Could LINK Soar to $44? Grayscale Submits Chainlink ETF Application to the SEC

Jakarta, Pintu News – Reporting from CCN, Chainlink prices have the potential to print new highs driven by the filing of a LINK exchange-traded fund (ETF) by asset manager Grayscale.

Following this development, LINK’s price jumped to $23.62 (9/9/25). However, this level does not seem to be the peak price of LINK in the current market cycle. Therefore, here are the reasons and possible price targets that LINK could reach, based on CNN website analysis.

Chainlink Strengthening

Between Friday, August 22 and September 8, Chainlink (LINK) prices had difficulty breaking through major resistance levels. But now the situation has changed. As of September 9, LINK successfully moved through the resistance line, driven by increased buying pressure.

Read also: 3 Most Popular Stablecoins, Are They in Your Portfolio?

If you look in more detail at the 4-hour chart (9/9/25), the bullish momentum is getting clearer. The Money Flow Index (MFI) rose to the level of 76.10, signaling a strong inflow of funds. At the same time, the Bull Bear Power (BBP) turned positive, indicated by a row of green histograms confirming the dominance of buyers.

If this trend continues, bulls are expected to defend the support area at $21.90. If it holds, this could open up opportunities for Chainlink prices to test the next resistance at $27.15.

Grayscale Ajuka Chainlink ETF with Ticker GLNK, Holder Accumulation Increases

In addition to technical factors, the positive sentiment towards Chainlink is also reinforced by Grayscale’s move to propose an ETF based on Chainlink.

In its filing document, Grayscale confirmed that the fund is a conversion of the existing Chainlink Trust, with the aim of giving investors direct access to the original LINK-crypto that powers Chainlink’s decentralized oracle network.

If approved, the ETF will trade on NYSE Arca under the ticker GLNK, while Coinbase Custody Trust Company will serve as custodian. This move marks the expansion of regulated investment access to altcoins, beyond Bitcoin and Ethereum .

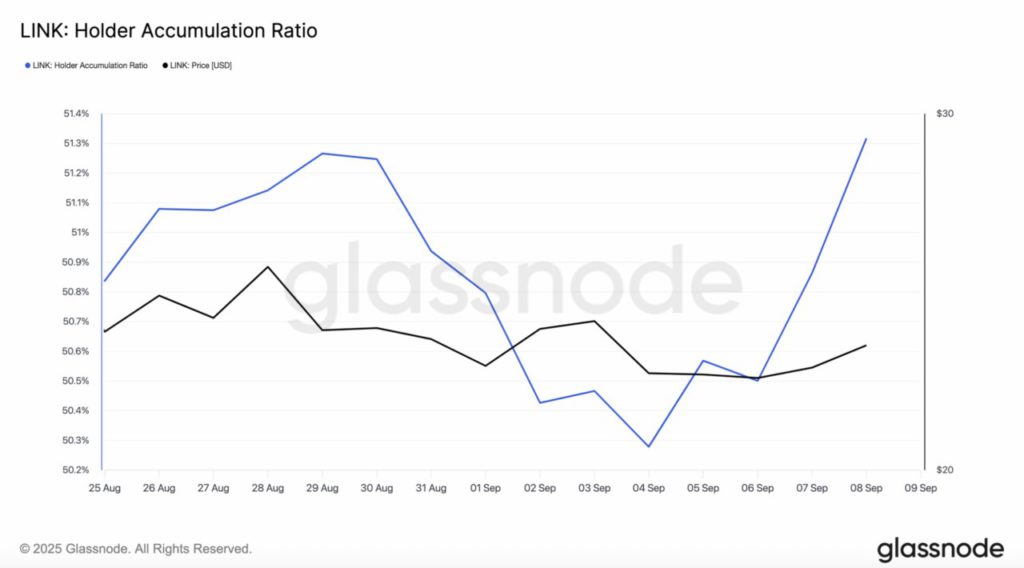

Along with the filing, Chainlink’s holder accumulation ratio jumped to 51.32%. A figure above 50% indicates net accumulation among active holders.

This metric is important as it reflects the behavior of truly active market participants. A rise in the accumulation ratio signals stronger conviction, with investors preferring to add to their holdings rather than take profits.

Read also: Dogecoin ETF Hype and Retail Interest Drive DOGE’s Bullish Outlook in September

If this trend continues to hold, the potential selling pressure will diminish, supply in the market will tighten, and bullish conditions may form.

In Chainlink’s case, the current ratio indicates an optimistically skewed holder base. If accumulation continues, this could expand demand and potentially push LINK prices higher.

LINK Price Prediction: Downtrend Ends

On the daily chart, Chainlink (LINK) prices managed to break the upper trendline of a falling wedge pattern, a bullish reversal pattern that often marks the end of downward momentum.

The Directional Movement Index (DMI) indicator has also turned positive. Currently, the +DMI (green) value stands at 22.49, surpassing the -DMI (red) at 16.99, signaling the dominance of buyers.

Meanwhile, the Average Directional Index (ADX) rose to 19.94, indicating the trend is starting to strengthen, although it still has room to grow before it truly confirms an established trend.

If the current trend continues, LINK could potentially break the resistance at $26.52, which could pave the way towards $30.99 in the short term. Further ahead, consistent bullish momentum could push this altcoin up to $44, making it a significant long-term target.

However, this outlook comes with risks. Failing to cross the resistance above could trigger selling pressure again, dragging LINK’s price down to the $18.09 support level.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CCN. Chainlink (LINK) Price Eyes $44 as Grayscale Files ETF Application With US SEC. Accessed on September 10, 2025

- Coingape. Chainlink Price Prediction: Analyst Sees 48% Rally as Grayscale ETF Filing Ignites Hype. Accessed on September 10, 2025

- Coinspeaker. Asset Manager Grayscale Files for Spot Chainlink ETF, LINK Price Goes Up. Accessed on September 10, 2025