3 Cryptos Showing Strong Performance: ASTER, ZEC & PUMP Extend Their Rally Despite Market Turmoil

Jakarta, Pintu News – Aster , Zcash , and Pump.fun made it through the crypto market turmoil on September 24 and emerged as the day’s best performing assets.

Citing FX Street’s report, Aster’s rise was driven by a surge in trading volume, while growing interest in Zcash and the Pump.fun derivatives market fueled the positive trend.

Aster Targets New Record High as Bullish Momentum Builds

On September 24, Aster was trading above $2.00, aiming for the all-time high of $2.15 reached on Tuesday (September 23). The token from Decentralized Exchange (DEX) gained more than 4% on the day, continuing its 19% surge from the previous day.

Read also: Is Hyperliquid on Track for $100? Analysts Weigh In on Supply Cut Plans and Price Outlook

Recently, the DEX recorded a perpetual trading volume of over $11 billion in just 24 hours, as reported by FXStreet.

In addition, DeFiLlama data shows that among DeFi protocols (excluding stablecoins), Aster ranks top by daily revenue at $7.12 million, surpassing its competitor Hyperliquid , which recorded $2.79 million.

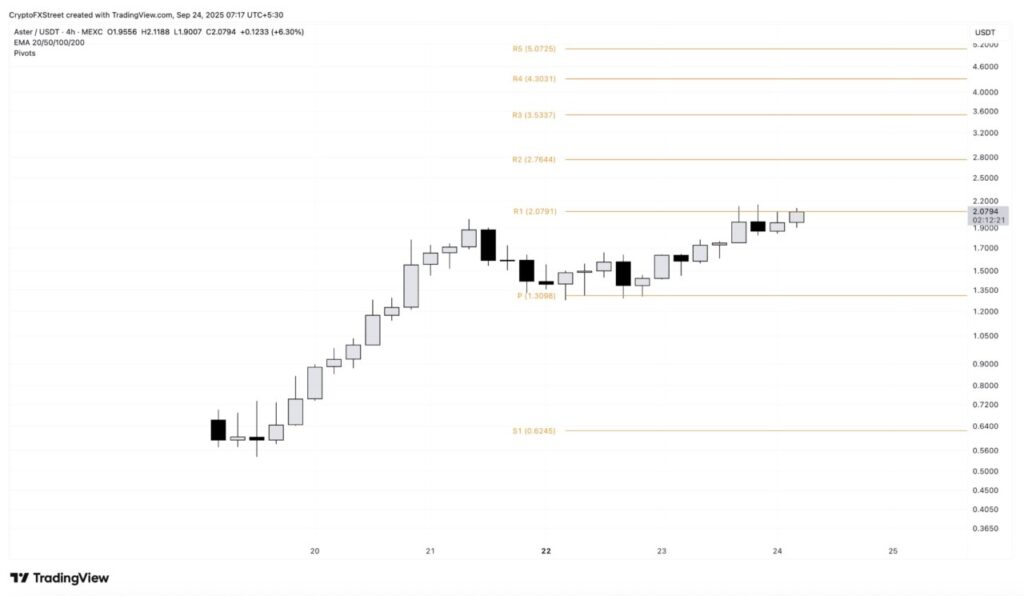

ASTER’s rally faces resistance at the R1 pivot level of $2.07 on the 4-hour chart. A strong close above this level could potentially extend the rally towards the R2 pivot level of $2.76.

However, in case of a reversal from $2.07, the price risks testing the middle pivot level at $1.30 again.

Zcash aims for further gains as open interest surges

On Wednesday (Sep 24), Zcash corrected slightly by around 1% after surging 13% the day before. The privacy token recorded its highest daily close since January 16 on Tuesday, while breaking the R1 pivot level of $54.13.

CoinGlass data shows Zcash’s open interest rose 39% in the last 24 hours, reaching $19.04 million. This large influx of capital signals increased trader confidence.

Adding to the optimism, the OI-weighted funding rate at 0.0145% indicates a strong bullish sentiment, as long position holders are willing to pay a premium to balance the swap and spot prices, while closing the leverage imbalance.

As ZEC takes a pause, a potential rebound could target the R2 pivot level at $56.41 as the closest resistance.

This intraday surge also pushed the momentum indicator to the positive on the daily chart. The Relative Strength Index (RSI) stands at 63 and continues to climb above the centerline, indicating increasing buying pressure.

In addition, the Moving Average Convergence Divergence (MACD) crossed its signal line, signaling the end of the short-term bearish phase. If the MACD trend continues upwards, Zcash has the potential to extend its rally.

Read also: XRP Price Forecast: Analyst Says the Token Is Entering the Early Stages of a Sudden Breakout

But on the other hand, if ZEC closes the day below $54.13, the breakout rally will be canceled. This could extend the decline towards the 200-day Exponential Moving Average (EMA) at $42.35.

Pump.fun Prepares to Bounce off 200-Period EMA

On Wednesday (Sep 24), Pump.fun was trading above $0.005900 after bouncing off the 200-period EMA on the 4-hour chart. The launchpad token stabilized above the psychological level of $0.005000 and the S1 pivot level at $0.005779.

A potential reversal on PUMP is likely to face resistance at the declining 50-period EMA at $0.006629, followed by the middle pivot level at $0.007267.

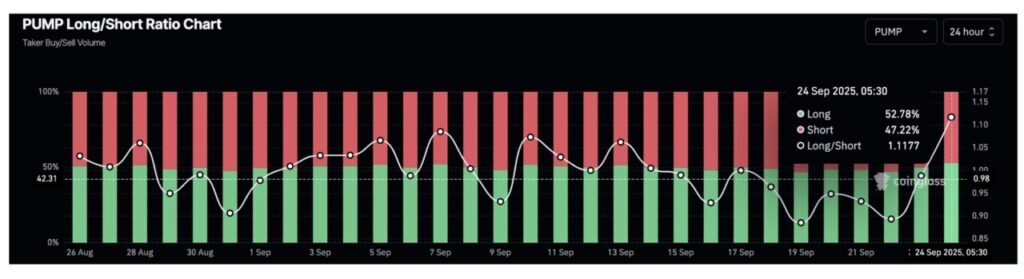

Supporting the bullish outlook, CoinGlass data shows long positions rose to 52.78% from 49.71% in the last 24 hours (24/9). This reflects a shift in trader sentiment towards the positive.

The RSI at the 40 level on the 4-hour chart also bounced back from the oversold boundary line, indicating the easing of selling pressure. Moreover, MACD crossing its signal line adds to the signs that bullish momentum is starting to reappear.

However, if PUMP falls below the 200-period EMA at $0.005571, the price risks retesting the S2 pivot level at $0.005023.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- FX Street. Top Crypto Gainers: ASTER, ZEC, PUMP extend gains in a volatile market. Accessed on September 25, 2025