Will Bitcoin (BTC) Follow the S&P 500’s Decline in September 2025? Check out the Analysis!

Jakarta, Pintu News – Global financial markets are undergoing interesting dynamics, especially in relation to Bitcoin and the S&P 500 index. With the changes in the US Treasury Bond Yield Curve Spread, there is a potential significant impact on Bitcoin (BTC) prices. Currently, the global crypto market capitalization is registering an increase in liquidity even though it has been on the decline for the past few weeks.

The Effect of Yield Curve on Bitcoin (BTC)

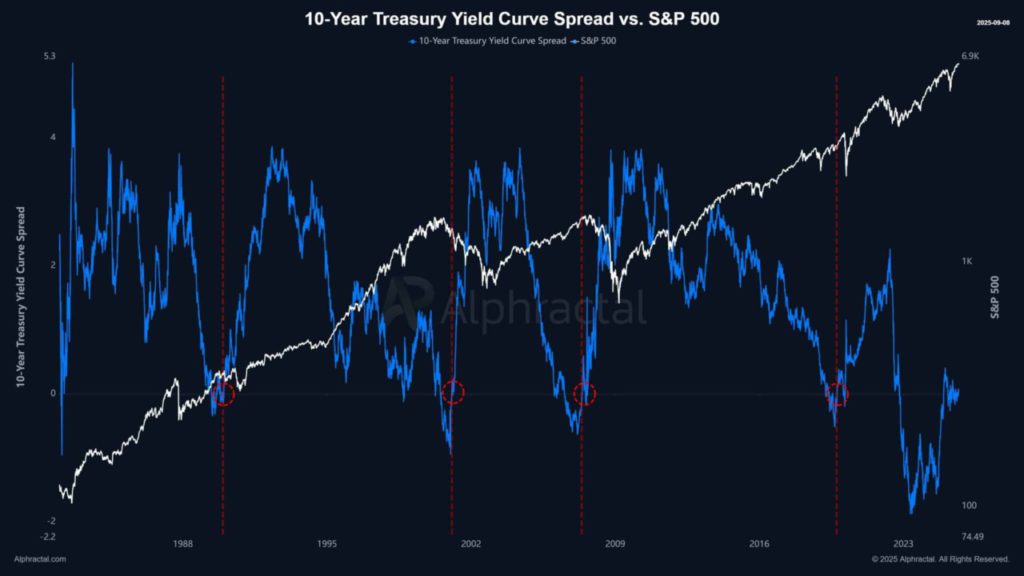

According to the latest analysis from Alphractal, macroeconomic sentiment has an important role to play in Bitcoin’s (BTC) performance. The US Treasury 10-Year Yield Curve spread, which is often used to predict the direction of the S&P 500, now shows a historically significant configuration. Fluctuations in this spread, both positive and negative, have consistently signaled broader equity market trends.

When this spread has turned positive, it has historically often preceded bear markets in the S&P 500. Currently, the spread is nearing a positive turning point, which suggests that the S&P 500 may be headed for a decline. Given the strong correlation between Bitcoin (BTC) and equity markets, this change could put downward pressure on the cryptocurrency.

Annual analysis shows that between 2021 and 2023, Bitcoin (BTC) saw a rise of 282%, while the S&P 500 rose by only 55%. This suggests that if equities experience a sharp decline, Bitcoin (BTC) is likely to follow the trend.

Also Read: Solana (SOL) Strengthens, Can the Trend Continue in September 2025?

The Role of Global Liquidity

Global liquidity continues to play a key role in this dynamic. Historically, Bitcoin (BTC) has shown a close reaction to shifts in liquidity. Currently, global liquidity shows a decrease of 0.32% in the past day, an outflow that directly correlates with the current trend of the Treasury Yield Curve.

The global crypto market capitalization, which briefly dipped below the $4 trillion milestone, is now on track to reclaim that level with a current value of $3.88 trillion. Bitcoin (BTC) maintains its dominance with more than 50% of this valuation. Analysts suggest that the asset could see more inflows as global liquidity continues to shift.

Role of US and Korean Investors

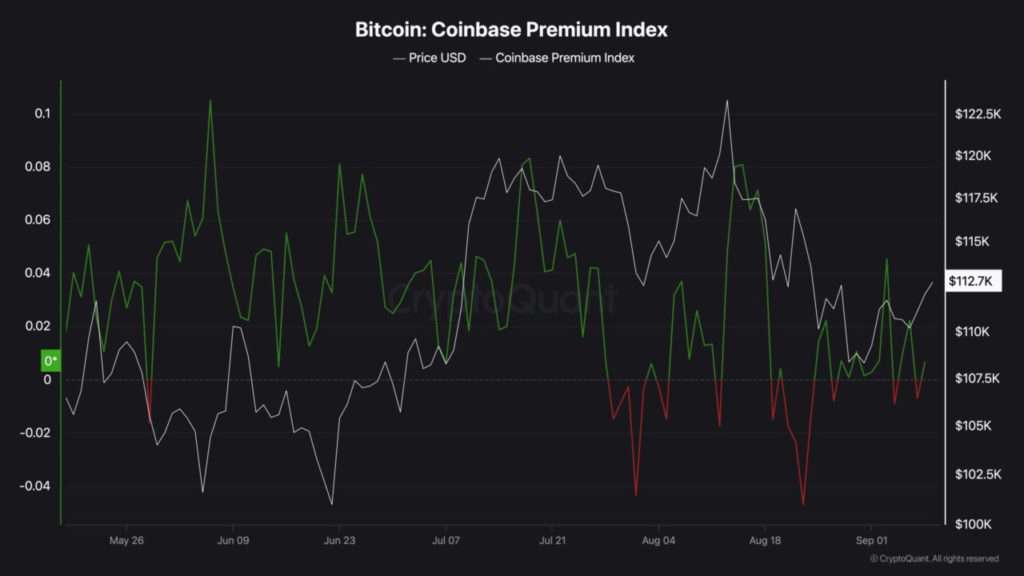

Investors from the United States and Korea are showing different approaches in the current market, although both are trending towards a bullish position according to CryptoQuant. The Coinbase Premium Index, which tracks US investor activity, showed an upward trend with a reading of 0.006, signaling continued buying interest.

In contrast, the Korean Premium Index showed a decline of 0.4, indicating that Korean investors reduced their exposure. This difference highlights an important dynamic: while US investors continue to accumulate, Korean investors are trimming positions. If US buyers maintain their momentum and Korean investors return to positive flows, Bitcoin (BTC) could experience more positive market outcomes.

Conclusion

With potential changes to the US Treasury Bond Yield Curve and global liquidity dynamics, Bitcoin (BTC) investors need to be aware of the possibility of significant price movements. The correlation between Bitcoin (BTC) and the S&P 500 shows that changes in one market can affect the other.

Therefore, constant monitoring of macroeconomic indicators and global financial markets is key to understanding the future direction of Bitcoin (BTC).

Also Read: ALtcoin Flock (FLOCK) Price Surges 219% After Listing on Coinbase & Upbit!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- AMB Crypto. Bitcoin traders alert: Could BTC mirror a potential S&P 500 dip?. Accessed on September 10, 2025