Ripple (XRP) Price Surge: What Investors Need to Know Before November 2025?

Jakarta, Pintu News – Ripple has recently recorded a significant increase in trading activity, pushing prices to higher levels. Despite this increase, technical analysts suggest that there is a potential risk of consolidation in the short term. Momentum indicators that usually give an idea of the strength of the current trend suggest that investors may need to be cautious. This price increase comes amid a large flow of funds into the Ripple (XRP) market, which has caught the attention of many market participants.

News Background

The cryptocurrency market has experienced many dynamics that affect various digital assets, including Ripple (XRP). Factors such as policy changes from central banks, adoption by large corporations, and changes in investor sentiment often have a direct impact on prices. Ripple (XRP) itself has seen increased interest from both retail and institutional investors. This is mainly due to the potential application of Ripple’s blockchain technology in a more efficient and faster global payment system.

Also Read: Top 3 Crypto’s that are Trending and Stealing Investors’ Attention by the End of 2025!

Price Action Summary

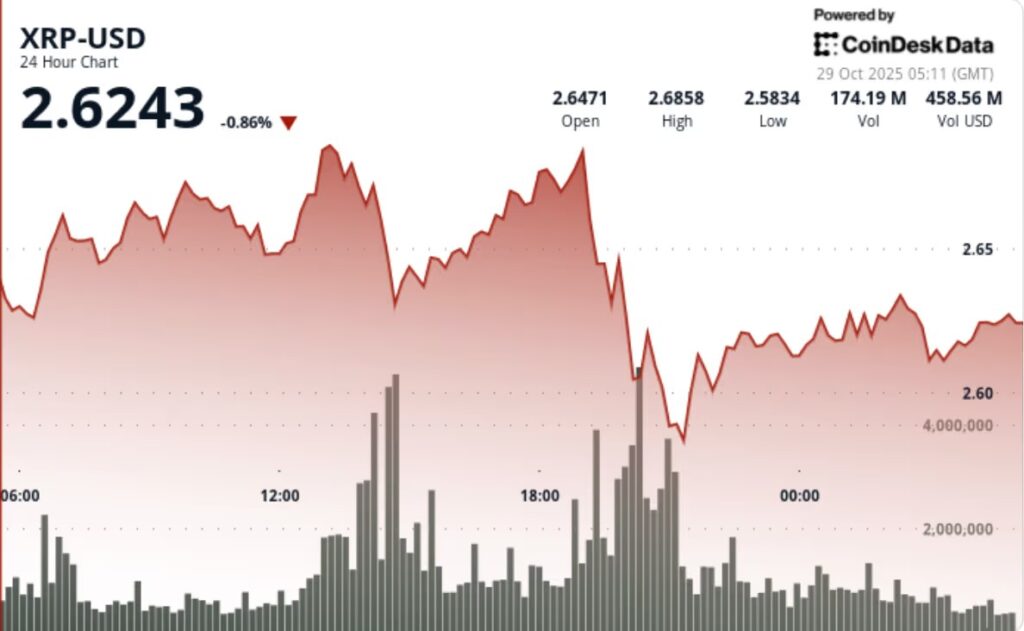

In recent days, Ripple (XRP) has managed to maintain support in the $2.60-$2.63 price range. If the price can hold and continue to rise past $2.65, it might change the market outlook to a more bullish one. However, it is important to note that the cryptocurrency market is highly volatile and price predictions can change quickly. Investors and traders should monitor technical indicators and market news to make informed decisions.

Technical Analysis

From a technical standpoint, Ripple (XRP) is currently at a tipping point. Indicators such as the Moving Average Convergence Divergence (MACD) and Relative Strength Index (RSI) suggest that despite the price increase, the momentum may not be strong enough to support a sustained uptrend. Therefore, it is important for market participants to observe whether Ripple (XRP) can maintain support at the current price levels or if there will be a decline.

Takeaways for Market Participants

Although Ripple (XRP) is showing some positive signs in terms of fund flows and trading activity, market participants should remain vigilant. Given the volatile nature of the cryptocurrency market, investment decisions should always be based on careful analysis and continuous monitoring of market conditions. By paying attention to both technical and fundamental analysis, investors can take the right steps in the face of ever-changing market dynamics.

Also Read: Bitcoin (BTC) Breaks $115,000, Fear & Greed Index is Neutral!

Follow us on Google News to get the latest information about the world of crypto and blockchain technology. Check today‘ s bitcoin price, today’s solana price, pepe coin and other crypto asset prices through Pintu Market.

Enjoy an easy and secure crypto trading experience by downloading Pintu crypto app via Google Play Store or App Store now. Also, get a web trading experience with various advanced trading tools such as pro charting, various types of order types, and portfolio tracker only at Pintu Pro.

*Disclaimer

This content aims to enrich readers’ information. Pintu collects this information from various relevant sources and is not influenced by outside parties. Note that an asset’s past performance does not determine its projected future performance. Crypto trading activities are subject to high risk and volatility, always do your own research and use cold hard cash before investing. All activities of buying andselling Bitcoin and other crypto asset investments are the responsibility of the reader.

Reference

- Coindesk. XRP Trades Higher on Big Flows Yet Technical Setup Signals Caution. Accessed on October 30, 2025