There Was a Time When 1 Bitcoin Could Buy 1 iPhone — Now, How Many iPhones Can You Get with Just 1 BTC?

Jakarta, Pintu News – Eight years ago, in early 2017, the price of Bitcoin was around $1,000, while the iPhone X was launched at $999. This means that at that time, one Bitcoin was enough to buy one iPhone.

Today, with the price of Bitcoin around $112,000 and the iPhone 17 priced from $799, one Bitcoin is equivalent to 140 iPhone units. When the iPhone X arrived as Apple’s first phone at $1,000, Bitcoin was on its way to the peak of its 2017 rise, which almost touched $20,000.

The Big Reversal in Digital Wealth

The price of Bitcoin has soared by 2,700% since September 2017, while the price of iPhones has remained relatively stable when adjusted for inflation.

Read also: OpenSea Prepares to Launch SEA Token and AI Art Project, Stirring the Crypto Market

The basic iPhone 17 model is priced at $799 (IDR 13,167,956), which is $200 cheaper than the launch price of the iPhone X eight years ago. Apple has managed to keep prices consistent by improving efficiency and presenting a wide selection of tiered models.

The iPhone 17 series consists of a base model at $799, iPhone 17 Air at $899 (IDR14,816,011) – $949 (IDR15,640,038), iPhone 17 Pro at $999 (IDR16.4 million), and iPhone 17 Pro Max at $1,199 (IDR19.7 million).

In comparison, the first iPhone released in 2007 was priced at $499, which is equivalent to about $760 when calculated at today’s inflation rate.

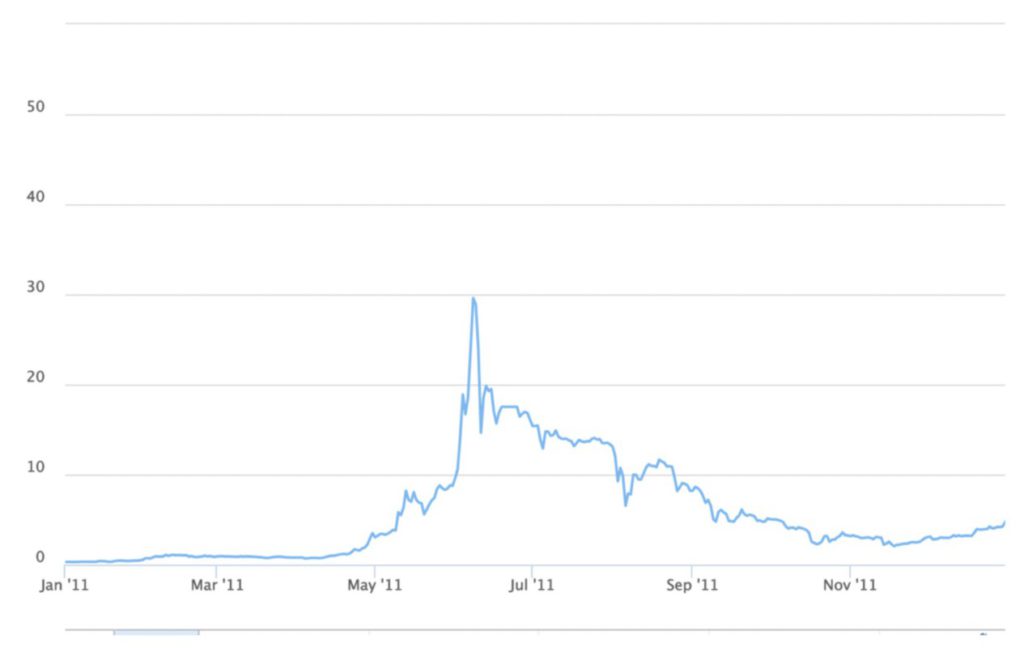

Bitcoin’s journey from almost worthless in 2009 to its current level is full of important milestones. The crypto asset crossed the $1 level in 2011, broke $1,000 in 2013, and broke $100,000 in December 2024 before stabilizing at its current range.

The famous story of Bitcoin’s pizza transaction in May 2010, in which 10,000 BTC were exchanged for two $41 pizzas, is now a symbol of value comparison. That amount of Bitcoin is currently worth about $1.12 billion-enough to buy 1.4 million iPhone 17 units or even finance months of Apple retail store operations.

Bitcoin’s First Price Journey

Bitcoin’s first recorded price in 2010 was just $0.0009, when the New Liberty Standard Exchange set the inaugural rate. Since then, massive adoption and infrastructure developments have given Bitcoin real purchasing power.

