Top 10 Biggest Crypto Whales Right Now, According to Arkham Intelligence

Jakarta, Pintu News – Arkham Intelligence has released its latest list of the 100 largest crypto owners, also known as crypto whales. The total assets held by this group are estimated to be around $1.6 trillion.

In the list, Arkham does not sort by individual wallets, but instead groups the wallets into units called “entities”. These entities can be protocols, companies, individuals, or even whale exchanges.

This approach provides a clearer picture of who dominates crypto ownership. Let’s take a deeper dive into this list of crypto whales and what makes them so influential.

Crypto Rich List: The Top Crypto Whales

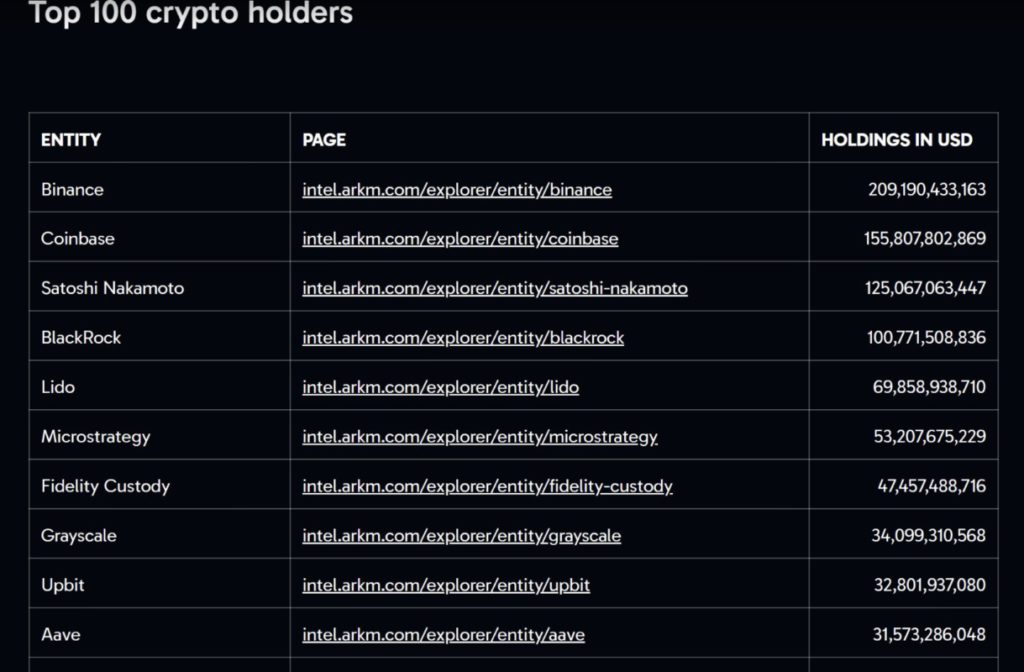

Binance takes the top spot on Arkham’s list of crypto holders with approximately $209 billion in holdings. In second place is Coinbase, which holds approximately $155 billion worth of crypto assets. This fact shows that crypto exchanges dominate asset ownership in the crypto market.

Read also: Analyst Michael Poppe Predicts Altcoins Could Outshine Bitcoin by Q4

The still-anonymous creator of Bitcoin , Satoshi Nakamoto, came in third place, as one of the top Bitcoin owners with a total BTC value of around $125 billion. Major financial companies also made the list.

BlackRock is recorded as holding around $100 billion, while Fidelity Custody holds assets worth around $47 billion. This shows that the traditional financial sector is starting to embrace digital assets.

Decentralized protocols such as Lido and Aave are not far behind, holding around $69 billion and $31 billion respectively. MicroStrategy, which is known for making Bitcoin part of the company’s reserves, also makes the list with around $53 billion in crypto holdings.

Governments are also on the list of the biggest crypto whales. The United States and the United Kingdom are listed as having around $23 billion and $6.9 billion, mostly from crypto assets held or seized.

Early investors and crypto-native projects are also represented. Investment groups like Winklevoss Capital hold around $2.2 billion, while new projects like pump.fun register holdings of around $3.2 billion.

Why This Crypto Whale List Matters

Read also: 3 Made in USA Cryptos that Whale and Smart Money Are Raiding Right Now

According to Arkham, the “entity-based” approach provides a more accurate picture of wealth distribution in the crypto world, rather than just looking at individual wallets. Many people on the crypto-rich list use multiple wallets for security or strategic reasons.

By combining the holdings of various wallets, we can see the true picture of influence. For example, Binance holds the most crypto, at $209 billion, because it holds the funds of its users and certainly can’t rely on just one wallet.

DeFi protocols and investment firms show the growing role of various parties in the DeFi ecosystem and traditional finance.

Overall, this crypto whale ranking gives an idea of where the wealth in the crypto industry lies. Not only individual billionaires, but also protocols, institutions, exchanges, and some of the early pioneers that are the foundation of today’s crypto economy.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Who Are the Biggest Crypto Whales? Arkham’s $1.6 Trillion Rich List Revealed. Accessed on September 12, 2025