Canary’s TRUMP ETF Makes Its DTCC Debut — Could SEC Approval Be Next?

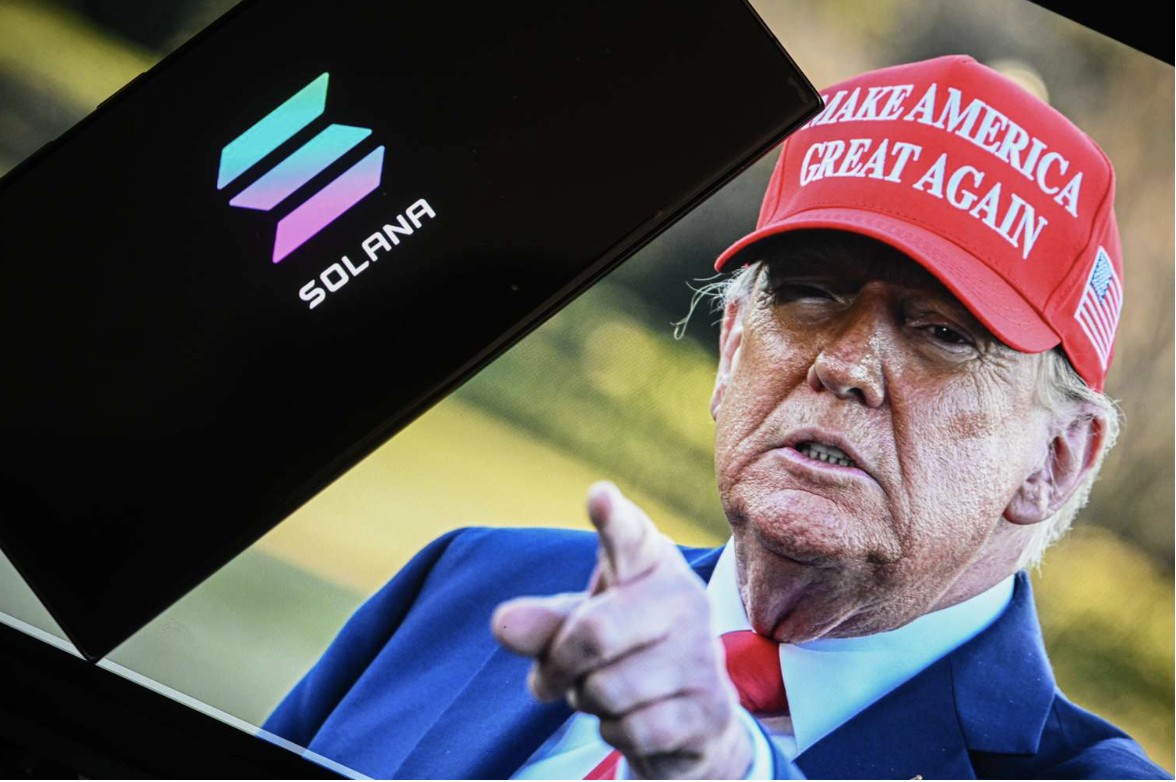

Jakarta, Pintu News – A new crypto ETF (exchange-traded fund) linked to the Donald Trump meme coin has reportedly quietly appeared on the DTCC platform under the symbol TRPC.

This listing, secured by Canary Capital Group, marks the first step towards the possible launch of such an ETF. According to industry experts, listing on the DTCC is a standard procedure for ETFs preparing to enter the market.

This move confirms that the ETF is technically ready for the trading and settlement process, but does not mean that it has been officially licensed by the SEC (US Securities and Exchange Commission).

Fund Focus on Solana-Based TRUMP Token

Read more: Solana’s Hidden Bullish Signal Reappears – Is a New Record High Near?

Interestingly, Canary Capital had filed a registration with the SEC in August to establish a fund fully backed by the TRUMP token, a Solana blockchain-based asset inspired by the former US president. This filing falls under the Securities Act of 1933.

This structure differs from previous crypto ETF filings that utilized the Investment Company Act of 1940, where issuers typically held crypto assets indirectly through offshore entities or bundled them with holdings of U.S. Treasury securities.

In contrast, Canary’s approach removes that intermediary layer, allowing investors to gain direct exposure to TRUMP token volatility without a mix of other instruments.

Analysts are Cautious on the Outlook

Even so, market observers still doubt the ETF’s chances of escaping the SEC’s close scrutiny in the near future.

For example, Eric Balchunas, an ETF expert from Bloomberg, explains that the commission usually requires there to be an active futures market for an asset for at least six months before considering spot ETF approval.

Currently, there are no futures contracts related to the TRUMP token traded on any regulated exchange, so this proposal is in a regulatory gray area.

Balchunas also added that a TRUMP-based ETF would most likely be more realistic if it was made part of a diversified ETF under the Investment Company Act of 1940, rather than as a single spot ETF.

Fundraising efforts amid plummeting token prices

The development of this ETF comes alongside other initiatives to salvage the market price of the TRUMP token which continues to weaken.

According to a report by The Crypto Basic, Fight Fight Fight LLC, the TRUMP coin issuer led by Bill Zanker, a Donald Trump supporter, plans to raise between $200 million and $1 billion. The funds will be used to establish a digital asset treasury aimed at buying back the token and stabilizing its value.

Read also: Square, Led by Jack Dorsey, Introduces Bitcoin Payments with 0% Transaction Fees

However, these efforts are still at the initial negotiation stage and it is uncertain whether the funding target will be fully achieved.

TRUMP Token Experiences Sharp Price Drop

The TRUMP token, which peaked at around $75 in January, has now plummeted by around 90% and is trading at around $8 as of this report.

In addition, the downward trend has continued in recent weeks, with prices falling by more than 10% in the past month, signaling that selling pressure is still strong in the market.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Crypto Times. DTCC Adds Canary Trump Coin ETF (TRPC) to Listings. Accessed on October 10, 2025

- FX Leaders. Trump Coin ETF Listed on DTCC as Analysts Eye Breakout Above $8. Accessed on October 10, 2025

- The Crypto Basic. Canary Trump Coin ETF Secures DTCC Listing, Is SEC Approval Underway?. Accessed on October 10, 2025