention to understand its long-term impact on equity and crypto markets.

Also Read: Check out 4 US Economic Data that Potentially Affect the Crypto Market This Week!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Koreans Abandon Tesla for Crypto Bets: $657M Exodus Reshapes Markets. Accessed on September 3, 2025