Buy NVIDIA Stock 10 Years Ago? Here’s How Much It’s Worth Now-The Results Are Surprising!

Jakarta, Pintu News – Ten years ago, NVIDIA (NVDA) stock may not have caught the attention of many investors. However, who would have thought that a graphics chip company that was once known among gamers is now the king of the artificial intelligence industry. In the past decade, NVIDIA’s stock price has soared thousands of percent, making it one of the most profitable investments in modern stock market history.

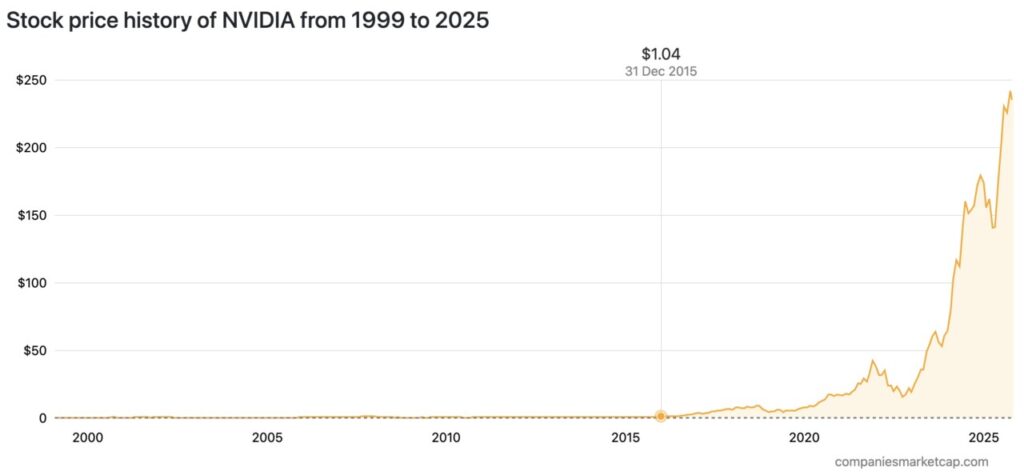

From $2 to Hundreds of Dollars: NVIDIA’s Spectacular Journey

In 2015, the share price of NVIDIA (NVDA) was only around $1.04 per share after adjusting for the stock split. Now, in 2025, its share price has reached $235, which is equivalent to around Rp3.8 million per share (exchange rate of Rp16,581 per USD). This means that the investment value will increase by more than 22,496%! in 10 years.

If someone invested Rp10 million in 2015, it would now be worth around Rp2.26 billion! This increase is driven by the rapid growth in the AI sector, data centers, and graphics chips for artificial intelligence that are now being used in various industries – from automotive tocloud computing.

Also read: 4 Factors Causing NVIDIA Shares to Rise, Here’s What You Need to Know!

AI is the main engine of NVIDIA’s stock rise

The main catalyst behind the surge in NVIDIA’s share price was the boom in generative AI technology starting in 2023. Global demand for GPU chips to train AI models such as ChatGPT, Gemini, and Claude saw the company post record revenues.

By 2025, NVIDIA’s market capitalization will have reached $4.426 trillion, putting it at the #1 most valuable company in the world, beating Apple and Microsoft.

Investors see NVIDIA as no longer just a graphics chip manufacturer, but the backbone of the global AI revolution, with gross profit margins above 70% – a figure almost unmatched in the tech industry.

Also read: These 5 Stocks are Analyst Favorites, META is in the Spotlight!

Is NVIDIA Stock Still Worth Buying Now?

Although it has risen thousands of percent, many analysts still think NVDA has not run out of steam. Demand for GPUs still far outstrips supply, and NVIDIA continues to introduce new chip series such as the H200 and Blackwell B200 that are more energy efficient and faster at processing AI data.

However, investors also need to be careful. The stock’s very high valuation makes its volatility increase. If demand for AI slows down or strong competitors such as AMD or Intel emerge, NVDA’s price could correct in the short term. However, for long-term investors, NVIDIA is still considered a “blue chip AI stock” with bright prospects until 2030.

US xStocks Comes to the Pintu: Access US Stocks Through the Crypto World

NVIDIA’s story is proof that innovation can turn an ordinary company into a global giant. In 10 years, NVDA grew from a gaming chipmaker to the leader of the artificial intelligence era.

For those who have invested since the beginning, the result is a huge, almost unimaginable profit. And for new investors, NVIDIA is still one of the most attractive stocks in the world-even though the price of admission is now much more expensive.

US xStocks (Tokenized) is now available for trading on Pintu. This product allows you to have exposure to major US stocks such as Apple (AAPLX), Tesla (TSLAX), and Nvidia (NVDAX) in the form of tokens whose value follows the original stock price.

US xStocks is a crypto asset that represents US public stocks and is backed by a verified underlying asset. With US xStocks on Pintu, you can easily access global stock markets through a secure and transparent crypto ecosystem.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Featured Image: Markets