Bitcoin Reserve Decline on Binance: A Bullish Signal for BTC Price in November 2025?

Jakarta, Pintu News – Bitcoin has not lived up to expectations in October, with a total gain of only around 1.54%. After a bullish start that set a new record high of $126,000, the cryptocurrency experienced a sharp correction in the middle of the month, which brought the current price to around $111,400. Crypto analyst Amr Taha recently observed significant changes to the Binance network that could bring good news for market participants.

Exchange Reservations Approaching Critical Point

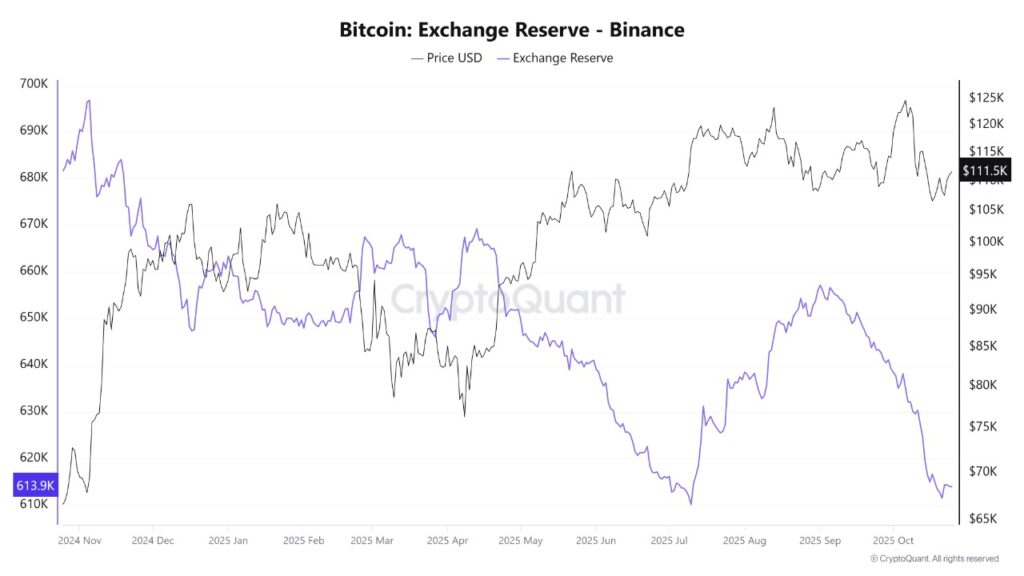

According to Amr Taha’s latest post on CryptoQuant, Bitcoin (BTC) reserves on Binance have shown a significant decline. Currently, the amount of Bitcoin (BTC) stored on the exchange’s wallet is close to 610,000 BTC, a figure that was last reached in July last year and is one of the lowest levels ever recorded.

A decline in reserves on exchanges is often considered an indicator of investor sentiment. A high amount of reserves usually indicates that investors may be preparing to sell, signaling a lack of confidence. However, a large withdrawal from an exchange indicates confidence in the prospects for price appreciation of that asset.

Factors Causing the Decline in Bitcoin Reserves

Taha explained that Bitcoin (BTC) price fluctuations around the $111,500 level reflect strong demand. This reinforces the notion that long-term holders are increasingly confident about Bitcoin (BTC)’s prospects. As such, Bitcoin (BTC) may soon experience increased momentum that could push the price upwards.

In addition, accumulation by large institutions and whales is considered a key driver of the decline in reserves. Taha also highlighted the huge demand from spot ETFs as another factor at play. A portion of Bitcoin (BTC) is usually absorbed by these funds, which competes with the supply of Bitcoin (BTC) available on the market.

Potential Impact on Bitcoin Price

A drastic drop in exchange reserves can lead to a supply shock, i.e. a sudden drop in the available supply of that asset. A decrease in the supply on sale also increases the market’s vulnerability to price increases, with increased demand serving as fuel to support large spikes. Under current conditions, if the trend of Bitcoin (BTC) withdrawals from exchanges continues, this could be a strong indicator that the price is set to rise. Investors and market analysts should take note of this indicator as one of the factors in making investment decisions.

Conclusion

Looking at the current dynamics, the Bitcoin (BTC) market is showing some signals that should not be ignored. The drop in reserves on Binance, in particular, could be a precursor to significant price movements. Market participants may need to prepare their strategies in anticipation of a possible bullish scenario.

Also Read: 5 Most Profitable Investments of the Past Year: Spotlight on Gold and Crypto!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app through Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- NewsBTC. Bitcoin Reserves on Binance Fall to July Lows, What This Means for Price. Accessed on October 27, 2025