Grayscale Launches Hedera Trust, What are the Prospects?

Jakarta, Pintu News – Buying momentum for Hedera Hashgraph is increasing in the spot market, along with the filing of Form S-1 by Grayscale for their new Hedera Trust. This filing, made yesterday, marks a major step for Grayscale in providing investors with regular access to HBAR.

With these regulated financial products in place, investors now have a safer and more structured opportunity to invest in these crypto assets. This rise in interest is evident from market indicators showing an increase in demand.

Grayscale Introduces the Hedera Trust

Grayscale, one of the major players in the crypto investment world, has just filed paperwork for a new Hedera Trust. This trust is designed to provide regulated exposure to the Hedera Hashgraph (HBAR), allowing investors to participate in the growth of this digital asset through more traditional means.

With this Trust, Grayscale aims to attract more institutional investors who may still be hesitant to jump into the crypto market due to its volatility. The filed documents explain the structure and purpose of the Hedera Trust, which will make it easier for investors to gain direct exposure to HBAR without having to face the technical complexities of buying and storing crypto directly.

Also read: Vietnam Starts a New Era with a 5-Year Crypto Market Trial, Here’s the Strategy!

HBAR Strengthening in the Spot Market

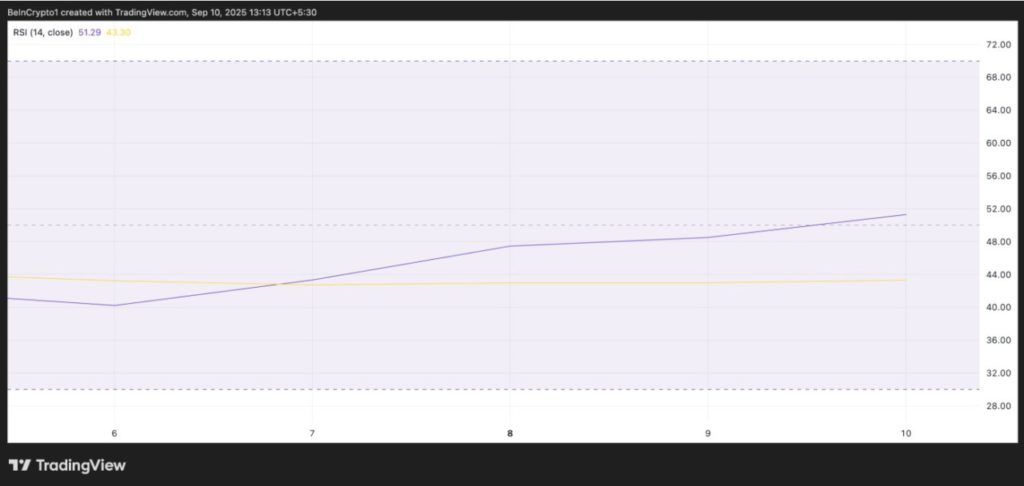

Since the Grayscale announcement, the Hedera Hashgraph (HBAR) has shown significant strength in the spot market. The HBAR/USD Relative Strength Index (RSI) on the one-day chart has broken the neutral line of 50 and continues to show an uptrend. This signals a change in market sentiment that is more towards investor optimism.

This strengthening is driven by the expectation that the new Trust will add liquidity and provide further validation of HBAR as an investment asset. Investors seem to be responding positively to Grayscale’s move, which is expected to bring more stability and long-term growth to HBAR.

Also read: Pi Network price hits $2.6, this whale is potentially a crypto billionaire?

HBAR Outlook and Risks

With the new initiative from Grayscale, Hedera Hashgraph (HBAR) has the potential to reach a new high of $0.3050. However, every investment comes with risks, and for HBAR, the downside risk is at $0.1963. Investors are advised to pay attention to both the potential gains and the risks involved.

It is important for investors to conduct in-depth analysis and consider external factors that could affect the price of HBAR. With the right strategy and a good understanding of the market, investors can capitalize on the opportunities offered by this Hedera Grayscale Trust.

Conclusion

With Grayscale’s move to file a Hedera Trust, new opportunities have opened up for investors looking to gain exposure to the Hedera Hashgraph (HBAR) in a more regulated and secure format. This marks a new era in crypto investment, where regulated financial products are increasingly becoming an important bridge between the crypto world and traditional financial markets.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. Grayscale Hedera Trust (HBAR) Rally Outlook. Accessed on September 11, 2025

- Featured Image: Cryptoslate