Michael Saylor’s Strategy Firm Buys 4,048 Bitcoin for $449 Million!

Jakarta, Pintu News – Strategy, formerly known as MicroStrategy, has made another weekly Bitcoin purchase, further cementing its position as the firm with the largest public Bitcoin cash.

This comes amid falling prices for BTC and MSTR stock, where the two assets are known to have a strong positive correlation.

Strategy Buys 4,048 BTC Worth $444 Million

In a press release, the company announced that it purchased 4,048 BTC worth $449.3 million at an average price of $110,981 per Bitcoin, achieving a BTC yield of 25.7% year-on-year (YTD). Currently, the company owns 636,505 BTC, which it acquired for a total of $46.95 billion and an average price of $73,765 per Bitcoin.

Read also: Bitcoin Holds Steady at $110,000 Today as BTC Faces 3 ‘Death Cross’ Signals

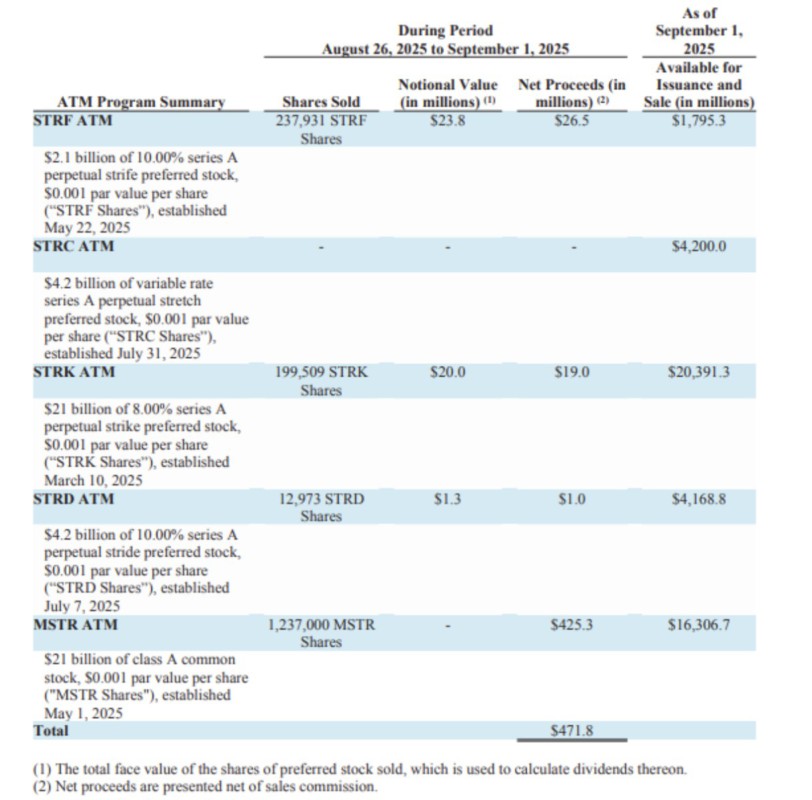

To finance this purchase, Strategy again sold MSTR shares, raising $425.3 million from the sale of 1.23 million shares. In addition, the company also raised $26.5 million, $19 million, and $1 million from the sale of STRF, STRK, and STRF shares, respectively.

Interestingly, Strategy co-founder Michael Saylor hinted at making another Bitcoin purchase on August 31.

In a post on X, he stated that BTC is still being sold at a discount, suggesting that they are capitalizing on the price drop to add to their reserves.

This latest purchase is the fifth consecutive weekly purchase by the company. Last week, Strategy announced that it had purchased 3,081 BTC worth $356.9 million, making their BTC holdings exceed 3% of the total Bitcoin supply.

MSTR Shares Decline

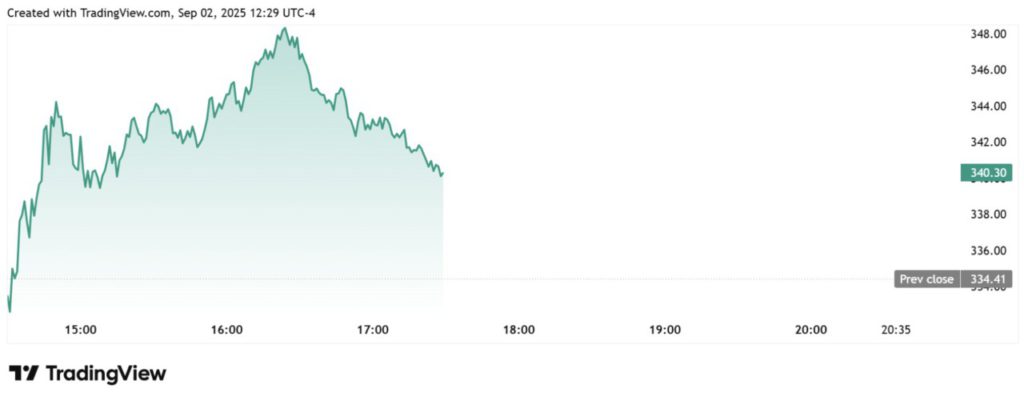

Meanwhile, these purchases came amid a decline in MSTR shares. Data from TradingView shows that the stock is down more than 15% in the past month.

The stock continued its downward trend last week and closed in the red, trading around $334. However, the stock gained almost 2% in today’s trading session, trading around $340.

Read also: Metaplanet Buys More Bitcoin, Reaches 20,000 BTC Milestone Amid Market Response

The decline in Strategy shares coincides with Bitcoin’s price drop from its all-time high of $124,000, which was reached just over two weeks ago. The flagship cryptocurrency is currently down more than 12% from its ATH.

It should be noted that this share price drop comes after the company’s decision to cancel their promise not to issue MSTR shares to buy BTC when the mNAV is below 4.0x. Strategy and Saylor have funded their last two purchases largely with the sale of MSTR shares.

Amidst the decline in MSTR stock, a positive development is that Michael Saylor and his company are no longer facing a class action lawsuit regarding alleged accounting errors in their Bitcoin holdings.

The plaintiffs voluntarily withdrew their claims by precedent, which means they cannot bring the same claims again.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Michael Saylor’s Strategy Buys the Dip with Bitcoin Purchase. Accessed on September 3, 2025

- Coinspeaker. Strategy Buys the Dip, Stacks New 4048 Bitcoin for $449 Million. Accessed on September 3, 2025

- Crypto Briefing. Bitcoin Acquisition Strategy: Saylor Buys the Dip. Accessed on September 3, 2025