Crypto Market Analysis Today (10/21/25): Bitcoin (BTC) Rebounds to Above IDR 1.8 Billion

Jakarta, Pintu News – The price of Bitcoin started the third week of October 2025 with a significant gain, breaking through the $111,000 level (around Rp1.84 billion) after falling sharply earlier.

Data from TradingView shows that the price briefly hit a weekly low of around $108,600 (Rp1.8 billion) before climbing back up, giving investors and hodlers a bit of a sigh of relief.

US Inflation Data Could Determine Bitcoin’s Next Move

However, some analysts think this rally may just be a “dead cat bounce”, aka a temporary bounce before the price drops again. Trader CrypNuevo warns that the $116,000-$117,000 (Rp1.92-Rp1.95 billion) zone is now a short squeeze-prone area, where traders’ positions betting on a price drop could be liquidated en masse. According to him, Bitcoin’s current movement is still driven by “imbalance” or imbalance of liquidity in the market.

Macroeconomic factors also come into play this week. The United States Consumer Price Index (CPI) is scheduled for release on Friday, despite the US government shutdown. Interestingly, this will be the first CPI release since 2018 to occur during a government shutdown, adding to market uncertainty.

According to a report by The Kobeissi Letter, the CPI results this time will greatly influence the Federal Reserve’s interest rate decision on October 29. If the inflation figure is lower than expected, it could increase the chances of a 0.25% rate cut, which is usually a positive catalyst for risky assets such as cryptocurrencies.

However, trade tensions between the US and China are still a major limiting factor that could quickly reverse the market’s direction.

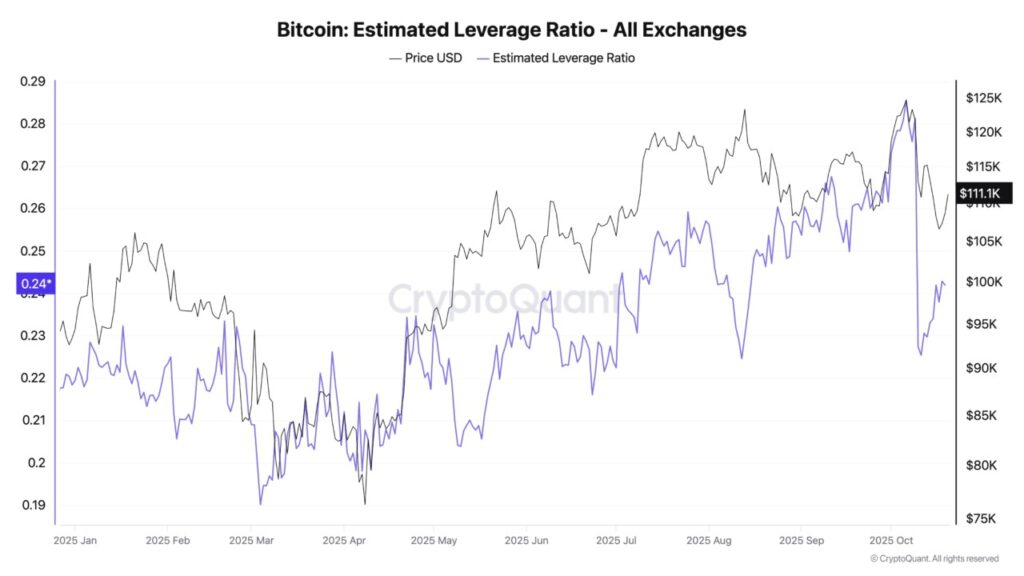

Leverage starts to rise again, but crypto traders are still cautious

After experiencing a massive $19 billion liquidation on October 10, the crypto derivatives market is starting to show signs of recovery. Data from CryptoQuant reveals that Bitcoin’s leverage ratio rose from 0.148 to 0.166 in the past week, signaling traders are slowly starting to open new positions.

Also read: How Much is 1 Robinhood xStock (HOODX) Today (10/21/25)?

Analyst Arab Chain said this increase reflects the return of speculative interest in the market, although it is still accompanied by a cautious attitude. According to him, if the Bitcoin price is able to stay above $110,000 (Rp1.82 billion), then investors’ confidence in a short-term recovery could be strengthened. However, he emphasized that the increase in leverage also has the potential to increase the risk of extreme volatility if the market reverses.

Bitcoin’s dominance in the crypto market is starting to weaken

While Bitcoin is still in the spotlight, its market share among all cryptocurrencies is starting to decline. Rekt Capital, a renowned analyst, mentions that Bitcoin Dominance (BTCDOM) is now losing its long-termuptrend and potentially entering a new downward phase(macro downtrend).

Bitcoin’s dominance now stands at around 59.6%, down from a peak of 63.5% on October 10. If this trend continues and the 57.6% level is broken downward, analysts foresee a potential “altseason”-a period where altcoins such as Ethereum , Ripple , and Pepe Coin could experience significant rallies.

However, as of now, most altcoins are still stuck below 2022 pre-bear market levels, suggesting investors are still holding back from taking big risks.

Read also: Jumped 50% in 24 Hours, Why Avantis (AVNT) Rallied Today (10/21/25)?

Will Bitcoin Rise to IDR1.96 Billion or Fall Again?

Although Bitcoin prices have recovered, many analysts are still pessimistic. Trader Roman warned that the move towards $118,000 ($1.96 billion) could just be part of a “head and shoulders” pattern before a major bearish trend begins. He also noted a decrease in trading volume despite the price increase, which usually indicates the weak strength of the rally.

This technical condition shows that the market is at an important junction. If Bitcoin fails to break and hold above $111,000-$112,000, then the potential for a drop towards $102,000 (Rp1.69 billion) is still wide open to “close the wick” that has not been touched since October 10.

Conclusion

Overall, this week was a crucial moment for Bitcoin and the crypto market. The price increase to the Rp1.8 billion level gave new hope, but macroeconomic pressures and technical risks remain large. The release of US inflation data and the Fed’s decision will determine whether this rally is the start of a revival – or just a “dead cat bounce” before the next downturn begins.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Trading crypto carries high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Cointelegraph. Dead cat bounce to $118K? 5 things to know in Bitcoin this week. Accessed October 21, 2025.

- Featured Image: Generated by Ai