Aster Reclaims Perp DEX Dominance as Wintermute Returns to Buy ASTER Tokens

Jakarta, Pintu News – Aster is again gaining momentum in the perpetual DEX space as it managed to surpass Lightchain in 24-hour transaction volume. This comes after Wintermute quietly accumulated millions of tokens, following an earlier period of heavy selling.

Aster Reclaims Top Spot in Perp DEX Rankings

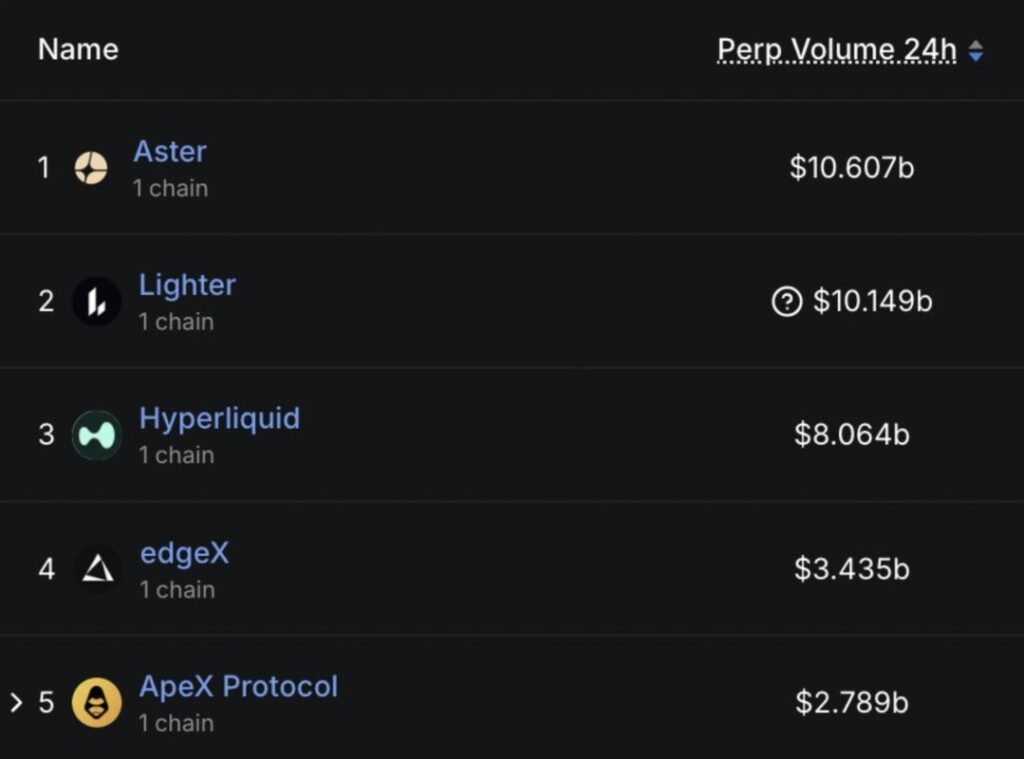

Based on data from DefiLlama, Aster leads the perpetual decentralized exchange (perp DEX) market with over $10.6 billion in trading volume in the last 24 hours. Aster is slightly ahead of Lighter which recorded $10.1 billion, while Hyperliquid is in third place with $8 billion.

Read also: Crypto Whales Are Quietly Accumulating Chainlink — Is LINK Poised for a Major Rally?

Aster’s resurgence comes after several weeks of doubt, following DefiLlama’s initial decision to remove its trading data. At the time, DefiLlama questioned whether activity on the platform was truly organic or manipulated, as it found an “almost perfect correlation” with volume reports from Binance.

However, DefiLlama has quietly returned Aster’s data to their analytics dashboard without any public announcement. This action sparked further discussion in the DeFi community.

Dragonfly Managing Partner Haseeb Qureshi highlighted the “huge gaps” in the updated trading history, and questioned whether the data had been verified.

The platform’s anonymous founder, 0xngmi, admitted that the numbers are still a “black box.” He also confirmed that the Aster team requested that their data be returned while a new verification system was being developed.

The move coincides with Robinhood’s decision to list ASTER in spot trading, which helped lift the token’s price from its recent lows amid broader market weakness.

Wintermute buys back ASTER after massive sell-off

Meanwhile, Wintermute seems to be changing its attitude towards the ASTER token. After weeks of gradually selling tokens and sending over $4.8 million to exchanges such as Bybit and Gate, the institution is now reportedly back in accumulation mode.

Read also: Will XRP Soar or Slump Between Halloween and Christmas 2025?hristmas 2025?

On-chain data shows that Wintermute currently holds around 2.7 million tokens – a huge jump from the mere 5,400 tokens left after the previous liquidation phase.

This repurchase comes at a time when the token price is still at its recent low, signaling that Wintermute may be preparing for a potential recovery in ASTER’s price and trading ecosystem.

One of the latest challenges came from the ASTER token airdrop event. After discovering a discrepancy in the user allocation ratio, the DEX side decided to stop the distribution. Some participants received the wrong amount, while others were allocated accordingly.

The Aster team explained the issue and promised to compensate the affected users. They also decided to temporarily suspend the process to investigate the cause of the discrepancy.

Despite the disappointment, the Perps platform emphasized its commitment to transparency and fairness. They assure users that the final allocation will not be less than the amount they are supposed to receive.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Coingape. Aster Outpaces Lighter in Perp DEX Rankings as Wintermute Buys the Dip after Previous Dump. Accessed on October 22, 2025