Fed could stop cutting interest rates this year, here’s how the crypto market reacts!

Jakarta, Pintu News – Recent statements from several Federal Reserve (Fed) officials suggest that there may be no more interest rate cuts this year. This is based on the high inflation and stable labor market dynamics.

Raphael Bostic’s Statement on Interest Rate Policy

Atlanta Federal Reserve President Raphael Bostic stated in an interview with the Wall Street Journal that he sees little reason for further interest rate cuts this year. Bostic, who is not a member of the Federal Open Market Committee (FOMC) this year, revealed that he only projects one rate cut this year.

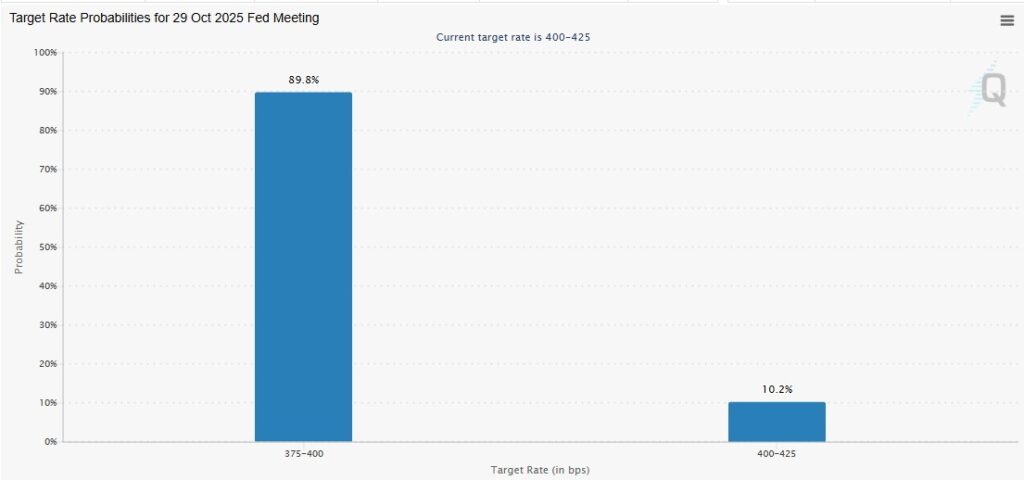

Such a cut was already made at last week’s FOMC meeting, where rates were reduced by 25 basis points (bps). Although CME FedWatch data shows an 89.8% chance of a 25 bps rate cut at the upcoming October FOMC meeting, Bostic remains skeptical. He expressed concern over inflation, which has long been above the 2% target set by the Fed. As such, he is not in favor of further cuts at this point.

Also Read: 5 Shocking Facts About AVAX: Up 10.52% in 24 Hours, Price Breaks IDR 583,000!

Alberto Musalem and the Risk Management Approach

Meanwhile, St. Louis Federal Reserve President Alberto Musalem, who was a voting member of this year’s FOMC, also voiced similar sentiments. According to a Bloomberg report, Musalem only supported the last rate cut as a safety measure against a weakening labor market. He emphasized the importance of maintaining stable inflation and said that he would only support further cuts if labor market conditions deteriorate.

Musalem also added that the current interest rate is somewhere between moderately restructive and neutral, which suggests that the Fed needs to be cautious in making further decisions. Although Trump’s tariffs have not had a major impact on inflation, other factors seem to be contributing to the high inflation above the Fed’s 2% target.

Crypto Market Reaction to Fed Policy

The crypto market showed mixed reactions to the interest rate cut by the Fed last week. Following the cut, the price of Bitcoin briefly surged past $117,000, sparking bullish sentiment among investors. However, the market later retracted, with Bitcoin (BTC) now hovering around $113,000.

These fluctuations show that the Fed’s interest rate policy has a significant impact on the crypto market. Investors still seem to be trying to navigate through the uncertainty of monetary policy and its impact on digital assets.

Conclusion: The Fed’s Future Interest Rate Policy

With inflation still high and the labor market relatively stable, it seems that the Fed will be cautious in making further decisions on interest rates.

The statements from Bostic and Musalem suggest that there may not be any further rate cuts this year, unless there is a significant change in the economy. Investors and market participants should remain vigilant for further announcements from the Fed, especially ahead of the next FOMC meeting.

Also Read: 5 Facts on Hedera (HBAR) Price Pressure: Can it Survive Above IDR3,940?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coingape. No Need for Further Fed Rate Cuts This Year, Fed’s Raphael Bostic Says. Accessed on September 23, 2025