Ethereum Price Falls to $4,100 on September 23, 2025 — Is ETH at Risk of Dropping Below $4,000?

Jakarta, Pintu News – Ethereum is starting to show signs of increasing selling pressure as the number of wallet addresses reaches new highs.

The asset has dropped below the $4,500 level. Some analysts expect a further correction, while others remain optimistic about ETH’s long-term prospects.

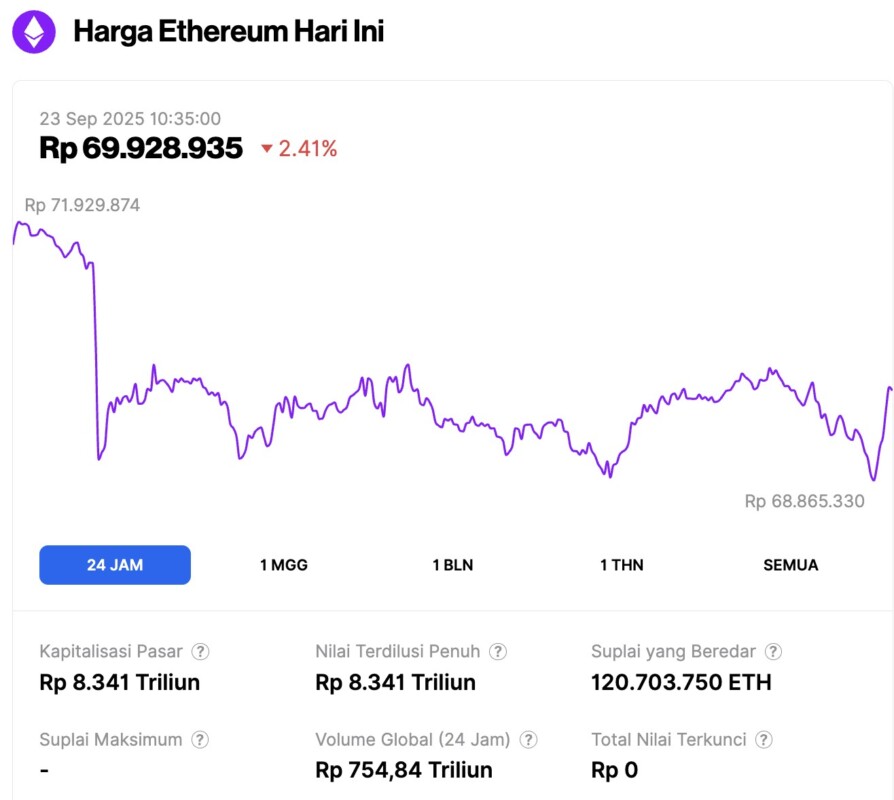

Ethereum Price Drops 2.41% in 24 Hours

On September 23, 2025, Ethereum was trading at around $4,191 (approximately IDR 69.9 million), marking a 2.41% decline over the past 24 hours. Within this timeframe, ETH slipped to a daily low of about IDR 68.9 million while reaching as high as IDR 71.9 million.

At the time of writing, Ethereum’s market capitalization is valued at roughly IDR 8,341 trillion, while its 24-hour trading volume has surged by 68% to around IDR 754.84 trillion.

Read also: With DOGE Down 3% Today, What Does Its Long-Term Future Hold?

Ethereum Whales Start Taking Profits Amid Highest Profitability Levels

According to Glassnode data, the number of ETH addresses recording profits reached an all-time record high of more than 155 million in September.

This record confirms the asset’s long-term strength and broad investor participation. However, it also increases the risk of short-term volatility as high levels of profitability are often followed by sell-offs.

On-chain activity seems to reflect that risk. Blockchain analytics firm Lookonchain reported that Trend Research transferred 16,800 ETH worth approximately $72.88 million to Binance.

The move sparked speculation of a change in outlook, with some seeing it as a preparation to sell assets after making gains.

“Will Trend Research start selling ETH again? The ETH just transferred was part of the 43,377 ETH they bought in early September. After that purchase, they held a total of 152,000 ETH at an average cost of about $2,869,” EmberCN analysts explained.

Profit-taking was also seen on other whales. Address (0xB04) sold 3,000 ETH worth $13.14 million. However, the wallet still holds 9,804.32 ETH worth around $42.57 million.

The derivatives market also reinforced the bearish sentiment. According to an analyst, ETH traders on Binance switched extremely negative. The Taker Buy/Sell ratio dropped below 0.87 on September 19.

Read also: Bitcoin’s Strength Fades: 3 Signals Point to Weakness in Late September

Why ETH Price Could Fall Below $4,000

Amid signals of increasing pressure, ETH’s price movements reflect the condition. BeInCrypto Markets data shows this altcoin fell 10.5% in the past week.

The price drop came after the Federal Reserve cut interest rates by 25 basis points. However, ETH is still stuck below its latest price peak, with its rally towards $5,000 stalled. As of September 22, the second-largest crypto asset was trading at $4,153, down 7.37% in the last 24 hours.

Some market analysts predict ETH still has the potential to fall deeper, even breaking below the $4,000 level.

“ETH will likely return to the $3,900-$4,000 range. There is still one unresolved wave of movement. I don’t believe ETH will reach $6,000 in this cycle,” wrote trader Philakone.

Analyst Ted Pilows also highlighted a gap at CME in the $3,000-$3,500 range that has yet to close.

Despite short-term headwinds, long-term optimism prevails. In another post, Pilows mentioned that Coinbase’s stock chart-which is often considered an early indicator-signaled a potential correction followed by a new rise, a pattern that ETH might follow.

“Global M2 supply now projects ETH in the $18,000-$20,000 range at the peak of the cycle. Even if ETH only reaches half of that, its value remains above $10,000. I remain bullish for the long term and expect a liquidity sweep in the $4,000 zone to occur before a reversal,” Pilows explained.

Thus, although short-term risks still loom, Ethereum’s long-term outlook remains in the direction of an overall bullish trend.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. Ethereum Faces Pressure as Profitable Addresses Hit New Peak. Accessed on September 23, 2025