Bitcoin Soars to $115,000 on September 12 — Whale Investors Jump Back In!

Jakarta, Pintu News – Bitcoin price is still moving in a narrow range between $90,000 and $100,000. However, on-chain data reveals that mid-sized whales – also known as “sharks” (wallets holding 100-1,000 BTC) – are quietly starting to reshape market dynamics.

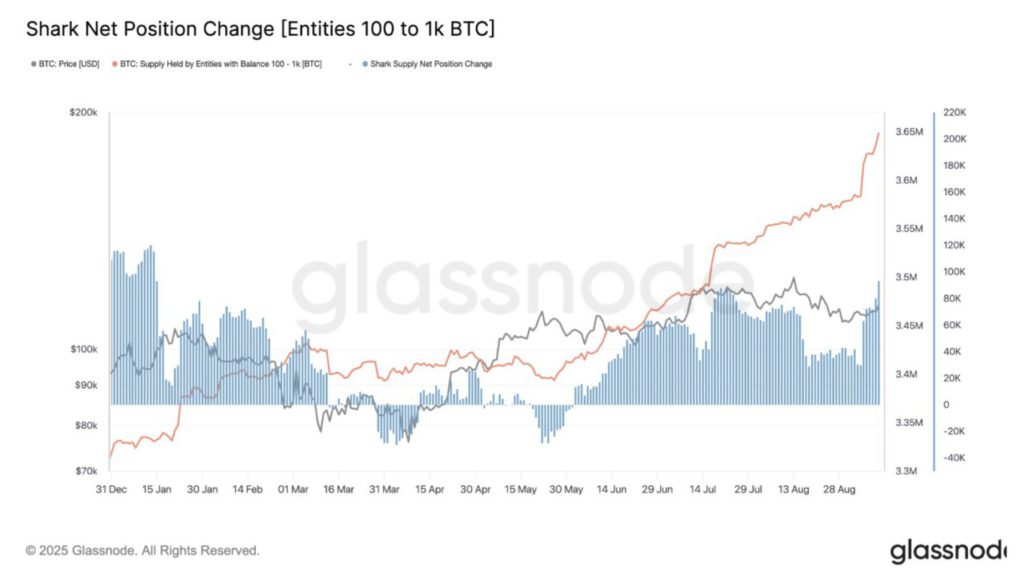

According to data from Glassnode, this group has been aggressively increasing their accumulation since July 2025. Now, their total holdings have reached a new record high of over 3.65 million BTC.

This growing concentration of supply in the hands of powerful investors has the potential to influence the next big move in Bitcoin price.

Bitcoin Price Rises 0.85% in 24 Hours

On September 12, 2025, Bitcoin was trading at $115,222, equivalent to IDR 1,892,392,228 — a modest increase of 0.85% over the past 24 hours. During this time, BTC hit a low of IDR 1,864,934,417 and climbed to a high of IDR 1,911,995,995.

At the time of writing, Bitcoin’s market capitalization is approximately IDR 37,767 trillion, while its 24-hour trading volume has declined by 5% to IDR 798.34 trillion.

Read also: DOGE Surges 5% Amid Whale Accumulation — Could a 50% Jump Be Next?

“Shark” accumulation reaches record high, a bullish signal for Bitcoin?

Recent data shows that “shark” entities – wallet owners with 100 to 1,000 BTC – are not only accumulating Bitcoin, but doing so at the fastest rate so far this year.

The Shark Net Position Change indicator shows a very positive figure, indicating that the group is adding to their holdings consistently, instead of selling when prices rise.

History shows that accumulation patterns like this often precede major bullish phases in Bitcoin. This reflects the strong conviction of well-capitalized investors who are risking significant amounts.

According to data from Glassnode, in the last seven days alone, the shark group has added nearly 65,000 BTC to their portfolio. Their total holdings now stand at nearly 3.65 million BTC – an all-time record high.

This aggressive buying activity pushed BTC’s net supply into a deficit state, as sharks absorbed both coins from the secondary market and new issuance proceeds.

Why it Matters for Bitcoin Price

As of September 11, Bitcoin is currently holding above the crucial $112,000 support level, which in recent weeks has been a zone of strong demand. The recent surge above $113,800 also attracted massive buying interest on various platforms, which makes the market momentum now in favor of the bulls.

Read also: 3 Warning Signals Appear for BTC, Bitcoin Still Prone to Plummet?

This indicates the potential for a continued breakout – however, to confirm this, the price of BTC must break through a major resistance level that has been a barrier to bearish dominance.

Currently, Bitcoin (BTC) is consolidating around $113,957, with the Bollinger Bands indicator starting to narrow – a common sign that a major volatile move may be imminent. The next important resistance levels are at $114,827 and $118,617.

If BTC manages to breakout and break $115,000, the path to $120,000 to $125,000 in the short term could be wide open.

On the other hand, the closest support is at $113,345, then $107,274 and $103,950. If the price falls below $103,000, the decline could continue towards $98,200. Overall, as long as the price holds above $113,000, the market bias remains bullish, with the next upside target being at $125,000.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coinpedia. Bitcoin Sharks Are Accumulating Heavily-What This Means for BTC Price. Accessed on September 12, 2025