Ethereum Holds Steady at $4,600 on September 15 — Surge in Open Interest Raises Key Questions

Jakarta, Pintu News – As reported by AMB Crypto, Ethereum’s 30-day NVT ratio has dropped to an unprecedented low, reflecting the high activity of the network compared to the current market capitalization.

Historically, a sharp decline in the NVT ratio is often a harbinger of price revival, as signals of undervaluation usually prompt a return of buying interest from investors.

However, this pattern has also coincided with unsustainable spikes in transactions, failing to deliver long-term growth. This puts Ethereum at a crucial point.

The extreme difference between network value and activity signals that investors should consider carefully – whether the current inflows reflect real adoption or just volatile, momentary speculation.

Then, how is Ethereum’s current price movement?

Ethereum Price Drops 0.63% in 24 Hours

Read also: Bitcoin Hits $116K Today — On-Chain Indicators Flash Bullish, Is $122K Next?

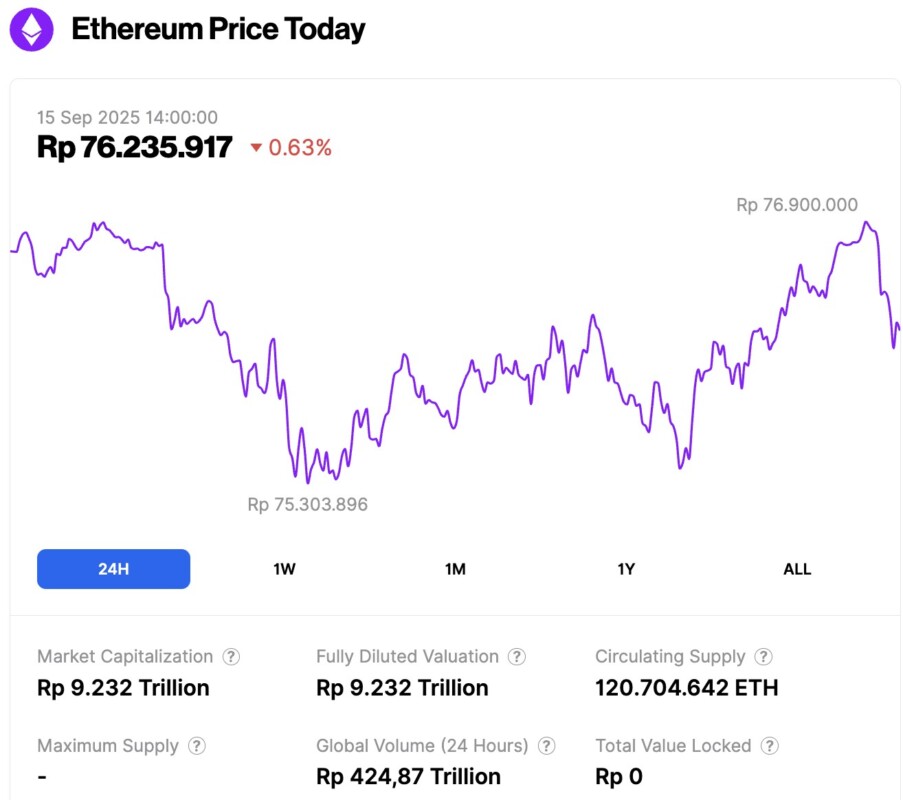

On September 15, 2025, Ethereum was trading at approximately $4,634 (equivalent to IDR 76,235,917), reflecting a 0.63% decline over the past 24 hours. During this time, ETH hit a daily low of IDR 75,303,896 and a high of IDR 76,900,000.

At the time of writing, Ethereum’s market capitalization sits at around IDR 9,232 trillion, while its 24-hour trading volume has increased by 4% to reach approximately IDR 424.87 trillion.

