5 facts about USDT being the “digital dollar” in Bolivia: From Toyota to 630% Spike in Transactions!

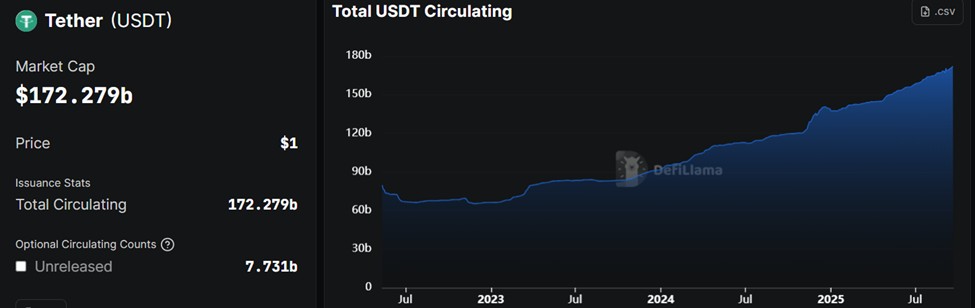

Jakarta, Pintu News – Tether , the world’s largest stablecoin, is now strengthening its position in the global market. According to the BeInCrypto report (21/9/2025), USDT’s market capitalization has reached $172.279 billion (Rp2,863 trillion at an exchange rate of Rp16,624/USD), accounting for nearly 58.8% of the stablecoin share.

This phenomenon has become more prominent in Bolivia, where major companies such as Toyota, Yamaha, and BYD have begun accepting payments with USDT. Amid the economic crisis and scarcity of US dollars, Bolivians are turning to cryptocurrencies to protect purchasing power.

Here are 5 key facts that explain why USDT is increasingly seen as the “digital dollar” in Bolivia.

1. Tether’s Market Cap Hits Rp2,863 Trillion

Data from DefiLlama quoted by BeInCrypto noted that Tether’s (USDT) market capitalization has reached $172.279 billion (Rp2,863 trillion). This figure makes it the most dominant stablecoin with a 58.8% share in the entire global stablecoin market.

Tether’s CEO, Paolo Ardoino, cited this achievement as proof that USDT is becoming the first choice of people in developing countries who seek digital stability amid monetary turmoil.

Also Read: 3 Big Liquidation Risks in the Crypto Market in September 2025 that Traders Need to Be Aware of

2. Toyota, Yamaha, and BYD Receive USDT in Bolivia

One of the biggest developments was the adoption of USDT as legal tender by Toyota, Yamaha, and BYD in Bolivia. BeInCrypto notes that transactions were made with the slogan “Tu vehiculo en dolares digital” (your car with digital dollars).

Ardoino emphasized that these stablecoins now function like digital dollars that can be accessed by millions of people, including in emerging markets where access to foreign currencies is difficult.

3. 630% Spike in Crypto Transactions in Bolivia

According to a report by the central bank of Bolivia (BCB) quoted by BeInCrypto, crypto asset transactions in the country reached $430 million (IDR 7.15 trillion) in the 12 months since the crypto ban was lifted in 2024.

This growth equates to 630% year-on-year (YoY), up from just $46.5 million the previous year. More than half of this occurred in the first half of 2025 with a total of $294 million (Rp4.8 trillion) in crypto transactions.

4. Economic Crisis is a Driving Factor

Bolivia is currently facing severe challenges: the highest inflation in 40 years, long fuel queues, and declining foreign exchange reserves. The value of the boliviano plummeted by almost 50% on the black market during 2025.

As a result, citizens flocked to stable alternatives, and stablecoins like USDT became the solution. Economists quoted by Reuters think this surge in adoption is not a sign of stability, but rather a reflection of weakening household purchasing power.

5. Global Regulations a Limitation, MiCA a Barrier in Europe

Despite expanding in Latin America, Tether is still holding back expansion in Europe due to MiCA (Markets in Crypto-Assets) regulations. Ardoino said Tether will not adjust its principles just to meet European rules.

In contrast, competitors such as Circle, the issuer of USD Coin , has received a MiCA license so it can serve 30 EEA countries with official status as an e-money token. This gives USDC a regulatory edge in the region.

Conclusion: USDT is an Alternative Digital Dollar in the Midst of Crisis

The case of Bolivia highlights how stablecoins, particularly Tether (USDT), can serve as a substitute for physical dollars in everyday commerce. From car purchases to remittance transactions, these dollar-based cryptocurrencies are opening up new financial access for people in developing countries.

However, regulatory challenges and macroeconomic risks remain factors to consider. While USDT has proven to support global transactions, its long-term stability is still highly dependent on market conditions and government policies.

Also Read: Uniswap Price Prediction 2025-2031: Will UNI Remain Stable?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Lockridge Okoth / BeInCrypto. Has Tether’s USDT Stablecoin Become the Dollar Bolivia Actually Trusts? Accessed on September 22, 2025