Altseason Index Movement: Altcoins Outperform BTC in the Last 7 Days

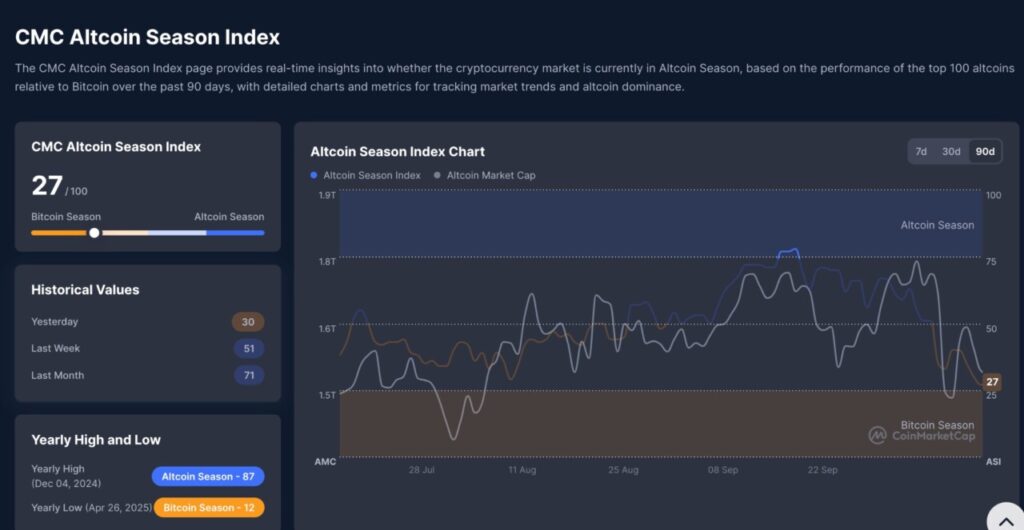

Jakarta, Pintu News – After being sluggish, altcoins have shown impressive performance against Bitcoin in the last seven days. Based on the latest data from CoinMarketCap Altcoin Season Index, the altseason index fell to 27/100, indicating that the market is still dominated by Bitcoin. However, when viewed over a period of a week, altcoins managed to record outperformance compared to BTC.

What is Altcoin Season Index?

The Altcoin Season Index (ASI) is an indicator that shows whether altcoins are collectively outperforming Bitcoin. The index score ranges from 0 to 100, where:

- 0-25 = Bitcoin Season (BTC outperforms altcoins)

- >75 = Altcoin Season (Altcoin outperform BTC)

- 26-74 = Neutral/transition zone

In the past 90 days, the index touched 87 in December 2024 (a sign of a strong alt-season), and scored a low of 12 in April 2025.

ASI drops to 27, but altcoins win this week

According to CoinMarketCap data the Altcoin Season Index is now at 27, close to Bitcoin’s dominance zone. But when compared to last week, there was a sharp drop from a score of 51, suggesting that altcoins have recently undergone a profit-taking phase after a significant rally.

Historical data shows:

- Yesterday: 30

- Last week: 51

- Last month: 71

Despite ASI’s decline, the price performance of altcoins in the last 7 days remains better than Bitcoin, with many altcoins recording double to triple digit returns in the last 90 days.

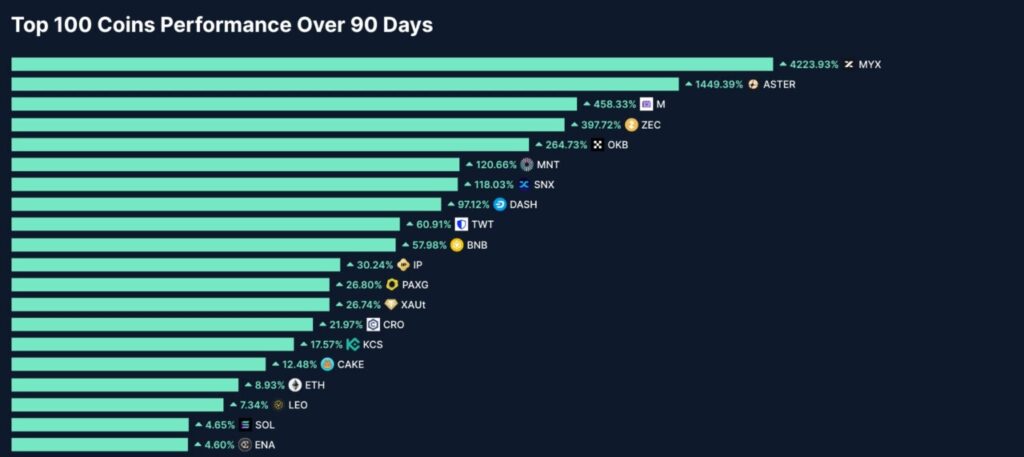

5 Best Altcoins In 90 Days

Here are the highest performing altcoins over the last 90 days according to CoinMarketCap:

- MYX (MYX) – Up +4,223.93%

- ASTER – Up +1,449.39%

- Mantle (M) – Up +458.33%

- Zcash – Up +397.72%

- OKB (OKB) – Up +264.73%

This extraordinary surge confirms that altcoins have much higher volatility and potential for profits than Bitcoin in the short term, albeit with higher risks.

Why are altcoins winning right now?

Based on analysis from CoinMarketCap there are several reasons why altcoins can outperform:

- Low capitalization allows for the potential for rapid gains.

- Sentiment AI, DeFi, and tokenization give certain projects a boost.

- Capital rotation from BTC to altcoins after BTC’s consolidation phase.

However, it’s important to note that this performance spike could be short-term. Historically, the altseason phase can be followed by a return to Bitcoin dominance (BTC season), as shown by the index dropping from 71 to 27 in just a month.

Graphs & Trends

The ASI chart shows that the peak of the altcoin season occurred in early September and started to decline from the middle of the month. Currently, the altcoin market cap also shows a slight correction, although some coins such as ZEC and SNX remain positive.

What Should Investors Look Out for?

For crypto investors, it is important to monitor trend rotation from Bitcoin to altcoins. Indices like ASI can help make entry/exit decisions. However, don’t get hung up on momentary trends. Fundamentals and project roadmap should still be the main considerations.

Conclusion

Although the Altcoin Season Index is currently in the “Bitcoin Season” zone, the performance of altcoins in the last 90 days-especially in the last 7 days-shows that altcoins are still highly attractive to aggressive traders. With extreme moves like MYX rising over 4,000%, this trend is worth monitoring more closely in the next few weeks.

Also Read: Michael Saylor’s Strategy: $27.2 Million Bitcoin Purchase Before the Crypto Market Crash

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- CoinMarketCap. Altcoin Season Index. Accessed October 16, 2025.