5 facts about DRIFT’s rise today: Reached Rp11,704, Up 16%! What Happened?

Jakarta, Pintu News – The Drift cryptocurrency has caught the attention of the crypto market again after surging sharply in the past 24 hours.

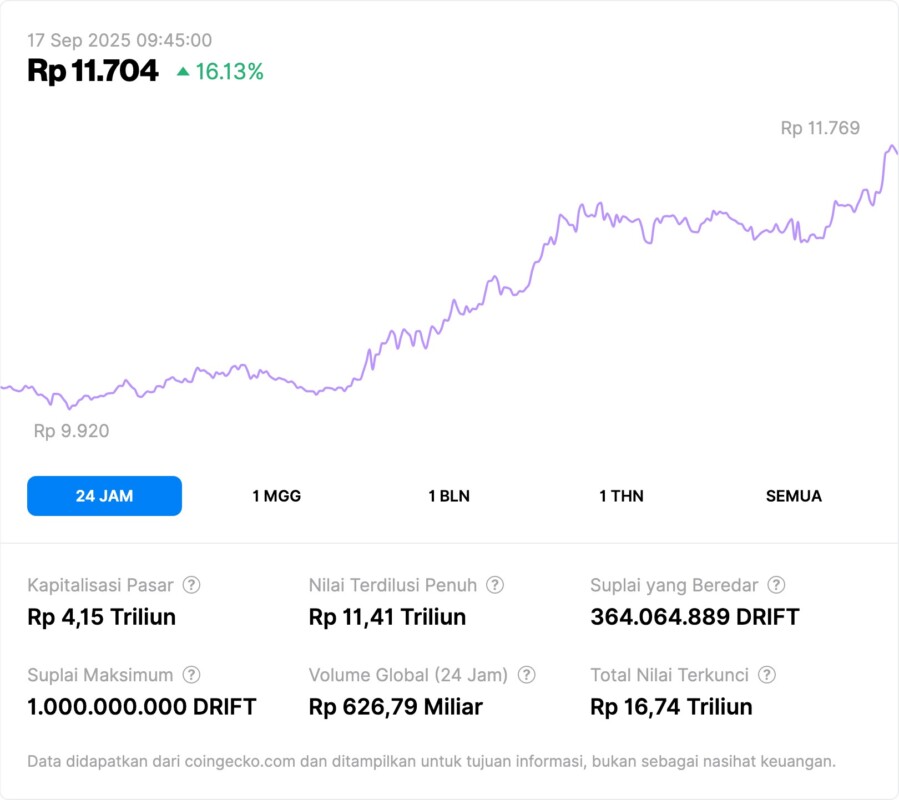

Based on data displayed on the Pintu.co.id website as of Wednesday, September 17, 2025 at 09:45 WIB, the price of DRIFT was recorded at IDR 11,704 per piece-an increase of 16.13%. This surge puts DRIFT as one of the shiniest crypto assets in a relatively stagnant market.

1. DRIFT Price Up 16.13% in 24 Hours

The increase in DRIFT prices was significant, rising 16.13% in the last 24 hours, from the level of Rp9,920 to Rp11,704. In fact, the highest daily price touched Rp11,769, indicating a strong momentum in terms of market demand.

This data was obtained from the Pintu crypto price analytics site integrated with CoinGecko. This double-digit increase in a short period of time indicates the potential for a short-term uptrend, although further technical and fundamental movements must still be examined.

Also Read: 5 Reasons Bitcoin Allocation on Wall Street Will Explode by the End of 2025

2. DRIFT Market Capitalization Reached Rp4.15 Trillion

With this price surge, DRIFT’ s market capitalization (market cap) was also hoisted up to IDR 4.15 trillion. This shows that DRIFT is increasingly taken into account by market participants and is starting to enter the radar of institutional and retail investors.

Meanwhile, DRIFT’s fully diluted valuation stands at IDR 11.41 trillion, based on the assumption that all tokens are in circulation. This gives an idea of the long-term potential of this asset if all the maximum supply of 1,000,000,000 DRIFT is distributed to the market.

3. 24-Hour Transaction Volume Touches IDR626.79 Billion

According to data from CoinGecko, the global volume of DRIFT trades in the last 24 hours reached IDR626.79 billion. This volume indicates an increase in buying and selling activity from investors and traders capitalizing on price momentum.

Rising volume along with a price spike usually signals the strength of an uptrend (bullish momentum). However, it’s also worth noting that large volume can also indicate short-term profit-taking.

4. Circulating Supply Only 36% of Maximum Total

To date, the number of DRIFTs in circulation is only about 364,064,889 tokens, or about 36.4% of the total maximum supply of 1 billion tokens. This means that most of the tokens are still not in the market and could be a factor in future price volatility.

As the limited supply is still out of circulation, investors need to be wary of the impact of additional token distribution on price pressure. Especially if the distribution is done in the near future without transparency from the project developer.

5. Total Value Locked (TVL) Reached IDR 16.74 Trillion

One indicator of a cryptocurrency project’s strength is its Total Value Locked (TVL), which is the value of assets locked in its ecosystem. DRIFT recorded a TVL of IDR 16.74 trillion, according to data from CoinGecko via Pintu.

A large TVL indicates that there is user confidence in the platform, both in terms of staking, liquidity pools, and other DeFi activities. The higher the TVL, the stronger the economic basis that supports the token price.

Conclusion

With a price surge of 16.13% and high transaction volume, Drift (DRIFT) is showing positive signals in the crypto market right now. Although fundamental data such as TVL and market capitalization look solid, investors should still be wary of the potential for high volatility, especially considering that many tokens are still not in circulation.

It’s worth noting that cryptocurrency price movements can be affected by many external factors, including market sentiment, macroeconomic policies, and regulations.

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Doors. DRIFT Price Today. September 17, 2025