Bitcoin Hits $120,000 Today — Is Another All-Time High on the Horizon?

Jakarta, Pintu News – The leading digital asset, Bitcoin, briefly rose 3% on October 2, 2025 as optimism in the overall crypto market increased. This rise came amid fears of the US government shutdown weakening the dollar, prompting a surge in fund inflows into BTC.

With buying pressure getting stronger, the largest cryptocurrency has the potential to break another record high. So, how is the current Bitcoin price movement?

Bitcoin Price Up 0.84% in 24 Hours

On October 3, 2025, Bitcoin was priced at $120,273, equivalent to IDR 1,988,528,785, marking a 0.84% gain over the past 24 hours. During this period, BTC traded as low as IDR 1,962,301,909 and climbed to a peak of IDR 2,004,233,872.

At the time of writing, Bitcoin’s market capitalization is estimated at IDR 39,796 trillion, while 24-hour trading volume has declined by 13% to IDR 1,084 trillion.

Read also: Ethereum Hits $4,500 Today as Crypto Whale Snaps Up 840,000 ETH!

BTC inflows surge as dollar weakens

Amid the weakening US dollar, global investors have started shifting their capital to other assets such as BTC. According to SosoValue data, net inflows into BTC spot ETFs surged to the highest level in recent weeks, reaching $675.81 million yesterday – a sign of rising institutional participation.

This resurgence in capital flows contrasts sharply with last week, when more than $900 million exited the same instrument.

The new inflows signal that institutional interest in BTC is starting to return, as market participants consider how long the US government shutdown will last and the impact on risk assets.

If this trend continues, BTC could follow the historical pattern of “Uptober” and have a chance to break through its record highs again and set new levels.

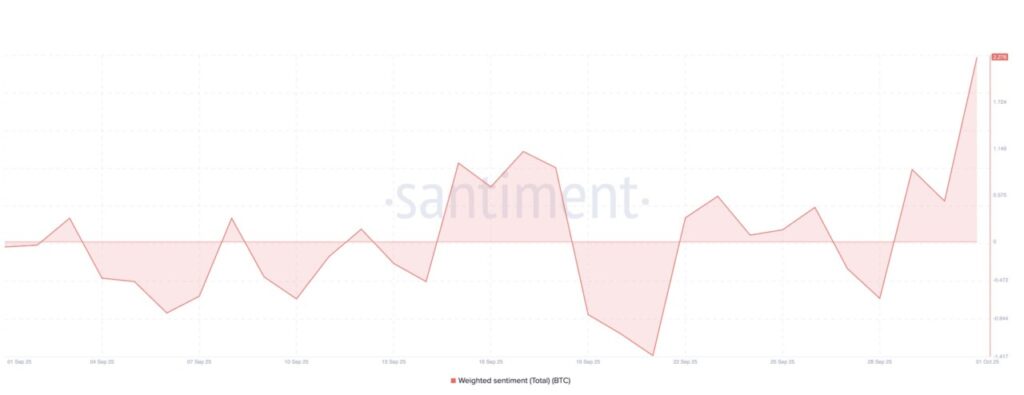

In addition, Santiment data shows BTC’s Weighted Sentiment continues to rise, now at 2.27 and moving in a positive direction. This indicator measures conversations related to an asset on social media and the ratio between positive and negative comments.

When the value is positive, it means that market sentiment tends to be optimistic, with bullish narratives dominating. Conversely, negative values indicate a stronger bearish sentiment, reflecting investor fear or caution.

The current upward trend in BTC sentiment is quite noteworthy. Over the past month, the indicator had fluctuated sharply, reflecting the high volatility in the crypto market. However, the steadier rise now signals that optimism is starting to return and is getting stronger. If this trend continues, it could sustain the ongoing BTC rally.

Read also: Telegram Founder Pavel Durov Predicts Bitcoin Price to Break $1 Million!

Can the King of Crypto Break $120,000 Resistance?

On the daily chart (2/10), BTC’ s Aroon Up line touched the 100% level again – a signal that usually confirms the strength of a bullish trend.

The Aroon indicator itself is used to measure the strength and direction of price trends by analyzing the time since the price last touched the highest(Aroon Up) or lowest(Aroon Down) level.

When the Aroon Up line is near 100%, it indicates the price is consistently printing new highs, reinforcing the potential for the uptrend to continue.

If demand for BTC continues to rise sharply, the “crypto king” could potentially test its record high of $123,731 again. However, to achieve this, the price must first break the $120,144 resistance level.

Conversely, if demand weakens, BTC risks falling again and could even fall below $115,892.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. BTC Price: All-Time High Within Reach Now. Accessed on October 3, 2025