5 Important Facts about Antam’s Gold Price Today: Penetrated Rp 2.1 million, is it time to invest?

Jakarta, Pintu News – Antam’s gold price trend continues to show a consistent increase in recent months. Based on official data from Brankas LM as of September 23, 2025, the purchase price of gold, both in physical form and through BRANKAS Corporate, has increased significantly. This surge can be an important signal for market participants, both investors and collectors, in developing precious metal-based investment strategies.

1. Today’s Antam Gold Price Rises IDR 41,000 per Gram

The physical gold buying price on the Brankas platform today was recorded at IDR 2,164,000/gram, up IDR 41,000 from the previous price of IDR 2,123,000/gram. The same increase also occurred in the purchase price of Corporate BRANKAS gold, which is now at the level of IDR 2,104,600/gram, from the previous IDR 2,063,600/gram.

According to the description on the Brankas dashboard, this BRANKAS price applies exclusively to corporate customers. This shows that in the current market conditions, demand for gold remains high, both from individuals and institutions.

Also Read: 3 Big Liquidation Risks in the Crypto Market in September 2025 that Traders Need to Be Aware of

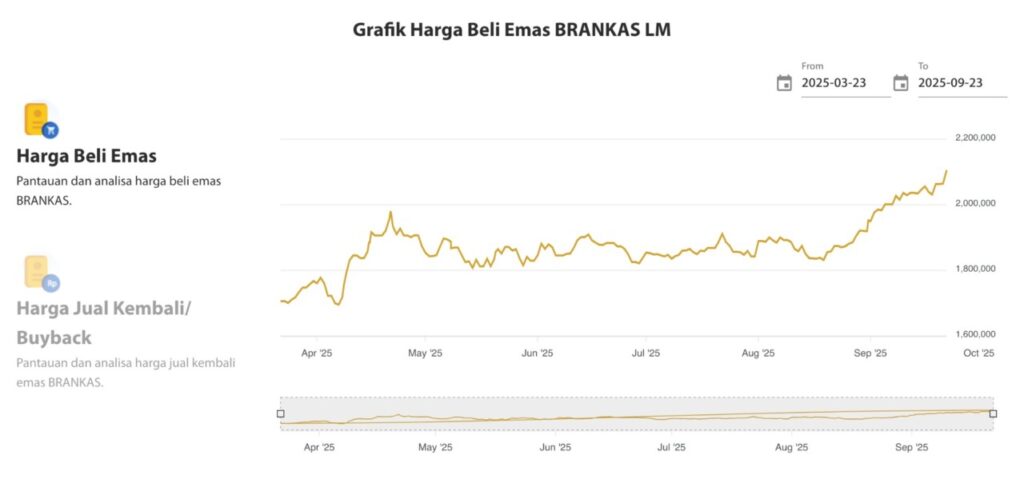

2. Gold Price Chart Rises Steadily Since the Beginning of September 2025

If you look at the BRANKAS LM gold price chart for the last 6 months, you can see a steady upward pattern, especially since the beginning of September 2025. Gold prices that had stagnated in the range of Rp1,900,000 per gram are now moving towards Rp2,200,000/gram.

According to analysis of the chart, the price movement reflects increased interest in safe haven assets like gold amid global uncertainty. Rising prices could be a response to inflation, geopolitical tensions or interest rate policies of major economies.

3. Gold Price Hits Highest Point Since March 2025

Data from Brankas LM shows that today‘ s gold price reached its highest point in the last 6 months. At the end of March 2025, gold prices were still below IDR 1,800,000/gram. The price increase of more than Rp300,000 per gram since then reflects the positive performance of gold as a hedging instrument.

In this context, gold remains an attractive investment instrument for those who want portfolio stability, especially when crypto and stock markets are experiencing high fluctuations.

4. Physical and BRANKAS Price Differences: Which is More Favorable?

The price of physical gold is always slightly higher than that of BRANKAS gold. For example, today the physical gold price is IDR2,164,000/gram, while the BRANKAS price is only IDR2,104,600/gram. This difference of around Rp59,400 reflects the additional cost of managing and storing physical gold.

According to Brankas’ records, BRANKAS pricing is only applicable to corporate customers. For retail or individual investors, prices may differ and can be checked directly through the Brankas LM mobile app. If the investment goal is long-term and liquidity is not a top priority, BRANKAS gold could be an option with lower entry fees.

5. What are the Implications of Rising Gold Prices for Investors?

The rise in gold prices to a new record in the last 6 months signals a positive sentiment towards hedge assets. According to many analysts, this shows the market’s confidence in gold amid global uncertainty.

However, keep in mind that just like any other asset including cryptocurrencies, the price of gold can still fluctuate. Therefore, it is important for investors to diversify and understand their individual risk profile before making a decision.

Conclusion

Antam’s gold price today shows a fairly consistent upward trend, especially since the beginning of September 2025. Both physical and BRANKAS gold prices have increased by IDR 41,000 per gram. The price chart also indicates that the price is currently in a bullish phase. Nevertheless, investment decisions still need to be made carefully and based on careful research.

Also Read: Uniswap Price Prediction 2025-2031: Will UNI Remain Stable?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- LM vault. Today’s Gold Price in Brankas Dashboard. Accessed on September 22, 2025