3 major factors that could drive a September 2025 Bitcoin (BTC) rally!

Jakarta, Pintu News – After reaching a new price peak in August 2025 that surpassed $124,000 (approximately Rp2,039,340,000), Bitcoin is currently trading below $110,000 (approximately Rp1,808,970,000), representing a decline of $15,000 (Rp246,405,000).

However, despite the price drop, optimism about a potential Bitcoin rally in September 2025 remains high. There are several factors that could trigger a Bitcoin price increase in the coming weeks. Let’s take a deeper look at the main factors that might drive the Bitcoin price up in September.

1. Potential Fed Interest Rate Cut: Magnifying Interest in Risky Assets like Bitcoin

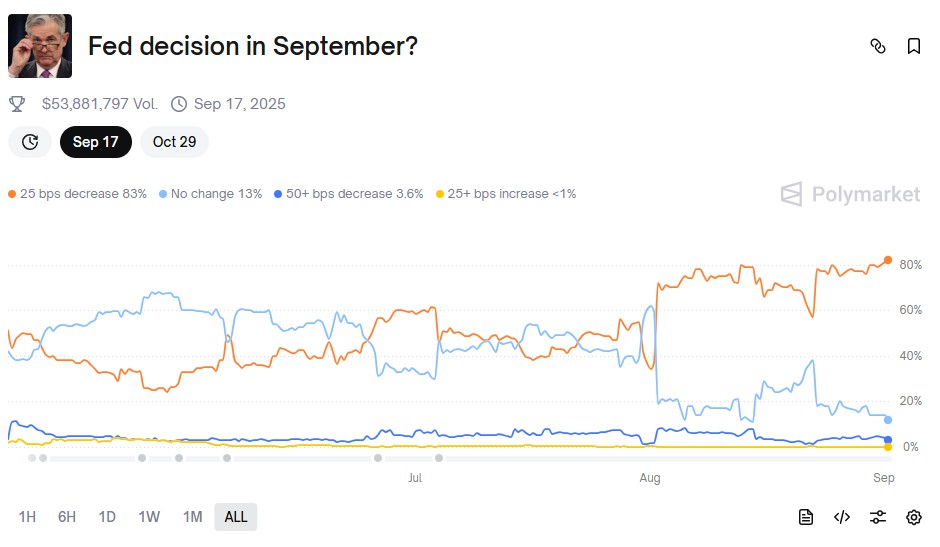

One of the main factors that could push Bitcoin (BTC) towards significant gains is an interest rate cut by the Federal Reserve (Fed). According to statements by Jerome Powell, Chairman of the Fed, there is a possibility that the benchmark interest rate will be lowered by the end of this year, with an 83% chance of a 0.25% reduction in September 2025.

If interest rates are actually lowered, this will make it easier to borrow money, which in turn could encourage investors to turn to riskier assets like Bitcoin. With lower interest rates, borrowing costs become cheaper, and this often sparks investor interest in seeking opportunities in the crypto market and other digital assets.

Also Read: 5 Facts about Metaplanet’s Crypto Strategy: Save 20,000 BTC Even if the Stock Price Plummets!

2. Exodus from Crypto Exchanges: A Positive Indication for Bitcoin (BTC)

The second factor that supports the possibility of a Bitcoin rally is the decline in the amount of Bitcoin stored on crypto exchanges. In recent times, the amount of BTC available on crypto exchanges fell to a seven-year low. This decline suggests that more investors are turning to self-custody rather than leaving their assets on exchanges.

This phenomenon can be viewed as a bullish (positive) indicator for Bitcoin, as a reduction in supply on crypto exchanges tends to reduce selling pressure that can hold down prices. With less BTC supply available for sale in the market, this could push the price of Bitcoin up as demand increases.

3. Fear and Greed Index: Is It a Good Time to Buy?

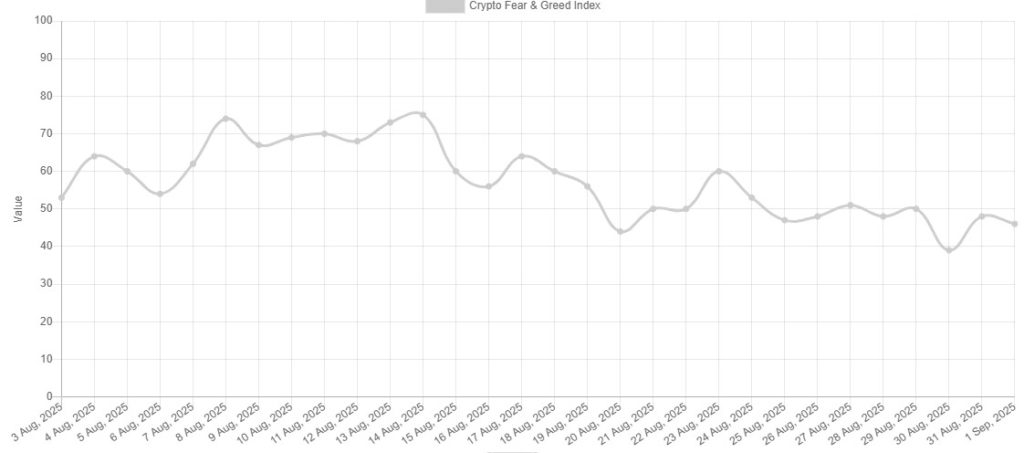

The Fear and Greed Index is a popular tool used to measure Bitcoin (BTC) market sentiment. At the time of the recent price drop, this index showed a reading of 46, which is in the “Fear” zone. While this could be seen as a bad signal for investors, many analysts point out that this fear phase could indicate that the market is already at a bottom and ready for a reversal.

Warren Buffett once said, “Be fearful when others are greedy, and greedy when others are fearful.” The current market condition dominated by fear could be an opportunity for investors to buy at lower prices, before a possible rally begins.

4. Bitcoin History in September: Potential Trend Reversal?

While there are several bullish factors supporting a possible Bitcoin rally, it is important to take note of Bitcoin’s September price history. Over the past 12 years, only four times has Bitcoin price managed to close positive in September. Typically, September is a weak month for Bitcoin, especially after a halving year.

The Bitcoin halving that occurred in spring 2024 was often accompanied by a price drop in the months that followed. Therefore, while there are factors that favor a potential rally, history shows that September tends to be more difficult for Bitcoin in terms of price performance.

Conclusion

While there are several factors that favor a potential Bitcoin rally in September 2025, investors should remain cautious and consider other factors such as global market conditions and the Fed’s monetary policy.

A possible interest rate cut, exodus from exchanges, and a low fear index could provide positive opportunities for Bitcoin (BTC). However, remember that the cryptocurrency market is highly volatile, and always do in-depth research before making an investment decision.

Also Read: Check out 4 US Economic Data that Potentially Affect the Crypto Market This Week!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Dimitar Dzhondzhorov/CryptoPotato. 3 Big Reasons September Could Spark a Bitcoin (BTC) Rally. Accessed on September 3, 2025