Why the Crypto Market Crashed Today, September 22, 2025

Jakarta, Pintu News – The crypto market is experiencing a worsening fall as the market capitalization drops, from a recent high of $4.10 trillion now falling to $3.89 trillion. Additionally, the Crypto Market Fear & Greed Index shows market sentiment shifting from neutral (53) last week to fear (45) currently.

Bitcoin lost steam and plummeted more than 3%, dropping below $113,000 today. Meanwhile, Ethereum slumped 7% to $4,150, with the amount of ETH liquidation in the last 24 hours far greater than BTC.

On the other hand, major altcoins such as XRP (XRP), BNB , Solana (SOL), Cardano (ADA), and Hyperliquid (HYPE) corrected 6-10% in the last 24 hours.

Not only that, meme coins such as Dogecoin , Shiba Inu (SHIB), and Pepe Coin (PEPE) also plummeted by more than 10%. Even DOGE fell more than 14% in a week, despite the recent launch of the REX-Osprey Dogecoin ETF.

Macroeconomic Impact Causes Crypto Market to Crash Again

Bitcoin and the crypto market are heavily influenced by macroeconomic conditions and events in the US, Japan, the European Union and other key regions. The Fed’s first interest rate cut of the year is starting to show its impact, as seen by the rise in US bond yields as well as the rally in gold prices.

Read also: Dogecoin Dips 10% Today — Is a Recovery Possible?

According to Bloomberg data, the Fed’s interest rate cut pushed the US bond market to record its biggest annual gain since the COVID pandemic. The yield on 10-year US government bonds rose to around 4.15% for the fifth consecutive day, ahead of new statements from Federal Reserve officials, including Jerome Powell, as well as the release of PCE inflation data this week. The US Dollar Index (DXY) also breached the 97.80 level today.

In Japan, Prime Ministerial candidate Yoshimasa Hayashi supported the Bank of Japan’s (BOJ) strategy to raise interest rates. This comes as yields on 10-year (JP10Y) and 2-year Japanese government bonds hit their highest levels since 2008.

Fund managers and analysts expect the Fed and BOJ policy changes to trigger a major rally in the bond market in the coming years.

Mike McGlone, Senior Strategist at Bloomberg Intelligence, said that cryptocurrencies and Bitcoin could signal a bigger risk asset bubble than internet stocks in 1999, amid the current risk-off sentiment.

Largest BTC and ETH Options Expiry Triggers Crypto Market Crash Fears

According to a Coingape report, on-chain options data shows a “Triple Witching” phenomenon in crypto options expiry – a combination of weekly, monthly and quarterly contracts – which could potentially trigger Bitcoin to fall to $105.5K. The risk of profit-taking is also heightened, given that 95% of BTC holders are currently still in profit positions according to Glassnode data.

More than $17.5 billion BTC options contracts and $5.5 billion ETH options contracts are scheduled to expire on Deribit this Friday. The max pain price (the price that hurts the majority of option holders the most) for Bitcoin is at $110,000 and for Ethereum at $3,700.

For the record, the notional value of BTC options reached over $18 billion last week. This indicates that traders have started liquidating and adjusting positions, anticipating the largest crypto contract expiration in history with a total value of around $23 billion.

Read also: Ethereum Slips to $4,300 as Investors Keep Accumulating

Massive Liquidation of Bitcoin, ETH, XRP, SOL, and ADA Shocks Crypto Market

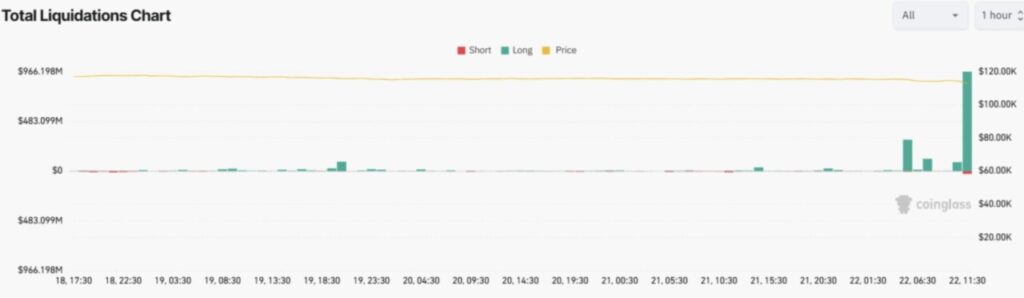

The crypto market correction has worsened after a massive $1.70 billion liquidation in the last 24 hours (22/9). Of this, nearly $1.6 billion of long positions and $85 million of short positions were liquidated.

According to Coinglass data, this was the largest liquidation in history, with over $966 million of long positions erased in just one hour.

A total of 410,000 traders were affected by liquidation in the last 24 hours. The largest single liquidation transaction was recorded on a $12.74 million BTC-USDT swap contract on the OKX crypto exchange.

The data also showed that crypto assets such as ETH, BTC, SOL, XRP, DOGE, ADA, ASTER, Ethena (ENA), and Uniswap experienced the largest liquidations, which triggered the broader crypto market crash.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Crypto Market Crash: Why Are Bitcoin, ETH, XRP, SOL, ADA Falling Today? Accessed on September 22, 2025