Crypto Whale Buys These 3 Altcoins Ahead of FOMC Meeting

Jakarta, Pintu News – The upcoming Federal Open Market Committee (FOMC) meeting on September 16-17, 2025 is one of the most anticipated events of the year.

The market currently expects that the Fed will make its first rate cut in 2025, with a fairly high probability. Over the past two days, the crypto market experienced a mild correction, suggesting that traders are starting to make adjustments. However, whale investors have taken a different tack.

While retail investors tend to be cautious and choose to hold their funds while waiting for the certainty of interest rate cuts, large holders have quietly started to buy altcoins that they believe will benefit if the Fed signals a softer (dovish) policy.

Here are three tokens that are being bought by whales ahead of the FOMC meeting. One of the tokens is even showing massive buying action as the price drops, citing the BeInCrypto report.

Cardano (ADA)

Crypto whales continued to add to their holdings of Cardano throughout September. On-chain data shows that since September 9, holders with more than 1 billion ADA have increased their asset count from 1.88 billion to 1.94 billion tokens.

Read also: Ethereum Price Dips as Crypto Whales Shift Over $20 Million in ETH

Meanwhile, ADA holders in the 10 million to 1 billion token range increased their balance from 3.75 billion to 3.81 billion. Overall, there was an addition of about 120 million ADA-with a value of about $103 million based on the current ADA price of close to $0.86.

The whales started buying when the price started to rise towards $0.95, indicating that they bought when the market was rallying. More importantly, they did not sell despite the recent decline in prices, signaling their belief that the FOMC decision could be a bullish catalyst.

In the Cardano price chart, it can be seen that ADA is moving in an ascending triangle pattern with support levels around $0.85.

If the price is able to break out of the $0.87-$0.90 range, then there is a chance to rise towards $0.96 and even reach the $1.00 psychological zone. However, this bullish scenario will fall if the price of ADA drops below $0.80.

The bull-bear power (BBP) indicator, which measures the strength of buyers versus sellers, has recently been moving up and down between green and red signals. This reflects confusion among retail investors.

But that’s precisely why the whale action is crucial. While the small traders are still hesitant, the whales are quietly accumulating, utilizing the current price zone as an entry point ahead of a possible rate cut by the Fed.

Chainlink (LINK)

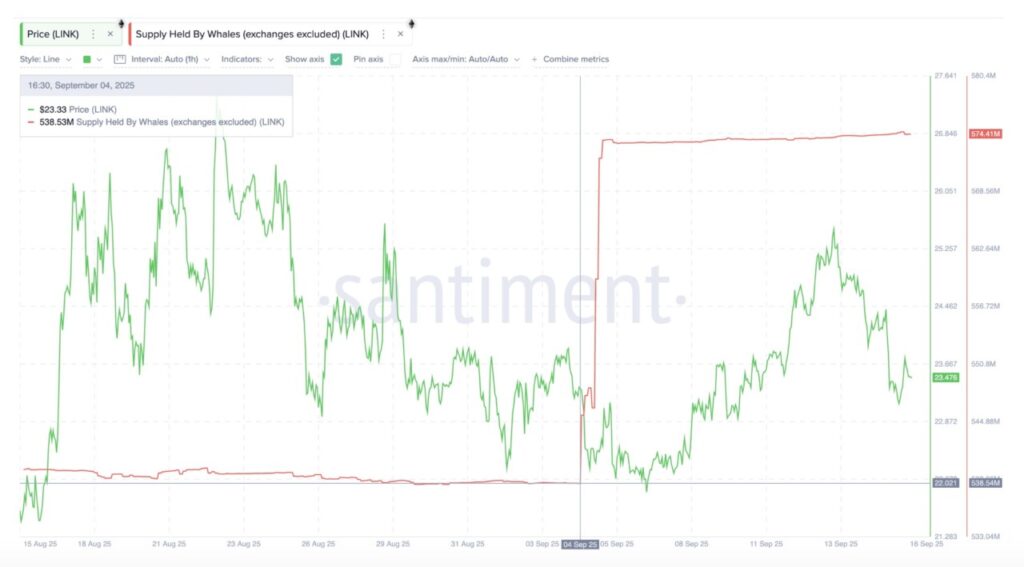

Whale investors continued to add to their holdings of Chainlink ahead of the FOMC meeting, where the market expects an important policy change.

Read also: What Coins Have Crypto Whales Bought, Sold, and Stored Recently?

Since September 4, the amount of LINK owned by the whales increased from 538.54 million to 574.41 million LINK. With the current LINK price at $23.50, this accumulation is worth about $843 million.

This buying spree started when LINK’s price dropped below $22 and continued even though the price started to rise. The whales were not tempted to sell on the bounce or panic on the short-term decline.

Instead, they continue to add and maintain their positions. This consistency shows confidence that the next few weeks – especially the Fed decision – could trigger a big move.

Technically, Chainlink’s price chart is currently forming an inverse head-and-shoulders pattern, a classic formation that usually signals an upward reversal. To confirm this pattern, LINK needs to break the neckline around $25.96.

If this breakout occurs, the upside potential based on the pattern leads to a minimum target of around $30.65. This is the technical signal that the whales are likely anticipating as they accumulate.

However, this pattern will fail if the price of LINK corrects too deeply. A drop below $22.91 would weaken the bullish scenario. Until that happens, whales seem to have started forming positions early, hoping that the combination of a dovish signal from the FOMC and the occurrence of a breakout will push LINK prices sharply higher.

Ethene (ENA)

Ethena whales have been quietly building up their positions in the days leading up to the FOMC meeting. The project’s synthetic stablecoin, USDe, competes with traditional dollar yields, so changes in interest rate policy in the US could indirectly affect its demand.

Read also: As DOGE Holders Hold Firm, Could 2025’s High Be Within Reach?

This connection explains why crypto whales preparing for the FOMC decision chose to focus on ENA.

The group of ENA holders in the range of 100 million to 1 billion tokens was recorded as holding around 4.46 billion tokens on September 10, when the ENA price was around $0.81. Since then, that number has increased to 5.66 billion tokens-despite the price dropping to $0.69. This means the whales added about 1.2 billion tokens, worth approximately $828 million at current prices.

Interestingly, they started buying when prices were near local peaks and continued accumulating when prices corrected. This shows that they are consistently practicing a dip-buying strategy, rather than panicking and selling when prices drop.

From a technical standpoint, ENA’s price has undergone a sharp correction-declining by about 12% in the past week and nearly 10% in the past 24 hours. However, the token is showing a hidden bullish divergence on the RSI (Relative Strength Index) indicator, which measures momentum based on the ratio between recent price increases and decreases.

Prices have formed higher lows between September 4 and 16, while the RSI recorded lower lows. This pattern suggests that the selling pressure is starting to weaken although prices are still falling.

Currently, ENA is trading at around $0.69. If the price manages to re-break the $0.73 level and hold above it in the daily close, the potential for a recovery towards $0.80 to $0.87 is open.

However, if the price drops below $0.60, the bullish scenario will turn bearish. The whales seem to be betting that this divergence signal will prove accurate, while utilizing the moment ahead of the FOMC decision as a potential trigger for price increases.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What are Crypto Whales Buying Ahead of the FOMC Meeting. Accessed on September 17, 2025