Bitcoin Forecast: What’s in Store for BTC This November 2025?

Jakarta, Pintu News – Bitcoin has struggled to regain momentum in recent days, with prices still stuck below the $115,000 resistance zone.

Despite the short-term weakness, a number of strong bullish indicators have begun to emerge, suggesting that price movements in November are likely to trend upwards.

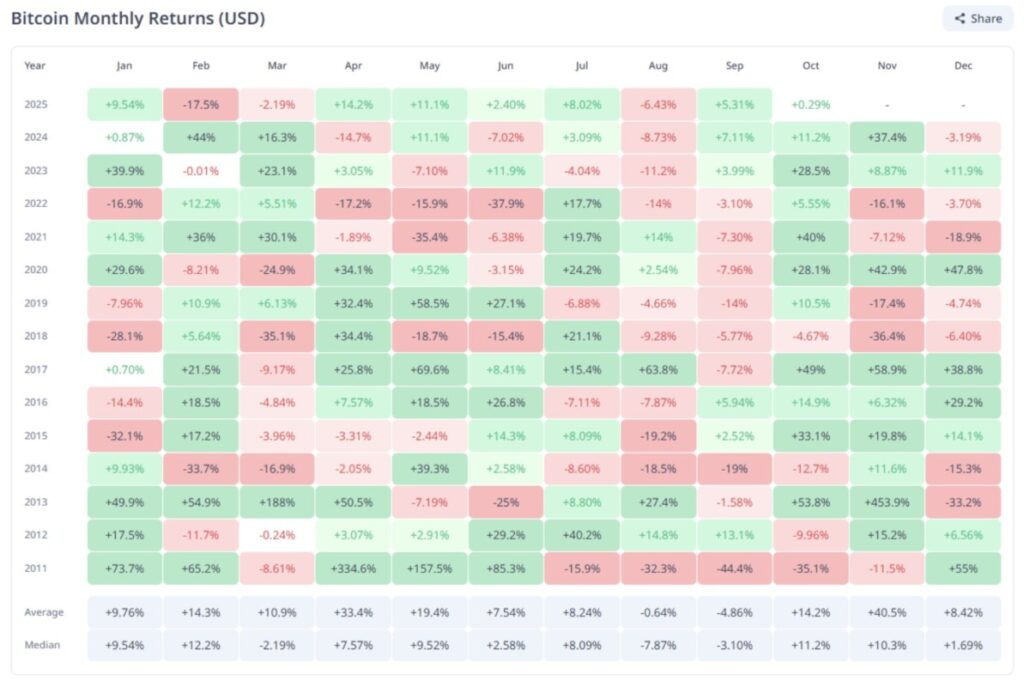

Bitcoin Has a Strong History in November

Historically, November has been one of the best months for Bitcoin. Data shows that Bitcoin’s median return in November reached 11.2%, making it the second-best performing month after October.

Read also: Bitcoin Price Drops to $112,000 Today: FOMC Triggers BTC Volatility!

This consistent upward pattern usually boosts investor optimism and strengthens market participation at the beginning of the month.

However, in an exclusive interview with the BeInCrypto page, Rachel Lin, Co-Founder and CEO of SynFutures, revealed that November 2025 could be different from previous years.

“Global trade tensions, inflation, and recession fears are affecting all risk assets – including Bitcoin. Recently, we’ve seen Bitcoin trading in the $104,000 to $108,000 range. Looking ahead, I expect November to be characterized by consolidation or a modest recovery – not a major rally, unless there is a strong trigger. If trade tensions worsen, Bitcoin could retest the $90,000 level. However, if the support level above $110,000 holds, we could potentially see a 10 to 20% rise, towards the $120,000 to $140,000 range by the end of the month. Especially if ETF inflows remain strong and whales continue to accumulate quietly,” Lin explained.

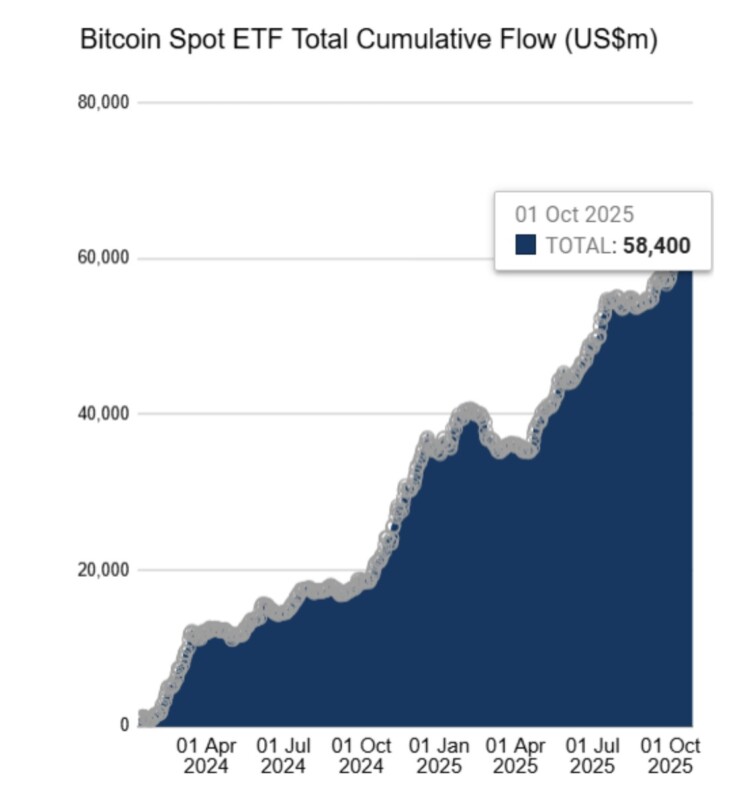

Bitcoin ETFs Show Signs of Strength

One noteworthy sign of strength comes from the performance of Bitcoin ETFs (Exchange-Traded Funds). During October, Bitcoin ETFs recorded net inflows of $3.69 billion.

