Ray Dalio reveals Bitcoin and Gold as alternatives to the US Dollar, see why!

Jakarta, Pintu News – In a recent interview, billionaire Ray Dalio highlighted the decline of the US Dollar’s status as the global reserve currency. He revealed that this trend is driving the adoption of Bitcoin , other cryptocurrencies, and gold as an alternative store of value.

Dalio points to the growth of the company’s crypto treasury and the recent spike in gold prices to $3,600 as indicators of a shift away from the USD.

Declining Confidence in the US Dollar

Ray Dalio, in his interview with the Financial Times, expressed his concerns for the long-term stability of the US Dollar and other large reserve currencies. He highlighted the growing debt burden as a threat to the USD and the increasing appeal of digital assets as “reserve currencies and stores of wealth”.

Dalio added that these structural issues have contributed to the ongoing rally in gold and cryptocurrencies.

Also Read: Ondo Finance could be a crypto dark horse in Q4 2025? Here are 4 ONDO facts to know!

Stablecoins and Necessary Regulations

Dalio also addressed concerns regarding USD-bound stablecoins, which are currently in the spotlight following the passage of the GENIUS Stablecoin Bill in June. He rejected the idea that stablecoins’ exposure to US Treasuries poses a major threat, provided they are properly regulated. However, Dalio flagged a decline in the real purchasing power of Treasuries as a real concern for investors.

The Future Role of Cryptocurrencies

On the future role of cryptocurrencies, Dalio stated that Bitcoin (BTC) and other digital assets are emerging as viable alternatives to fiat currencies due to their limited supply. “If dollar supply increases and demand decreases, crypto becomes an attractive alternative,” Dalio said. This shows a paradigm shift in the way traditional and digital currencies are viewed.

Shining Yellow Gold

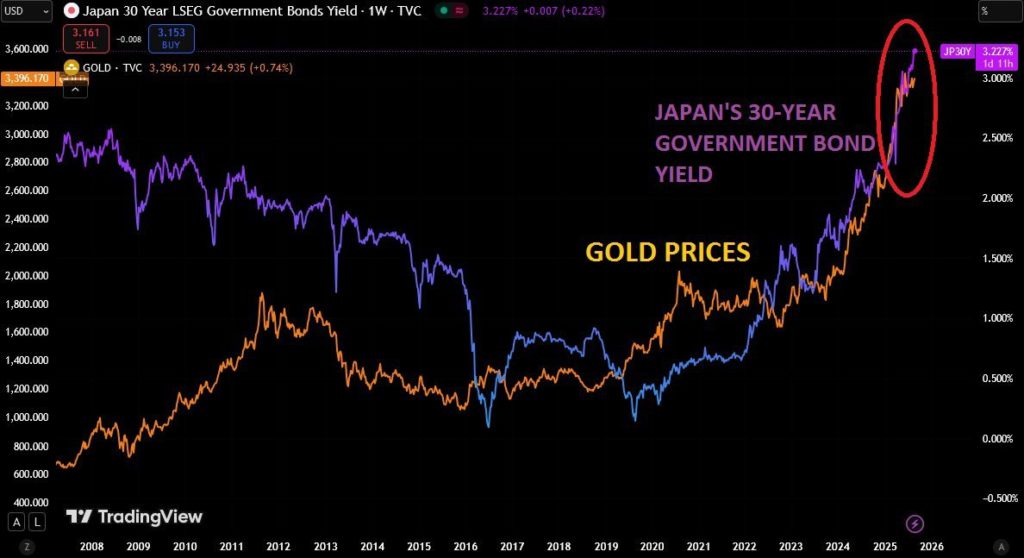

Recently, gold recorded a significant price increase, breaking $3,600/oz for the first time in history. Since the beginning of the year, gold prices have risen 33%, which is 3.5 times the return generated by the S&P 500 over the same period.

With an anticipated Fed rate cut at the September 17 FOMC meeting, the macro situation appears complex, while the 30-year bond yield has surged past 5.0%.

Conclusion

With various indicators and analysis from market experts, it is clear that gold and cryptocurrencies such as Bitcoin (BTC) are increasingly considered as strong alternatives to the US Dollar. Both assets offer safety in global economic uncertainty, appealing to investors seeking diversification and inflation hedging.

Also Read: XRP or Bitcoin? 3 Facts from the Chart that Reveal the Truth

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. Billionaire Ray Dalio Explains Why Bitcoin Gains with US Dollar Collapse. Accessed on September 4, 2025