5 Important Facts Behind Bitcoin & Ethereum Price Fluctuations: Option Contract Expiry Effect!

Jakarta, Pintu News – Bitcoin and Ethereum prices often move wildly for no apparent reason – but many don’t realize that option contract expiry is one of the triggers.

When a large number of options contracts approach their expiration date, the crypto market can experience a spike in volatility. This article summarizes 5 important facts about crypto derivative options and how they significantly affect BTC and ETH price movements.

1. What is Crypto Option Expiry and Why is it Important?

An option contract is an agreement that gives the right, not the obligation, to buy (call) or sell (put) an asset such as BTC or ETH at a certain price before a certain date (expiry).

As thousands or even billions of dollars in options contracts approach expiry, the market will see increased activity as traders try to lock in profits, avoid losses, or reposition positions. This creates spikes in volatility that retail investors are often unaware of.

Also Read: 5 Cryptos with the Tightest Ranking Spreads on the Futures Market – Save on Trading Costs!

2. Option Expiry Could Trigger a Spike in Market Volatility

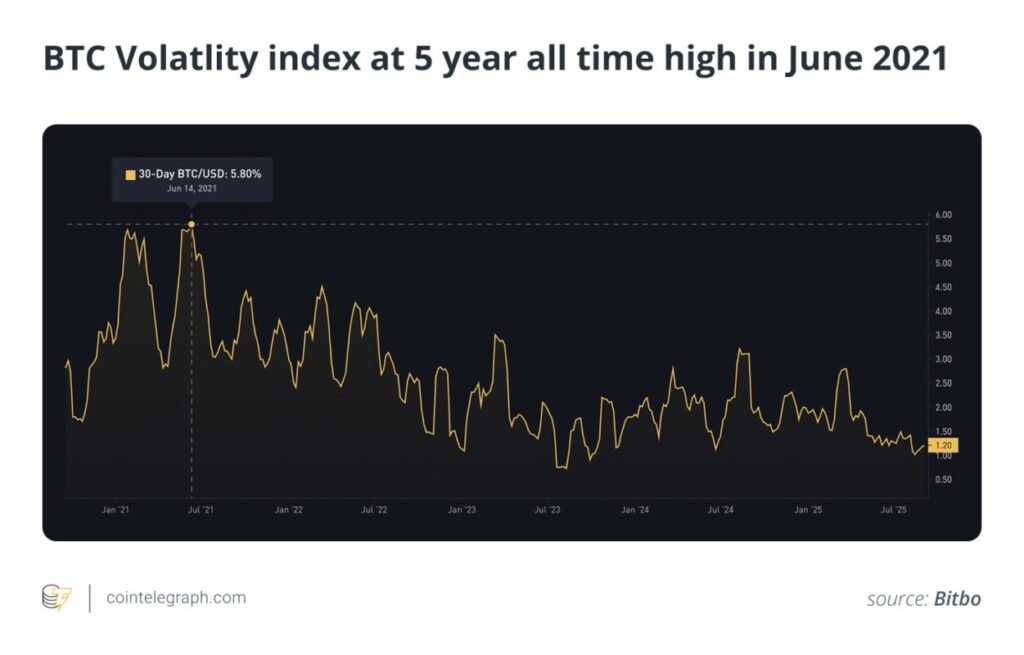

For example, in June 2021, more than $4 billion worth of BTC and ETH options contracts expired, triggering a 5.8% spike in the BTC volatility index – a five-year record high.

According to Cointelegraph data (September 29, 2025), large expiry events like this often occur on the last Friday of every month at 08:00 UTC. Traders who don’t pay attention to this can miss out on great opportunities or get caught in misguided positions.

3. Put/Call Ratio Indicates Market Sentiment

The put/call ratio is used to measure market sentiment.

- Ratio > 1 = more sell (put) contracts → bearish

- Ratio < 1 = more buy contracts (calls) → bullish

This ratio is an important signal when approaching expiry as it can predict the next price direction. When there is extreme imbalance, the market can prepare for a sharp post-expiry reversal.

4. “Max Pain” Theory and Price Manipulation

Max Pain is the price at which the number of option contracts that expire worthless is greatest. The theory is that prices tend to be pulled towards this level ahead of expiry by large market participants (whales), so that the majority of contracts are not profitable.

This opens up the potential for significant market manipulation. Professional traders use Max Pain data as temporary support/resistance levels to take strategic short-term trading positions.

5. Expiry Strategy: Hedging & Beware of Time

Some of Cointelegraph’s recommended strategies for dealing with expiry include:

- Monitor open interest and volume: Especially for BTC and ETH contracts towards the end of the month.

- Use options as a hedge against spot positions.

- Diversify assets and timeframes to avoid overexposure to one expiry event.

- Use advanced analysis platforms like CoinGlass or CME to monitor large expiries.

For example, in August 2025, Deribit recorded the highest expiry volume in history: $14.6 billion in BTC and ETH contracts – this event caused sharp volatility within 48 hours.

Don’t Ignore Expiry in Crypto Trading

Many novice traders overlook the expiry of options contracts, even though it is one of the biggest factors behind sudden price swings in BTC and ETH. Understanding options and expiry dynamics will keep you one step ahead of the market.

With this basic understanding, investors can make more informed decisions when volatility spikes – not just go with the flow.

Also Read: 5 Crypto with the Highest Futures Open Interest Last Week of September 2025!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Marcel Deer / Cointelegraph. The Hidden Force Behind Bitcoin and Ether Price Swings: Options Expiry. Accessed September 29, 2025.