The month started with cumulative flows of $58.4 billion and closed at $62.1 billion, reflecting a significant increase in investor exposure to BTC through officially regulated investment products.

These inflows show that institutional investors still see Bitcoin as a valuable asset for a diversified portfolio. Lin also added that despite some outflows in the middle of the month, the overall trend remains positive.

“On October 21 alone, we saw almost half a billion dollars come in – led by BlackRock and Fidelity. This shows how strong institutional investors’ confidence is. They increasingly see Bitcoin as ‘digital gold’, a hedge against inflation, currency debasement, and global uncertainty. Interestingly, this behavior is also reflected in on-chain activity. Every time there is a correction, inflows return, whales accumulate, and ETFs end up holding a larger portion of the total Bitcoin supply – now more than 6%. With better regulation and declining fees, it is now easier and cheaper for traditional investors to gain exposure to Bitcoin,” Lin concluded to BeInCrypto.

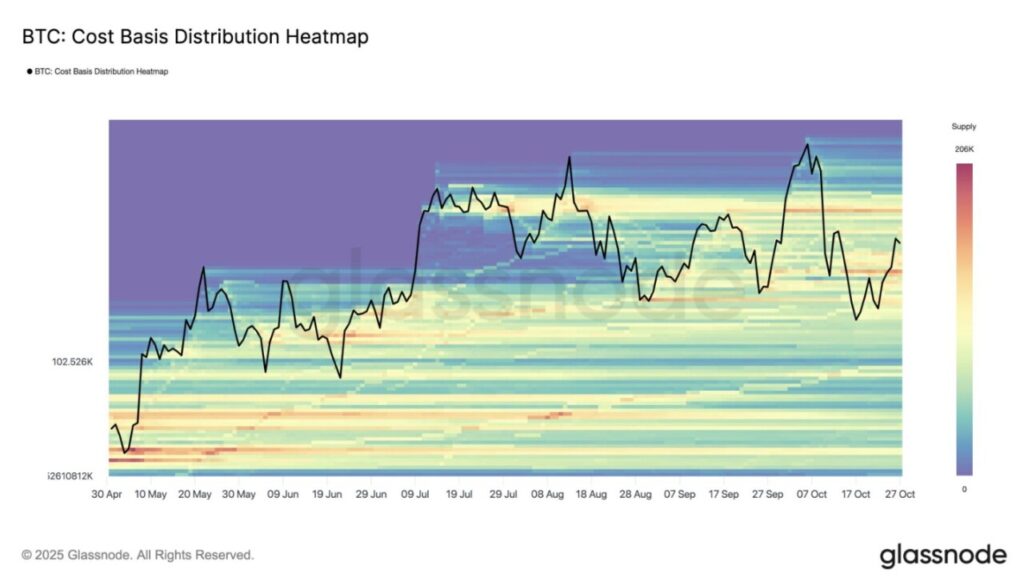

Bitcoin Begins to Set Crucial Levels

On-chain data provides additional insight into Bitcoin’s current position. The Cost Basis Distribution Heatmap shows significant support around $111,000 as well as considerable supply pressure around $117,000.

Read also: 4 Altcoins that are Likely to Rise in Early November 2025 Thanks to Their Bullish Development

This price range became a battleground between new buyers looking to defend their positions and investors looking to take profits after the recent rally.

If there is a breakout in either direction, it could determine the direction of price movement in the next few weeks. If the bulls manage to push the price past the $117,000 supply zone, momentum could increase sharply. Conversely, if the price fails to hold above $111,000, sentiment could turn bearish and trigger a short-term correction.

BTC Price Awaits Breakout

At the time of writing, Bitcoin’s price is at $114,518 – just below the important resistance level of $115,000. With investor sentiment getting more positive, BTC has the potential to break this level soon.

If the breakout is confirmed, it could trigger a new surge in momentum and push prices towards higher resistance levels during November.

Bitcoin’s short-term target remains at the All-Time High record price of $126,199, which requires an increase of about 10.2% from current levels. To achieve this, BTC must first break through the strong resistance zones of $117,261 and $120,000, where selling pressure from profit-takers is likely to slow down the upside.

However, if Bitcoin fails to maintain momentum above $115,000, short-term weakness could return. A drop towards $110,000 remains possible if buyer confidence starts to weaken. If the price breaks below this support level, the bullish view will lose validity.

That’s the latest information about crypto. Follow us on Google News to get the latest crypto news about crypto projects and blockchain technology. Also, learn crypto from scratch with complete discussion through Pintu Academy and stay up-to-date with the latest crypto market such as bitcoin price today, xrp coin price today, dogecoin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities have high risk and volatility, always do your own research and use cold cash before investing. All activities of buying and selling bitcoin and other crypto asset investments are the responsibility of the reader.

Reference:

- BeInCrypto. What to Expect from Bitcoin Price in November 2025. Accessed on October 29, 2025