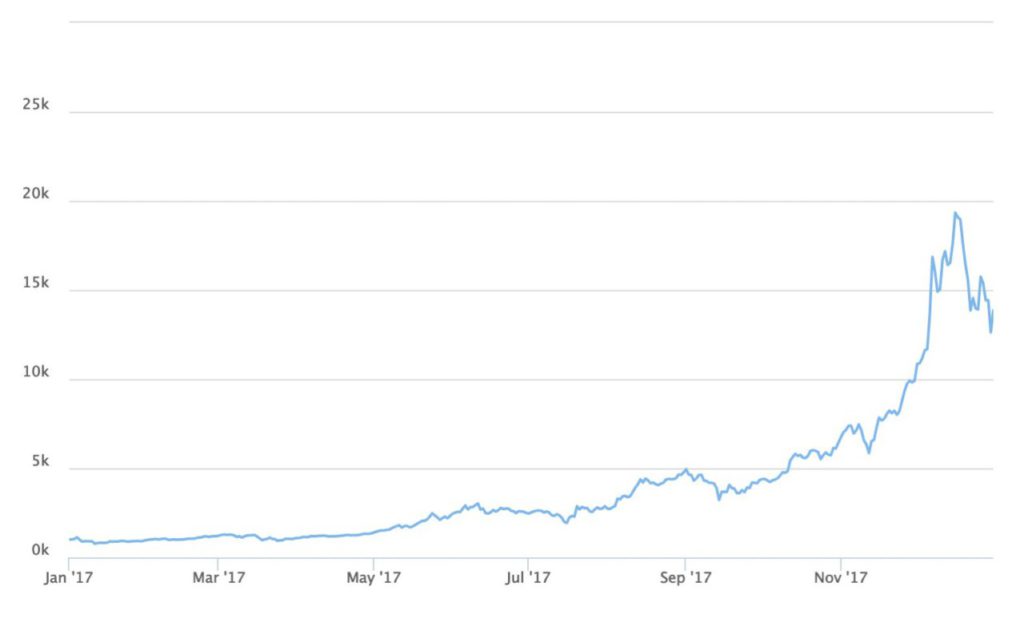

The bull run of 2017 saw Bitcoin’s entry into the mainstream. Retail investors pushed the price up from $1,000 to almost $20,000, coinciding with the launch of the iPhone X.

However, after reaching the peak, Bitcoin experienced an 84% correction, falling to $3,200 in December 2018. This long bear market period tested investors’ confidence, while Apple continued to release a new iPhone series every year with incremental improvements.

Bitcoin’s recovery accelerated during the COVID-19 pandemic, when institutional investors such as Tesla, MicroStrategy, and a number of large corporations began including Bitcoin in their treasury portfolios.

Payment platforms such as PayPal and Square, to traditional financial companies, are also integrating crypto services that are further driving mainstream adoption.

The 2021 bull run took Bitcoin through $69,000, equivalent to the price of 86 iPhone 12 Pro units. However, macroeconomic pressures and rising interest rates led to a fresh correction to $15,600 in November 2022.

Read also: JayDee Analyst Predicts XRP Price to Have a “Big Rally” at the End of 2025, Then Plummet 90%

Today, at around $112,000, Bitcoin is considered a mature asset class with institutional support, regulatory clarity, and global recognition. Major financial institutions such as BlackRock, Grayscale, and VanEck have launched Bitcoin ETFs, while some countries even recognize the asset as legal tender.

If You Don’t Buy iPhone 17 Now, Can You Get 24-25 iPhones in 2033?

If one chooses to buy Bitcoin instead of an iPhone 17 today, historical patterns suggest there is potential for tremendous purchasing power in the future. Buying Bitcoin at the equivalent price of the $799 base model iPhone 17 would yield approximately 0.00713 BTC at the current price of $112,000 per BTC.

Based on Bitcoin’s historical growth pattern over the past 8 years of 2,700%, the investment could theoretically be worth around $21,573 in 2033. On the other hand, the iPhone’s price history shows stability, with the base model since 2014 always staying in the $700-$800 range when adjusted for inflation.

Assuming similar trends continue, the iPhone price in 2033 is estimated to be in the range of $850-$900. This means that a Bitcoin investment equivalent to the price of one iPhone 17 today could, in theory, be exchanged for 24-25 future iPhone units.

However, this calculation assumes Bitcoin maintains the same growth rate-something that is increasingly difficult to achieve as the market capitalization grows.

History shows that Bitcoin’s rate of return has steadily declined in each cycle: the period 2009-2017 yielded over 2,000,000%, while 2017-2025 was only around 460%, despite setting a new record high price.