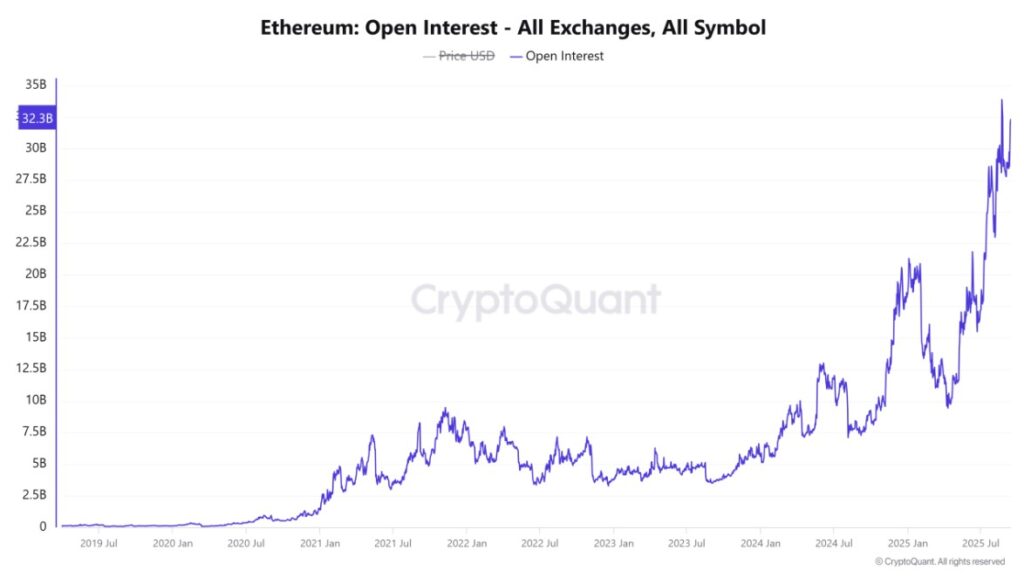

Rise in Open Interest Indicates Increased Speculative Appetite

Ethereum’s Open Interest (OI) has increased to $32.27 billion, up 4.11% in the last 24 hours (14/9/25). This consistent rise reflects increasingly active speculative positioning, with traders increasing exposure to both long and short positions.

Historically, OI spikes amid bullish trends often magnify volatility, as leveraged market participants compete with each other for control of market direction.

If this trend continues, it could be an indication of confidence in Ethereum’s breakout potential.

However, the risk of sharp liquidation has also increased, especially in important price areas such as $4,700. The market’s risk-taking courage shows Ethereum’s growing role, as traders prepare for the next big move.

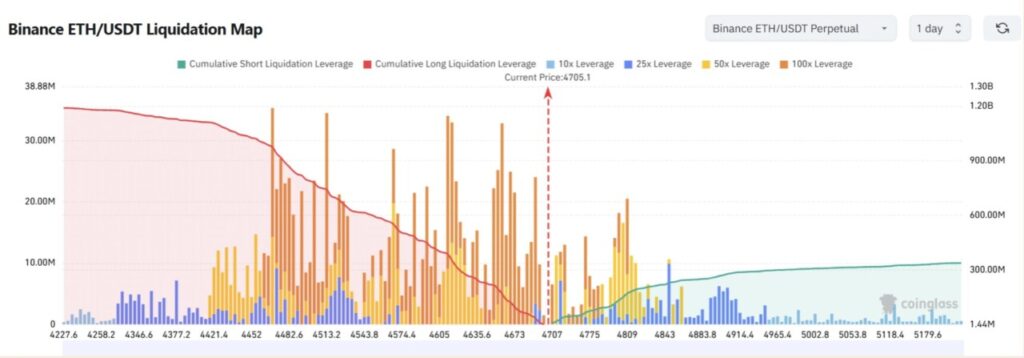

Liquidation Chart Reveals Heavy Pressure on Short Positions

The Ethereum derivatives market is seeing a significant imbalance in trading positions. The latest data shows that more than $14 million in short positions have been liquidated, compared to only around $3 million in long positions.

This sharp imbalance signals that the bearish side is currently suffering the biggest losses, while the bulls still maintain relative control over the market.

Interestingly, the recurrence of short squeezes often triggers the continuation of an uptrend, especially when open positions are not adjusted to lower leverage levels.

However, even if the current momentum favors buyers, a wave of profit-taking could quickly reverse the situation.

Read also: 3 Low-Cap Altcoins Crypto Whales Are Quietly Accumulating — What’s Going On?

This highlights how fragile Ethereum’s liquidation state is at current price levels.

Binance Liquidation Cluster Now Shifts to Higher Battlegrounds

Liquidation data from Binance shows that the $4,700 level is an important pressure zone. Now, with Ethereum trading above that level, the market focus is starting to shift to the next price cluster.

There is a high concentration of leverage just above the breakout zone, which means volatility could increase as prices continue to test higher levels.

If Ethereum is able to maintain its momentum, then cascading liquidations could drive a rapid price continuation towards the $4,900-$5,000 range.

Conversely, if ETH fails to hold above $4,700, a sharp correction could occur as a form of retest. But considering that many short positions have been liquidated before, the odds are still in favor of the bulls to remain in control at this phase.

Ethereum’s breakout above $4,700 confirms the dominance of the uptrend (bullish), supported by undervaluation signals from the NVT ratio, a surge in Open Interest, and continued pressure on short positions.

With the leverage cluster on Binance shifting to higher levels, the current conditions are highly favorable for a continued move towards $5,000.

The rare convergence between on-chain data and derivatives markets indicates that Ethereum is entering a new phase of expansion, with strong momentum on the buyer’s side.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

- Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- AMB Crypto. Ethereum bulls lead, $14M shorts liquidated – $5000 in sight? Accessed on September 15, 2025