Bitplanet buys 93 BTC! Here are 5 secret strategies behind the ambitious 10,000 Bitcoin target

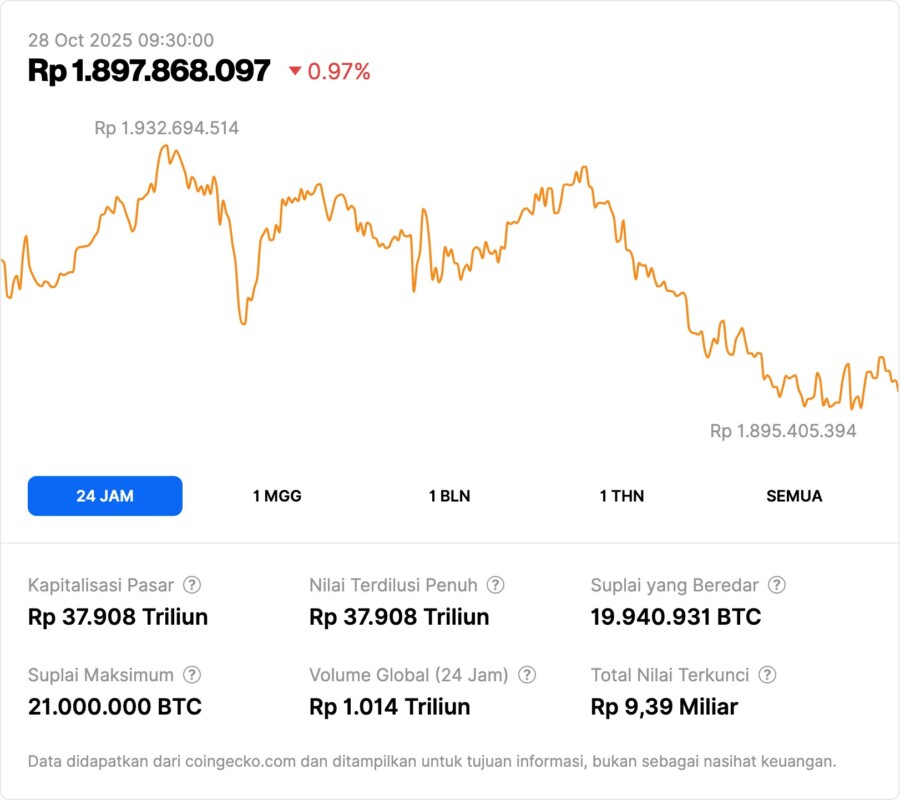

Jakarta, Pintu News – South Korean publicly traded company Bitplanet (KOSDAQ: 049470) has come under scrutiny after announcing the first step in building a Bitcoin reserve of 10,000 BTC. They kicked off this strategy by purchasing 93 BTC last Sunday, worth around Rp1.54 trillion based on the current Bitcoin price of around USD 112,572 or Rp1.87 billion per BTC (exchange rate 1 USD = Rp16,617).

This step is considered a breakthrough because it is done debt-free, aka without debt financing, which indicates a long-term strategic direction in managing digital asset treasuries. Here are five important points of Bitplanet’s strategy based on the Cryptopolitan report (October 27, 2025).

1. Ambitious Target: Reserve 10,000 BTC without debt

Bitplanet aims to raise 10,000 BTC, an amount equivalent to Rp18.7 trillion, without using debt financing schemes. According to Co-CEO Paul Lee’s statement, this approach will maintain flexibility and reduce the risk of leverage, something that has previously been the cause of losses in a number of crypto companies.

In his statement to the media, Lee emphasized the importance of governance and prudent capital management. This strategy also makes Bitplanet the first publicly traded company in South Korea to begin large-scale and structured BTC accumulation under the direct supervision of regulators.

Also Read: Potential DOGE Explosion November 2025: Technical Analysis Shows Sharp Rise?

2. BTC Purchases Systemized Through FSC Platform

Bitplanet has been running a daily BTC buying program even before its official announcement. All transactions are recorded and reported through a compliance platform controlled by South Korea’s Financial Services Commission (FSC), ensuring high transparency in the accumulation process.

This is of key importance given that South Korea is preparing for the implementation of the Digital Asset Basic Act in 2027. By implementing stricter regulatory interpretations early, Bitplanet is building a reputation as a compliant institutional player that is closely monitored by regulators.

3. Institutional Support is the Backbone of the Strategy

Bitplanet’s BTC accumulation program has the backing of institutional investors such as Sora Ventures, which is forming a consortium of public companies to build a crypto treasury in Asia. This signals a shift from retail speculation towards more measured and strategic institutional ownership.

However, this approach still faces obstacles in other Asian markets. As explained by Joshua Chu, Co-Chair of the Hong Kong Web3 Association, the different regulations in each country make the adoption of the crypto treasury model not easy to realize regionally.

4. Market Sentiment Strengthens, BTC Rises 4.8% in a Week

Bitplanet is capitalizing on the current positive momentum of the market. After plummeting due to the liquidation of USD 19 billion worth of leverage in early October, Bitcoin recorded a rebound of about 4.8% in a week, from a price of USD 107,000 to USD 112,572.

This accumulation strategy in a rising market shows an opportunistic yet restrained approach. Many analysts believe that institutional buying like this could create a medium-term bullish sentiment for the overall Bitcoin price.

5. Bitplanet’s Move Could Be a Model for Asia

Bitplanet’s move could set an important precedent for other publicly listed companies in Asia looking to enter the crypto space legally. While stock exchanges such as India’s HKEX and BSE still reject crypto-based treasury models, Bitplanet’s success could prompt a change in policy.

However, as warned by Chu, the relaxation of corporate rules when it comes to digital treasury should be done with extreme caution. Arbitrage and speculation risks can have a negative impact if not properly regulated, as happened in the dot-com era.

Conclusion

Bitplanet has made a bold move by accumulating Bitcoin in a systemized and debt-free manner, with the ultimate goal of reaching 10,000 BTC. With regulatory compliance, institutional backing, and a well-thought-out long-term strategy, this move has caught the attention of the global market. If successful, Bitplanet could pioneer the crypto treasury management model in Asia.

Also Read: Bitcoin Reserve Drop on Binance: A Bullish Signal for BTC Price in November 2025?

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- Collins J. Okoth/Cryptopolitan. Bitplanet begins journey to 10,000 BTC reserve with a 93 BTC purchase. Accessed on October 28, 2025