Market dynamics indicate that future Bitcoin appreciation is likely to be more moderate, as institutional adoption matures and regulation becomes clearer. Even so, Bitcoin still serves as a strong store of value.

Expert Prediction: Potential Future Surge in Bitcoin Value

Citing a report by Crypto News, some analysts have predicted an alternative scenario where the Bitcoin price could reach $500,000 to $1,000,000 by 2033.

If this prediction materializes, investing the equivalent of the base iPhone 17 price of $799 in Bitcoin would be able to buy about 135 iPhones at $500,000, or even 170 iPhones if Bitcoin breaks $1,000,000.

More conservative projections estimate Bitcoin’s annual growth at 20-30%, similar to historical market-leading stocks. Under this assumption, the price of Bitcoin in 2033 could be in the range of $350,000-$450,000, equivalent to the purchasing power of 90-110 future iPhones, compared to just one iPhone today.

This calculation assumes that the iPhone’s functionality remains the same, while Bitcoin continues to be viewed as a store of value. However, Apple could add new technologies such as augmented reality, artificial intelligence, and biotechnology integration, which could potentially change the pricing structure.

In fact, subscription-based business models of iPhone or digital services could replace traditional hardware sales, so direct price comparisons may become obsolete.

In fact, Apple’s current service revenue already surpasses the total revenue of many companies on the Fortune 500 list.

Unlike fiat currencies that are subject to inflation and impact iPhone prices, the deflationary nature of Bitcoin could cause iPhone prices to actually decrease in BTC terms-especially if Bitcoin is one day recognized as a global reserve currency.

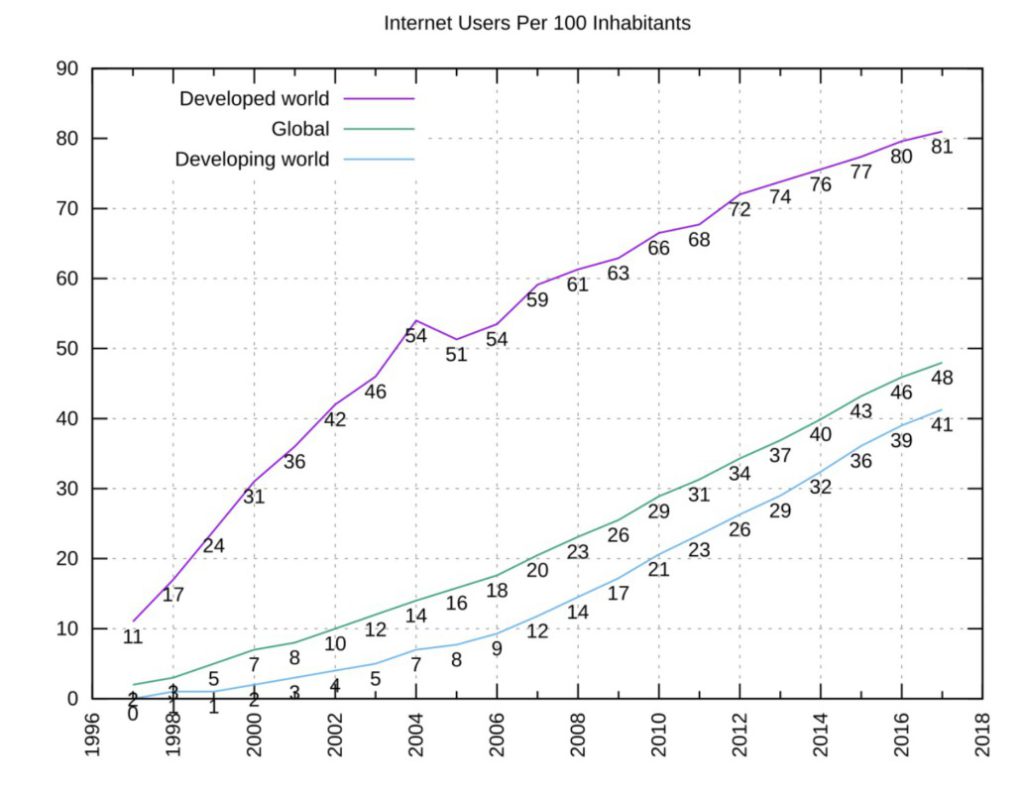

Looking at historical trends, technology adoption tends to follow a predictable curve, where early adopters usually benefit the most.

Bitcoin’s current position is often compared to the initial phase of internet adoption in the 1990s, which still holds tremendous growth potential in the future.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto News. 8 Years Ago You Could Buy an iPhone 17 with 1 Bitcoin – How Many Can You Get Now That It’s Launched? Accessed on September 11, 2025