5 Altcoins with the Largest Futures Volume in 2025

Jakarta, Pintu News – The crypto derivatives market continues to grow rapidly, and futures volume is one important indicator in assessing how actively an altcoin is traded. In 2025, a number of altcoins recorded huge futures volumes, indicating high interest from traders in these assets for short-term price speculation. Here are the five altcoins that stood out the most in terms of futures volume, based on recent data and trends!

1. Ethereum (ETH)

Ethereum has become one of the altcoins with the largest futures volume throughout 2025. According to The Block’s data, ETH futures volume per month continues to surge due to speculative demand and hedging needs in the DeFi sector.

Also, a report from Bitget mentioned that, ETH futures volume reached $62.1 billion, exceeding Bitcoin futures volume of $61.7 billion – a volume “flip” that shows a shift in trader interest from BTC to ETH.

A contributing factor is Ethereum’s highly active ecosystem – from DeFi applications, NFTs, to technical upgrades that catch the market’s attention. ETH futures traders tend to utilize the higher volatility compared to BTC, as well as reactions to technical news or network updates as triggers for sharp price movements.

Also read: Will the Crypto Bull Run Happen in October 2025?

2. Solana (SOL)

SOL is one of the altcoins that often appears on the list of “futures trading favorites” thanks to its high liquidity and strong ecosystem activity. Solana offers high transaction speed and low fees, which drives many DeFi projects and applications on it. Because of this, when new projects are launched or there is big news, SOL futures often record volume spikes.

Although Solana has experienced network disruptions, derivatives traders still see it as a high-opportunity asset due to the potential for large fluctuations. Under bull market conditions, SOL is often one of the “leading” altcoins whose volume functions very actively.

3. Binance Coin (BNB)

BNB, the token of the Binance ecosystem, is also emerging as one of the altcoins with large volume futures. As a utility token used to pay transaction fees and run Binance Smart Chain services, BNB has strong fundamental support.

Futures traders see BNB as an asset with a balance between liquidity and moderate volatility – not quite as wild as micro altcoins, but still with enough movement to generate opportunities. Since many BNB futures contracts are available on various exchanges, BNB is a popular choice among derivatives traders.

Also read: Top 5 Crypto to Trade Futures with High Leverage

4. Ripple (XRP)

XRP is increasingly attracting the attention of the derivatives market after several regulatory developments and institutional news. The decision of major exchanges to launch XRP futures contracts (as announced by CME) adds legitimacy and liquidity.

Futures traders often capitalize on price reactions to news such as regulatory approvals, institutional partnerships, or technical announcements. Since XRP is relatively sensitive to news, its futures volume often spikes when there is a major catalyst.

5. Avalanche (AVAX)

AVAX, as a Layer-1 blockchain with high speed and growing DeFi application support, is also on the list of altcoins with high-volume futures in 2025. When the AVAX network is in the spotlight, such as an upgrade or the launch of a major project, AVAX futures often spike in volume. Traders see AVAX as an asset with attractive upside opportunities, especially in moments of “altcoin market momentum.”

Futures Volume Gains Slightly, Perpetuals Plummet

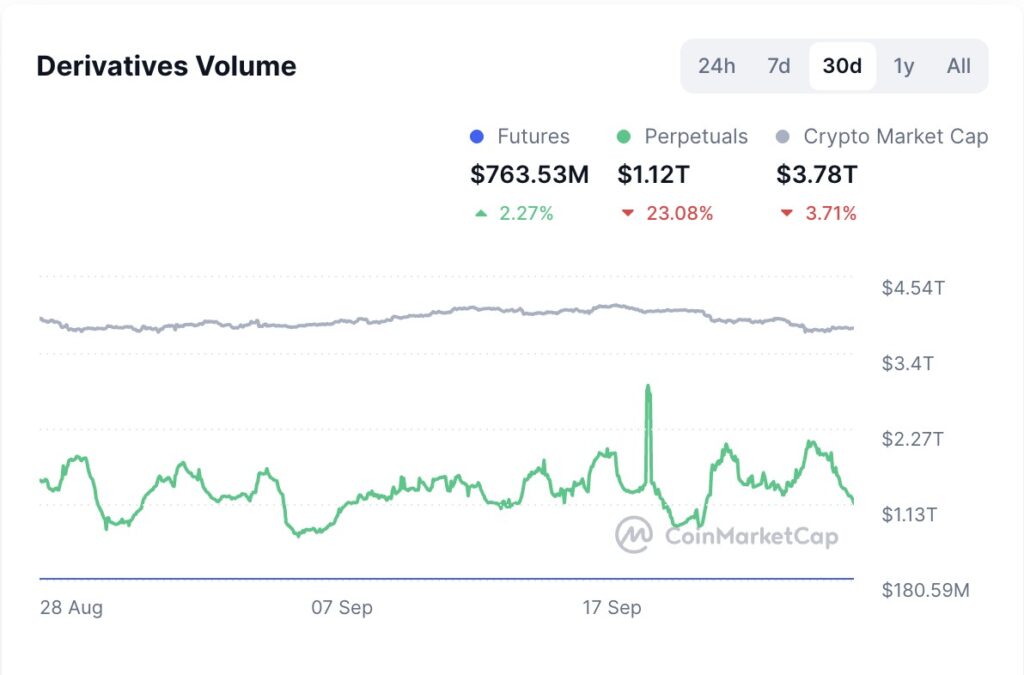

The chart above, sourced from CoinMarketCap, shows a comparison of crypto derivatives volume in the last 30 days, including futures (blue), perpetuals (green), as well as total crypto market cap movement (gray).

It can be seen that perpetuals volume dominated with a value of around $1.12 trillion, despite experiencing a significant decline of 23.08% during the period. Meanwhile, futures volume stood at around $763.53 million, actually edging up by around 2.27%. The overall crypto market capitalization stood at $3.78 trillion, down 3.71% over the same period.

In terms of movement trends, the green line (perpetuals) shows much more active fluctuations with some sharp spikes, such as in mid-September, signaling increased trading activity. In contrast, the blue line (futures) is almost flat and relatively small in volume, illustrating that futures contracts with fixed maturities are not as popular as perpetuals in the crypto market.

Overall, this chart emphasizes the dominance of perpetual futures in cryptocurrency derivatives trading. Momentary spikes in perpetuals indicate traders’ quick response to market sentiment, while futures tend to stabilize with limited movement.

Conclusion

Five altcoins-Ethereum, Solana, BNB, XRP, and AVAX-stood out as the assets with the largest futures volume in 2025. Data shows that ETH even briefly surpassed BTC in daily futures volume, signaling a change in derivatives market dynamics. While high volume often means liquidity and market attention, futures trading still carries substantial risk, especially when using leverage.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Featured Image: