CleanCore Launches Dogecoin Reserve and Appoints Elon Musk’s Lawyer as Chairman!

Jakarta, Pintu News – Nasdaq-listed CleanCore revealed its plans to join Bit Origin as a company managing Dogecoin reserves. The company has just completed a private placement, with plans to use the proceeds to accumulate the biggest meme coin.

In particular, Elon Musk’s lawyer, Alex Spiro, has been instrumental in realizing this initiative and will join the company as chairman of the board of directors.

CleanCore to Launch Dogecoin Reserve After Raising $175 Million in Funds

CleanCore Solutions has revealed their big move into the crypto world by raising $175 million to establish a Dogecoin Reserve. The initiative is backed by the Dogecoin Foundation and its commercial arm, the House of Doge, which places the meme coin at the center of CleanCore’s reserve strategy.

Read also: Ethereum Shuts Down Holesky Testnet and Switches to Hoodi, What’s the Impact?

“By making Dogecoin part of a reserve strategy backed by an official foundation, we are creating a precedent for public companies to work with foundations to build real utility around digital currencies,” said Marco Margiotta, CEO of House of Doge and future Chief Investment Officer at CleanCore, via an official press release.

The company raised funds through the private sale of 175 million Pre-Funded Warrants at $1 each. More than 80 investors, including Pantera, GSR, FalconX, MOZAYYX, and Borderless, participated in this round.

Alex Spiro, Elon Musk’s lawyer and longtime Dogecoin ally, has been named Chairman of the Board of Directors. CoinGape previously reported that Spiro was looking to form a Dogecoin Reserve company by raising $200 million, which has now materialized in a deal with CleanCore.

“This new reserve facility is a fundamental step towards institutional adoption of Dogecoin,” added Timothy Stebbing, director of the Dogecoin Foundation and new CleanCore board member.

Building Dogecoin’s Institutional Future

House of Doge and 21Shares, a company that manages $12 billion in assets, will oversee the governance and allocation of Dogecoin’s reserves. Their plans include exploring rewards such as staking for ownership and expanding retail integration to increase real-world utility.

CleanCore CEO Clayton Adams described the move as a planned bet on the future of digital currencies.

Read also: Michael Saylor’s Strategy Firm Buys 4,048 Bitcoin for $449 Million!

“By making Dogecoin our reserve, in collaboration with the Dogecoin Foundation and the House of Doge, we are adopting a reserve strategy that looks to the future while proving how public companies can embrace big changes,” he said.

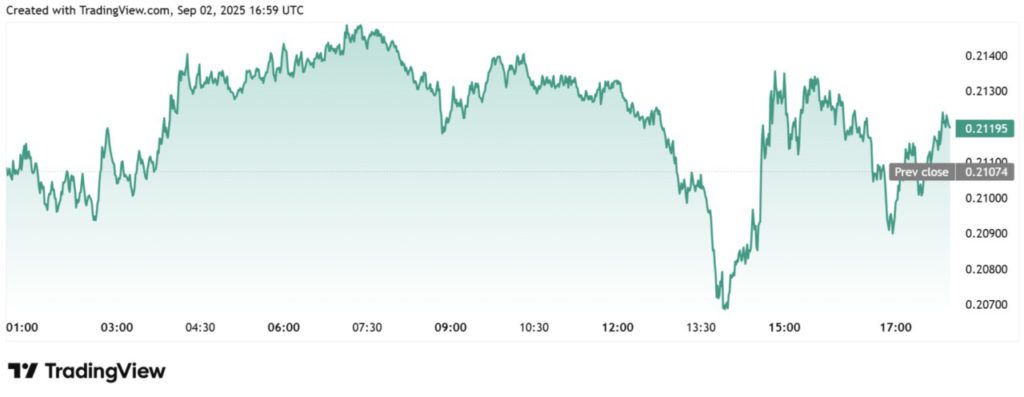

Dogecoin price is trading flat amid the emergence of this latest reserve company. TradingView data shows that the biggest meme coin is currently trading around $0.21, up less than 1% on September 2.

Meanwhile, Bloomberg analyst Eric Balchunas pointed out the decline in CleanCore shares after the announcement of the launch of the Dogecoin reserve. ZONE shares plunged by 59% and are currently down 50%, trading around $3.38, according to TradingView data.

However, ZONE stock is still up more than 200% in the past six months and 165% since the beginning of the year.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coindesk. CleanCore in $175M Deal to Establish a Dogecoin Treasury, Shares Tumble 60%. Accessed on September 4, 2025

- Coingape. CleanCore to Launch Dogecoin Treasury with Musk’s Lawyer Named Chair. Accessed on September 4, 2025

- Crypto News. CleanCore Solutions Raises $175M to Establish a Dogecoin Treasury. Accessed on September 4, 2025