Michael Saylor Plans His Next Bitcoin Buyout, Is It Time?

Jakarta, Pintu News – MicroStrategy’s Bitcoin purchases have seen a sharp decline, but Michael Saylor is signaling that there is no reduction in the company’s strategy towards Bitcoin (BTC). Although tighter financial conditions have curtailed new purchases, Saylor gave indications via social media suggesting possible upcoming Bitcoin (BTC) purchases.

Drastic Drop in Bitcoin Purchases by MicroStrategy

On October 26, CryptoQuant analyst J. Maartunn reported a sharp decline in weekly Bitcoin (BTC) purchases by MicroStrategy. While the company used to buy tens of thousands of Bitcoin (BTC) every week at the end of 2024, the number has now dropped to around 200 Bitcoin (BTC) per week.

At its peak, MicroStrategy once bought up to 55,500 Bitcoin (BTC) in a single week. This decline does not indicate a lack of confidence, but rather tighter financial conditions that limit the placement of new capital.

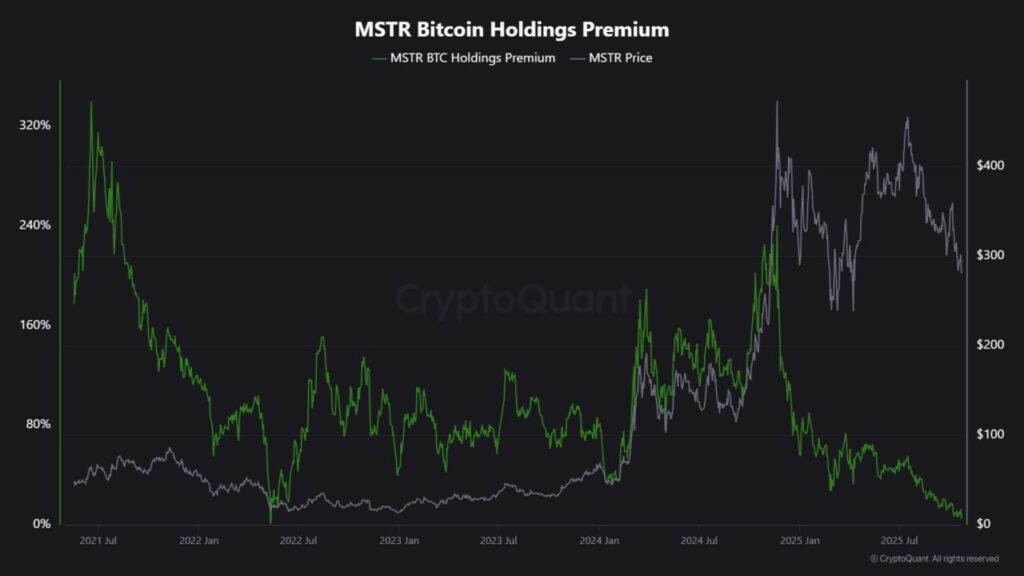

MicroStrategy’s equity issuance premium, which is the difference between the share price and the book value of their Bitcoin (BTC) holdings, has plummeted from 208% to just 4%. This decline makes new share offerings a less efficient way to raise capital for additional Bitcoin (BTC) purchases.

Also Read: 7 Altcoins Most Frequently Cross-Chain Partnered with XRP

Michael Saylor and the ‘Orange Dot Day’ Signal

Despite a decrease in purchase frequency, Michael Saylor continues to show that Bitcoin (BTC) remains at the core of the firm’s cash strategy. Via social media platform X, Saylor posted a screenshot of MicroStrategy’s Bitcoin (BTC) tracker with the phrase “It’s Orange Dot Day.”

This phrase is often used by Saylor before an official buyout announcement, signaling the possibility of a new buyout to be announced soon. These buyouts, although reduced in frequency, still show that MicroStrategy is one of the most aggressive institutional collectors in the market.

In 2025 alone, the company has spent around $19.5 billion on Bitcoin (BTC) purchases, only slightly below the $21.7 billion total in 2024. These purchases have increased MicroStrategy’s total Bitcoin (BTC) holdings to 640,418 Bitcoin (BTC), which is about 3.2% of all Bitcoin (BTC) in circulation.

MicroStrategy’s Future Prospects and Challenges

Despite the decline in the stock market and the value of Bitcoin (BTC), MicroStrategy does not seem to have reduced its focus on Bitcoin (BTC) as a strategic asset. The company’s share price dropping about 50% from its peak and Bitcoin (BTC) trading about 16% below its peak of $126,000, shows the challenges faced in maintaining an aggressive strategy in the current market conditions.

However, with the latest signals from Saylor, investors and market watchers may need to prepare for MicroStrategy’s next big move in the Bitcoin (BTC) ecosystem. Despite the change in buying strategy, the long-term commitment to Bitcoin (BTC) seems to remain strong. This shows the adaptability of the strategy in the face of changing market conditions while still maintaining a focus on the long-term value of Bitcoin (BTC).

Conclusion

With volatile market conditions and financial challenges at hand, MicroStrategy’s next move in the world of Bitcoin (BTC) will be decisive. Signals from Michael Saylor show that despite the downturn, there is no loss of interest in further accumulating Bitcoin (BTC). This shows a mature strategy that adapts to the prevailing conditions, while keeping a tight grip on the long-term vision.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- BeInCrypto. MicroStrategy Bitcoin Buy Slows, Saylor Gives Hint. Accessed on October 27, 2025