House of Doge Officially Acquires Italian Football Club, US Triestina Calcio 1918!

Jakarta, Pintu News – The House of Doge, the corporate arm of the Dogecoin Foundation, has acquired a majority stake in Italian soccer club US Triestina Calcio 1918, marking an important milestone in the union between digital assets and traditional industries.

The move comes amid efforts by crypto companies to gain a real foothold in the regulated sector.

By purchasing a European soccer club that has been around for over a century, the House of Doge is turning token-based enthusiasm into a real-world form of ownership, while demonstrating a change in strategy in the pursuit of legitimacy and crypto brand growth.

Crypto and Football: An Increasingly Tight Alliance

The House of Doge is now Triestina’s largest shareholder, bringing with it capital and plans to integrate blockchain technology. The club, which competes in Italy’s Serie C, will be a testing ground for a cryptocurrency ticket and merchandise payment system.

Read also: Dogecoin Drops 3% Today, but MVRV Z-Score Signals Room for Growth

The acquisition was made in conjunction with Brag House Holdings, the listed merger partner of House of Doge. Brag House provided the public company structure that made the purchase possible, while continuing to oversee governance and market access.

The two companies are now combining Brag House’s gaming and fan ecosystem with House of Doge’s blockchain network, creating a framework that connects digital communities with conventional sports audiences.

“Our investment aims to prove that digital assets can create real value, culture and passion. Football is the perfect stage to show how decentralized communities can generate sustainable impact,” said Marco Margiotta, CEO of House of Doge.

Analysts note that crypto companies are now starting to turn on-chain (blockchain-based) communities into revenue-generating off-chain (real-world) assets.

By entering the sports, gaming, and entertainment sectors, companies like House of Doge seek to balance the volatility of the crypto market with more stable operations.

Expanding the Legitimacy of the Crypto Industry

The link between cryptocurrencies and soccer is growing rapidly. Currently, many clubs are using blockchain technology for sponsorship, fan voting, and token-based loyalty systems.

Read also: VanEck Officially Filed the First Lido Staked ETH-Based ETF in the US!

For crypto companies, partnering with reputable teams gives them access to millions of fans while increasing their credibility in the public eye.

In 2025, Tether increased its stake in Juventus F.C. to 10.7%, making it the second largest shareholder in the club. The company aims to expand the integration of fan tokens and payment systems using stablecoins in Serie A competitions.

Meanwhile, Bitpanda is partnering with Arsenal F.C. and Paris Saint-Germain F.C. to develop a blockchain-based fan reward system. On the other hand, Socios continues to strengthen its collaboration with FC Barcelona and Inter Milan to increase fan engagement globally.

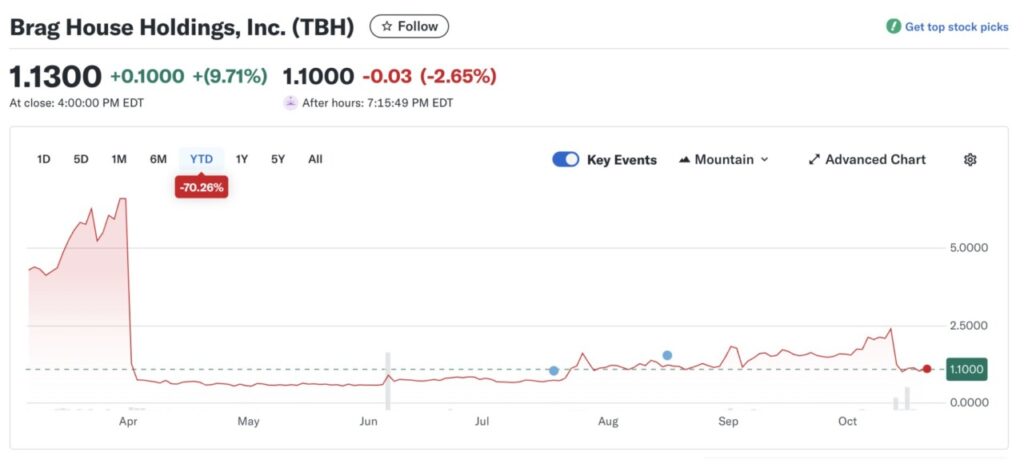

The House of Doge deal is in line with the company’s plans to list on an exchange through a reverse merger with Brag House Holdings (TBH). TBH itself started trading in March at around $4.30 per share, but has since dropped dramatically to $1.13, or almost a 74% drop-a reflection of the volatility prevalent among small-cap digital asset companies.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. House of Doge Acquires Italian Soccer Team. Accessed on October 21, 2025

- Crypto News. Dogecoin News: House of Doge Buys Italian Football Club. Accessed on October 21, 2025