Antam Gold Price Chart Today October 14, 2025: Up or Down?

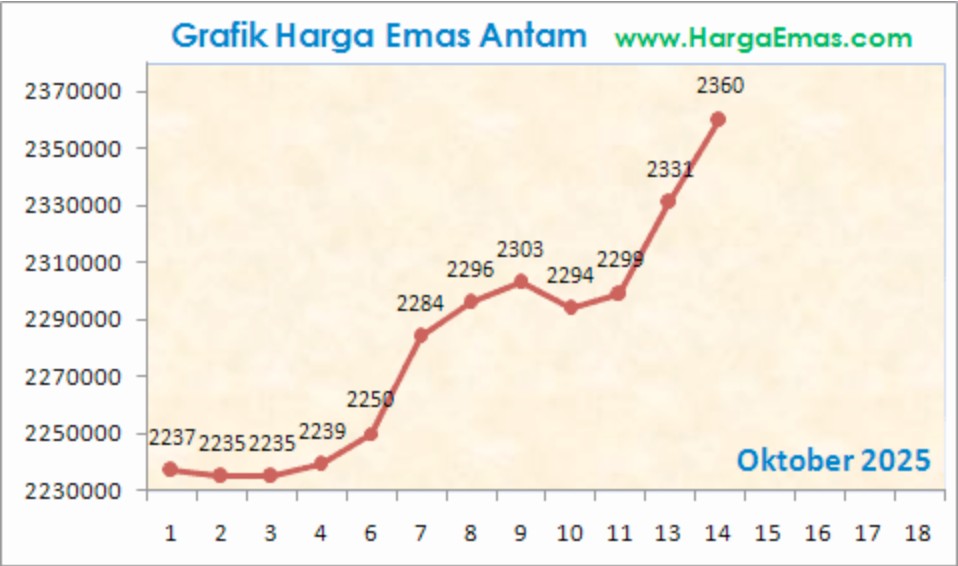

Jakarta, Pintu News – Antam gold prices climbed again in trading today, Tuesday, October 14, 2025, and set a new price record throughout October. Based on data from HargaEmas.com, the selling price of 1 gram of Antam gold was recorded at Rp2,360,000, up significantly from Rp2,331,000 on the previous day.

This rise confirms the bullish momentum that has continued since the beginning of the month. Historical data shows that Antam ‘ s gold price has surged from IDR2,237,000 on October 1 to IDR2,360,000 today, or up about 5.5% in just two weeks.

1. Global Spot Gold Price Rises Sharply to $4,145.70 per Ounce

The upward trend in domestic gold prices is inseparable from the surge in global spot prices which stood at $4,145.70 per troy ounce, up $40.00 from the previous day. This increase reflects the high demand for gold as a safe haven asset amid global geopolitical uncertainty and expectations of an economic slowdown.

If converted to Rupiah using the latest exchange rate USD/IDR = IDR16,553.15, the current world spot gold price is equivalent to IDR2,206,326 per gram. This value is very close to the buyback price in Indonesia, strengthening the positive sentiment towards physical gold in the country.

2. Rupiah continues to weaken, pushing up local gold prices

The Dollar to Rupiah exchange rate weakened slightly to IDR16,553.15, up about 6.99 points from the previous day. The weakening Rupiah exchange rate is one of the factors driving Antam’s gold price increase, as it makes global commodity prices – which are calculated in USD – more expensive in Rupiah.

Bank Indonesia is expected to remain vigilant against exchange rate weakness and maintain stability through intervention in the forex market. However, as long as pressure on the Rupiah continues, domestic gold prices are likely to remain high, regardless of global price movements.

3. Antam Price Chart Shows Sharp Spike in the Second Week of October

Based on the chart from HargaEmas.com, the price of Antam gold began to rise sharply since October 6, 2025, from the level of IDR 2,239,000 to reach IDR 2,360,000 on October 14. The significant surge occurred in two large waves:

- October 6-8: price increases from IDR 2,239,000 to IDR 2,296,000

- October 11-14: price jumps from IDR 2,299,000 to IDR 2,360,000

This gradual rise is indicative of strong accumulated demand from retail and institutional investors, particularly towards the end of the year when gold demand tends to increase.

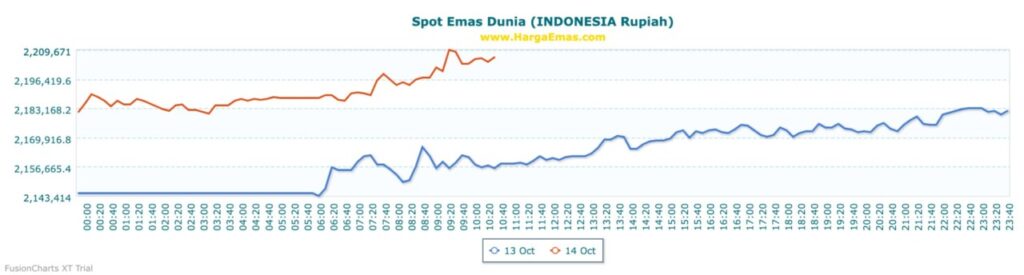

4. World Spot Gold in Rupiah Reaches Daily High of IDR 2,209,671

In addition to the spot price in USD, the world gold spot movement chart in Rupiah also shows an upward trend throughout October 14, 2025. Based on HargaEmas.com live chart data, the spot price in Rupiah had touched IDR 2,209,671 per gram-the highest daily level so far.

This supports the logic that Antam’s gold price in the domestic market still has room to continue rising, along with rising global spot value and weak Rupiah exchange rate.

5. Conclusion: Strong Momentum, Good Time to Collect Gold?

With the combination of rising global spot prices, weakening Rupiah, and increasing domestic demand, Antam ‘s gold price has the potential to continue its upward trend in the near future. For medium to long-term investors, this situation could be a strategic opportunity to accumulate gold.

However, investors also need to be aware of the possibility of a short-term correction. As always, be wise in reading market sentiment, and adjust your investment strategy to your individual risk profile.

Also Read: 5 Gold Price Predictions at the End of 2025 – Could it Reach Rp2.5 Million?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- HargaEmas.com. Gold Price Today. Accessed October 14, 2025.